| News | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Rural Cooperatives: Repositioning (Shri R. Gandhi, Deputy Governor - February 9, 2016 - at the “National Conference of Cooperative Banks – Regaining Leadership in Agricultural Finance” held at BIRD, Lucknow) |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 11-2-2016 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

I am glad to be addressing you all at this National Conference on Cooperative Banks – Regaining Leadership in this historic city of Lucknow. It is a very contemporary issue. Actually, it is an ever-green issue for the past over a century or so. You only need to recall the famous saying by the All India Rural Credit Survey of 1951 “Cooperation has failed. But, cooperation must succeed”. That showed that cooperation had a chequered history in India, with several ebbs and flows. That is why we are talking about “Regaining Leadership” as the organisers of this Conference have chosen to put it and “repositioning” as I have preferred to reflect upon. Part I – Rural Cooperatives: Current Status 2. Rural credit cooperatives came into existence essentially as an institutional mechanism to provide credit to farmers at affordable cost and address the twin issues of rural indebtedness and poverty. With its phenomenal growth in outreach and volume of business, rural credit cooperatives have a unique position in the rural credit delivery system. Through the short and long-term structures, they continue to play a crucial role in dispensation of credit for increasing productivity, providing food security, generating employment opportunities in rural areas and ensuring social and economic justice to the poor and vulnerable. Several committees, from the All India Rural Credit Survey Committee to the Vaidyanathan Committee have stressed the relevance and importance of cooperative credit societies to the development of agriculture and rural economy. 3. Today, short term cooperative credit structure has 32 state cooperative banks and 371 district central cooperative banks operating through 14907 branches. There were 92,996 Primary Agricultural Credit Societies (PACS) as on March 31, 2014 at the grass root level catering to the credit requirements of the members but also providing several non-financial services like input supply, storage and marketing of produce, supply of consumer goods, etc. 4. The journey has not been smooth for the cooperative banking structure. There were legal, structural and organisational rigidities which created conflicts and challenges in the functioning of cooperatives. 5. Reserve Bank of India as regulator of banks is mandated to maintain a sound and stable banking system. Since banks are highly leveraged entities and accept unrestricted amount of uncollateralised public deposits, it is important to ensure that banks operate on sound lines, are well regulated and supervised and public faith in these institutions are sustained. 6. Economic and financial reforms initiated in early 1990’s were focussed mainly on commercial banks which have pan-India and international operations. Cooperative banks were kept outside the reforms since these banks had limited area of operations, simple banking products, low volume of business and insignificant share in the total assets and liabilities of the Indian banking system. The regulatory regime continued to be less rigorous for the cooperative banks. Capital adequacy and other prudential norms were not applied to cooperative banks. However, as commercial banks continued to make significant strides in expansion of business, product diversification and technology adoption, weaknesses in the cooperative system became more and more conspicuous and posed a threat to their survival. Particularly, the relevance and existence of cooperative banks came into question since a large number of state and central cooperative banks were operating without banking license even after 40 years from the date of bringing them in the ambit of Banking Regulation Act. 7. A major initiative for reforming the short term cooperative credit system (STCCS) came from the Government of India when it constituted a Task Force in August 2004 to suggest an action plan for reviving rural cooperative credit institutions and legal measures necessary for facilitating this process. The Task Force, chaired by Prof. A. Vaidyanathan has recommended that any financial restructuring without addressing the root causes of the weaknesses of the system would not result in its sustained revival. The Task Force made several suggestions including a financial package for cleaning up the balance sheets of STCCS, legal and institutional reforms necessary for cooperatives to function as democratic institutions. One of the major recommendations was on capital adequacy norms for the three tiers of STCCS. Regulatory Initiatives 8. The Committee on Financial Sector Assessment recommended that all banks should obtain a license before March 31, 2012 and those who failed to obtain a license should be phased out of a cooperative space in a non-disruptive manner. 25 State Governments signed the MoU for the financial assistance under the Government of India Revival Package for STCCS announced as per the recommendations of the Task Force. Reserve Bank, as a major policy measure, relaxed the licensing norms for state and central cooperative banks. The twin initiatives resulted in licensing of a large number of banks starting from 2008. Progress in licensing of state and central cooperative banks

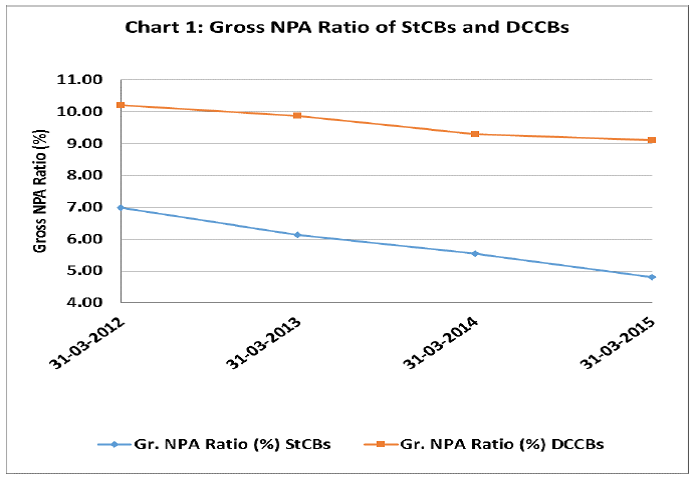

9. The position of CRAR in respect of state and central cooperative banks as on March 31, 2013 revealed that 23 out of 31 state cooperative banks (StCBs) and 278 out of 371 central cooperative banks (CCBs) had CRAR above 7%. Six StCBs and 48 CCBs had CRAR between 4% and 7%. We felt that the time was appropriate to introduce Basel I capital adequacy framework to these banks. Hence, the banks were placed under phased implementation of Basel I norms with a target of 7% CRAR by March 31, 2015 and 9% CRAR by March 31, 2017. The banks were allowed to raise the additional capital resources through Long Term (Subordinated) Deposits and Innovative Perpetual Debt Instruments. As on March 31, 2015, 30 StCBs and 301 CCBs had CRAR of 7% or above. 10. Pursuant to the Banking Laws (Amendment) Act 2012, CRR to be maintained by non-scheduled StCBs and CCBs and SLR to be maintained by all StCBs and DCCBs were brought on par with commercial banks from the fortnight beginning July 12, 2014. Eligible assets for SLR were also brought on par. With a view to enabling the banks to meet the revised requirements, a roadmap was provided to phase out the existing SLR term deposits by March 31, 2017. 11. Regulatory functions related to urban and rural cooperative banks have been brought under a single department within RBI with effect from October 1, 2014. Erstwhile Urban Banks Department was bifurcated and rechristened as Department of Cooperative Bank Regulation (DCBR) and Department of Cooperative Bank Supervision (DCBS). While supervision of UCBs is vested with DCBS, supervisory functions in respect of StCBs and CCBs remain with NABARD. The new arrangement is aimed at achieving synergy and harmonization in regulation of cooperative banks without losing sight of the structural differences in rural and urban cooperative credit systems. 12. Some of the recent policies aimed at harmonisation of regulation of cooperative banks are related to increase in gold loan bullet repayment limit from ₹ One lakh to ₹ Two lakh, guidelines on opening of branches / extension counters by state cooperative banks, issue of ATM / Debit cards, guidelines on setting up mobile / off-site ATMs and internet banking and permission to StCBs / DCCBs for investment in Market Infrastructure Companies like NPCI, CCIL, etc. With a view to speeding up approvals, we have delegated powers to our Regional Offices in most of these areas. Financial Performance of State and Central Cooperative Banks 13. Today the StCBs and DCCBs display a reasonable financial strength. Their combined capital and reserves stood at ₹ 20.1 thousand crores for the StCBs and ₹ 51.04 thousand crores for the DCCBs as on March 31, 2015. The combined balance sheet, as on March 31, 2015, of all state cooperative banks stood at ₹ 1.98 lakh crore and that of the district central cooperative banks at ₹ 4.06 lakh crore. Their Gross NPA stood at 4.8% and 9.1% respectively as on March 31, 2015. Their combined Net Profits were ₹ 1,005 crore and ₹ 793 crore respectively.

14. Asset quality of StCBs / DCCBs have improved over the last three years as may be seen from the fall in the percentage of NPAs between 2013 and 2015. However, the percentage of recovery to demand is a concern since it is showing a declining trend. There are wide variations region-wise too. In 2014, NPAs of StCBs varied between 1.93% in northern region and 17.12% in north-eastern region. In respect of CCBs, it was 5.27% in northern region and 10.98% in eastern region. During the same year, percentage of recovery to demand was 97.9 in northern region and 49.10 in north-eastern region for StCBs. Recovery to demand was 83.16% in northern region and 67.23% in eastern region in respect of CCBs.

Issues and Challenges 15. Some of the major issues to be addressed by the cooperative banking sector relate to governance, management, sound capital base, technology, risk management and frauds. We have prescribed fit and proper criteria for Chief Executive Officers of StCBs and CCBs. The Constitution (97th Amendment) Act mandates appointment of at least two professional directors in the Boards of cooperative banks. The Act has also covered other issues aimed at improving governance and autonomous functioning of cooperative societies such as engagement of professionally qualified auditors, tenure of Board, conditions for supersession of Board, active participation of members in annual general meetings, etc. Implementation of these directions in their true spirit is critical for ensuring good governance and management practices. 16. The Constitution (97th Amendment) Act requires that audit of a cooperative society to be conducted by qualified auditors or auditing firm to be appointed from the panel prepared by the State Government. NABARD has requested RCS of all states to provide chartered accountants for conducting statutory audit of StCBs / DCCBs. We come across large divergence between audited financial parameters and that assessed by NABARD, particularly in respect of reporting of NPAs and provisioning. Since audited financial statements are relied upon for granting various regulatory approvals and assessing compliance standards, quality of statutory audit needs to be improved. For achieving this, we have planned to conduct workshops / seminars for statutory auditors to familiarise them with our instructions. We will be taking the help of Institute of Chartered Accountants for preparing a standard audit report format for cooperative banks. 17. Cooperative banks should improve their bottom line through internal accruals without relying on frequent bouts of capital infusion by the government. They should review their pricing policies on deposits and loans, appraisal systems, recovery procedures, major expenditure items and devise suitable action plan to plug leakages and augment income. Implementation of effective loan appraisal policies at the approval stage will ease the pressure on recoveries at a later date and help to curtail expenditure on litigations. Continuous monitoring of loan accounts with give signals on creeping sickness and delinquencies and effective steps aimed at recovery at an early stage will prevent deterioration of asset quality. Further, higher provisioning towards NPAs severely erodes profitability. Banks should look for more fee-based activities to supplement their earnings. 18. Another area of persistent and serious concern to us and NABARD is that cooperative banks are unable to prevent frauds. Most of the times, the frauds have been perpetrated by or in collusion with the banks’ own staff. As on March 31, 2015, state and central cooperative banks have 2589 cases of frauds with outstanding amount of ₹ 877.7 crore. If the banks are unsuccessful in recovering the amount, the losses have to be absorbed by them. Cooperative banks need to think whether frauds are really non-preventable. 19. Technology adoption is an imperative in today’s banking. Implementation of CBS in StCBs and DCCBs which was started in 2012 has been completed in all 32 StCBs and 347 licensed DCCBs. These banks can now offer RTGS and NEFT facilities to their customers through direct or sub-membership route and also participate in Direct Benefit Transfer Scheme. RBI has already circulated the criteria for offering mobile and internet banking facilities by these banks. Since the technology brings its own risks, cooperative banks should have proper risk assessment and risk mitigation policies in place. Sound internal control system is critical to prevent frauds, data integrity and leakage of customer information. Banks should develop wherewithal to handle the liabilities that would devolve on them due to failures in internal controls. Any lapses on this count will not only impose cost in terms of money but also loss of customers’ faith. 20. Rural cooperatives have enormous potential to deliver financial inclusion to remote locations leveraging technology. NABARD extends support to cooperative banks in implementing the technology assisted banking platform and setting up Financial Literacy Centres and Common Service Centres with ICT-enabled kiosks to create awareness and demand for products and services. Financial assistance is provided from Financial Inclusion Fund for implementation of CBS in cooperative banks, data migration from PACS to DCCBs, issue of RuPay and KCC cards and meeting expenditure towards micro-ATMs and POS terminals. Cooperative banks should join hands with NABARD to reach financial products and services to the unserved. 21. Implementation of mobile and internet banking will facilitate anywhere banking without any necessity for the customers to visit banks’ premises. Since physical interactions with customers will be limited or nil, banks should pay attention to adequate KYC checks. Proper care should be taken at the time of engaging the services of third party service providers for managing the IT systems and outsourcing database management activities. 22. With the adoption of technology and liberalisation of regulatory policies, cooperative banks are foraying into new business activities where they have no familiarity. Training and capacity building assumes importance in the present context. Adequate training should be imparted to people at all levels including employees, Board of Directors and auditors to improve productivity, efficiency and professionalism. Cooperative banks should make use of financial assistance for capacity building provided by NABARD from Cooperative Development Fund and under Scheme of Financial Assistance for Training of Cooperative Banks Personnel (SOFTCOB). Cooperative banks may avail of training facilities available in the training establishments of RBI, NABARD and various cooperative training institutions. 23. Today’s customers have more awareness about their rights and demand transparency in our banking system. Leveraging the technology, every cooperative bank should provide on its website where customer can access information about products, procedures, forms, fees / charges, annual reports, etc. Customers should have the facility to communicate to the bank through e-mails. Transparency will improve confidence of customers, bank’s image and reduce complaints. 24. Cooperative banks are now functioning in a highly competitive environment. Entry of more players in the banking arena and technology have increased options to customers and banks have both opportunities to grow and challenges for survival. Cooperative banks with their intimate knowledge of customers and familiarity with the area of operation can attract new customers and retain the existing clientele with their unique selling proposition. However, this can be achieved only with suitable changes in outlook, processes, business model and strategy. Part II Rural Cooperatives: Re-Positioning Exalted Status 25. Co-operatives are an exalted position in India. How and why do I say so? There are very many types of economic entities like a proprietary firm, partnership firm, society, trust, company, body corporate, beside the cooperative. Of these, which one has got mentioned in the Constitution of India? It is cooperatives. That too, not just a passing mention; but, a full section on how cooperatives have to be formed, governed and operated has been incorporated as a part of our Constitution, thanks to 93rd Amendment. 26. Not only that, you look at the very many Five Year Plan documents - they are replete with strong references to the contribution of cooperatives, the role and expectations from cooperatives. To quote a few of them - The Second Five-Year Plan (1956-1961), emphasized “building up a cooperative sector as part of a scheme of planned development” as being one of the central aims of National Policy. The Third Five Year Plan (1961-1969) stressed that “Cooperation should become, progressively, the principal basis of organization in branches of economic life, notably agriculture, minor irrigation, small industries and processing, marketing, distribution, rural electrification, housing and construction and provision of essential amenities for local communities. Even the medium and large industries and in transport an increasing range of activities can be undertaken on cooperative lines”. The Eighth Five Year Plan (1992-1997) laid emphasis on building up the cooperative movement as a self-managed, self-regulated and self-reliant institutional set-up, by giving it more autonomy and democratizing the movement. 27. Pandit Jawaharlal Nehru, who had a strong faith in the cooperative movement, while opening an international seminar on cooperative leadership in South-East Asia, had said "But my outlook at present is not the outlook of spreading the cooperative movement gradually, progressively, as it has done. My outlook is to convulse India with the Cooperative Movement or rather with cooperation to make it, broadly speaking, the basic activity of India, in every village as well as elsewhere; and finally, indeed, to make the cooperative approach the common thinking of India....Therefore, the whole future of India really depends on the success of this approach of ours to these vast numbers, hundreds of millions of people". 28. Why this kind of attention, belief and expectations on cooperation? Is it because, it is more than 100 years old? Or is it because of the innate features that go to define a cooperative? Or is it because of the socio-economic Utopia of tranquility, mutual understanding, bonding and support and thereby growth that it promises for its members? Let us explore more. Some Historical Perspectives 29. Cooperatives came on the scene in India, in a big way, around the turn of 19th century into 20th century. In the first 50 years of its history, it is reported to have reached as high a number of more than two lakh cooperatives registered by mid 20th century. They had permeated across all spectrums of economic activity chain. Be it credit, mortgage, production, marketing, storage, sales, distribution, consumption, wholesale, retail, services, advisory, research, etc. etc. - you name it, the cooperatives were everywhere. Be it agriculture, allied services, rural industries, manufacturing - small, medium and large, services, you name any segment of economic activity, they were there. Such a wide swathe of the presence of cooperatives could not have happened without the magnitude and depth of the contribution of cooperatives. Or was it so? Or was it because of its status as socio-political unit and its grand belief of rendering marvelous Utopia? Let us probe a bit further. 30. We are from the financial sector and hence most of my comments will be with reference to the financial sector, more specifically to the banking sector. Credit cooperatives were the first to come within regulation. The proposal for agricultural banks was first mooted as long back as in 1858. Several Committees had been recommending constitution of Agricultural banks. In 1901 the Famine Commission recommended the establishment of Rural Agricultural Banks through the establishment of Mutual Credit Associations, and such steps as were taken by the Government of North Western provinces and Oudh. The underlying idea of a number of persons combining together was the voluntary creation of a new and valuable security. A strong association competent to offer guarantees and advantages of lending to groups instead of individuals were major advantages. The Commission also suggested the principles underlying agricultural banks and land banks. Based on the recommendations of the Edward Law Committee, the Cooperative Credit Societies Act was passed in 1904. As its name suggests, the Cooperative Credit Societies Act was restricted to credit cooperatives. It was only subsequently, a more comprehensive legislation called the Cooperative Societies Act was enacted. This Act, inter alia, provided for the creation of the post of registrar of cooperative societies and registration of cooperative societies for various purposes and their audit. 31. “The underlying idea of all Mutual Credit Associations, such as we recommend, is that a number of persons, by combining together, create a new and valuable security, which none of them previously possessed as individuals. Co-operation substitutes for isolated and helpless agricultural units a strong association competent to offer guarantees and capable of inspiring confidence. The advantages of lending to groups instead of to individuals need no demonstration. It is simpler for a creditor to deal with a group of fifty or a hundred associated cultivators than with the same number singly; it is simpler for him to obtain repayment from the group than from each of the members composing it; it is simpler for the group to make its own arrangements with each member than for the lender to try to do so”. 32. What I just now read is from the Report of the Famine Commission 1901. Doesn’t ring several bells? Our modern day Self Help Groups (SHG), Joint Liability Groups (JLG), Micro Finance Institutions (MFI) were all in the thought process some full hundred years before. Perhaps, they were the ideas well ahead of their times. Cooperatives in the First Half of 20th Century 33. The first half of the 20th century saw phenomenal growth of cooperatives in general and the number of credit cooperatives in particular had reached more than two lakh. But what was their contribution? The All India Rural Credit Survey, in their Report in 1954, brought forth the stark reality that cooperatives, despite all the widespread presence in villages, and the attention and encouragement received, did achieve pretty little. They just contributed to 3.1% of the credit needs of the villagers, as can be seen from Table 1 below:

34. This led them to conclude, with the famous saying, “Cooperation has failed; but it must succeed”. Cooperatives in Second Half of 20th Century 35. The next half century received quite a lot of rhetoric. I had quoted them before viz., about making the cooperative approach the common thinking of India, dependence of the whole future of India on the success of cooperative movement, building cooperative movement being the central aim of National Policy as a part of planned development, cooperatives to be the principal basis of organising economic activity, etc. 36. What has been the effect? Of course, there was impact. Cooperatives did deliver. As can be seen from Table 1, their contribution to rural credit increased gradually from the 3.1% in 1951 to an impressive 27.3% in 2002. And, as I mentioned in Part I, today, the short term cooperative credit structure has 32 state cooperative banks and 371 district central cooperative banks operating through 14907 branches and there were 92,996 Primary Agricultural Credit Societies (PACS) as on March 31, 2014 at the grass root level. The combined balance sheet, as on March 31, 2015, of all state cooperative banks stood at ₹ 1.98 lakh crore and that of the district central cooperative banks at ₹ 4.06 lakh crore. Their Gross NPA stood at 4.8% and 9.1% respectively as on March 31, 2015. Their combined Net Profits were ₹ 1,005 crore and ₹ 793 crore respectively. 37. Are we satisfied with this? Of course not. Why? First of all, these numbers hide wide variation among the 32 StCBs and the 371 DCCBs, whether in terms of financial strength, profitability, efficiency or asset quality. Secondly, there are variations among regions as well, be it in terms of the number, growth, strength, performance and asset quality. Thirdly, as on March 31, 2015, there were as many as 13 StCBs and 163 DCCBs with Capital to Risk Assets Ratio (CRAR) below the prescribed 9%. Their governance position has added to the worry. Cooperatives, which are to be fundamentally socio-economic entities, are being operated as socio-political entities. Opportunities Lost 38. These weaknesses of the cooperatives have caused certain serious opportunities slip by the cooperative system. What do I mean by this? Please recall the recommendations of the Famine Commission 1901 which I quoted earlier. They had recommended that micro finance, self-help groups, joint liability groups, etc. as a part and parcel of cooperative banks. Where are they today? Not with the cooperatives. They are with the Micro Finance Institutions (MFI). We are trying to bring them within the commercial banking segment. 39. Rightfully, the MF, SHG, JLG etc. concepts should have been gainfully employed by the cooperatives. Just visualise – if only we had leveraged the 95000 physical infrastructure of the primary agricultural cooperative societies, with the financial backing of the DCCBs and StCBs! Will we be still talking about how to reduce financial exclusion? Could we have not shown the world how to achieve financial inclusion? 40. We have to introspect about why are we discussing about organising SHGs, Village level SHG federations, district level SHG federation and state level SHG federations, when a time tested PACS-DCCB-StCB model, not just model, a functioning infrastructure is available. Questions for Introspection 41. In my opinion, the reasons are the perceptions about the cooperatives as being financially weak, being a socio-political structure and being reluctant to change. Added to these perceptions are the inabilities and indifference to capture the imagination and acceptance of the minds of the Gen-Next. 42. I would urge, you all, the veterans of the cooperative movement and the other stakeholders on the subject, to seriously reflect on the following questions, in order to re-position rural cooperatives to sub-serve, shall I say, the original function for which it was thought of viz., the micro finance:

43. It is in your hands whether we should say “Cooperation has failed”. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

9911796707

9911796707