| Law and Procedure an e-book | ||

|

Home |

||

Income Tax - Frequently Asked Questions (FAQs) |

||

FAQ on New vs Old Regime [AY 2024-25] |

||

|

|

||

In the new tax regime can I claim deductions under chapter-VIA like section 80C, 80D, 80DD, 80G etc. while filing the ITR for AY 2024-25? |

||

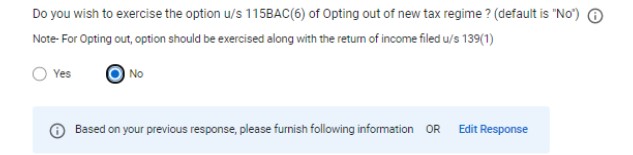

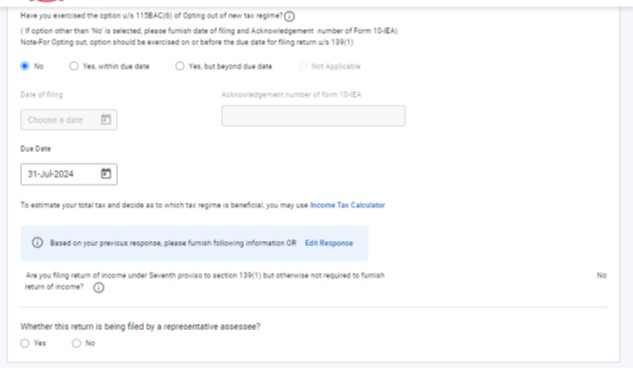

Ans. In new tax regime, Chapter-VIA deductions cannot be claimed, except deduction u/s 80CCD(2)/80CCH/80JJAA as per the provision of Section 115BAC of the Income Tax Act, 1961. In case, taxpayer wants to claim any deductions (as applicable), then taxpayer needs to choose the old tax regime by selecting “Yes” option in ITR 1 / ITR 2 (or) “Yes, within due date” option in ITR 3 / ITR 4 / ITR 5 in the field provided for “opting out option” under Schedule ‘Personal Information’ or ‘Part-A General’ in the respective ITR. in ITR 1 / ITR 2

|

||

9911796707

9911796707