| News | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Report on the Revenue Neutral Rate and Structure of Rates for the Goods and Services Tax (GST) |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 10-12-2015 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

I. INTRODUCTION 1.1 As the world economy slows, and increasing financial volatility and turbulence become the “newest normal,” only a few economies have the resilience to be a refuge of stability and the potential to be an outpost of opportunity. India is one of those few. As oil and commodity prices continue to be soft, and in the wake of actions taken by the government and the Reserve Bank of India, macro-economic stability seems reasonably assured for India. This bedrock of stability coupled with reforms to unleash the entrepreneurial energies of India can create the policy credibility and business environment that India is indeed seizing the historic opportunity afforded by domestic and international developments to propel the economy to a high growth trajectory. Key amongst these reforms is the goods and services tax (GST), which has, in some ways, been “priced” into expectations of the government’s reform program. 1.2 For nearly ten years, India has been on the verge of implementing a GST. But now, with political consensus close to being secured, the nation is on the cusp of executing one of the most ambitious and remarkable tax reforms in its independent history. Implementing a new tax, encompassing both goods and services, to be implemented by the Centre, 29 States and 2 Union Territories, in a large and complex federal system, via a constitutional amendment requiring broad political consensus, affecting potentially 2-2.5 million tax entities, and marshalling the latest technology to use and improve tax implementation capability, is perhaps unprecedented in modern global tax history. 1.3 It is easy to overlook how ambitious the Indian GST will be, and a cross-country comparison highlights the magnitude of ambition. According to the World Bank (2015), over 160 countries have some form of value added tax (VAT), which is what the GST is. But the ambition of the Indian GST experiment is revealed by a comparison with the other large federal systems-European Union, Canada, Brazil, Indonesia, China and Australia--that have a VAT (the United States does not have a VAT). 1.4 As Table 1 highlights, most of them face serious challenges. They are either overly centralized, depriving the sub-federal levels of fiscal autonomy (Australia, Germany, and Austria); or where there is a dual structure, they are either administered independently reating too many differences in tax bases and rates that weaken compliance and make inter-state transactions difficult to tax (Brazil, Russia and Argentina); or administered with a modicum of coordination which minimizes these disadvantages (Canada and India today) but does not do away with them. Table 1: Comparison of Federal VAT Systems

Source: World Bank (2015) 1.5 The Indian GST is expected to represent a leap forward in creating a much cleaner dual VAT which would minimize the disadvantages of completely independent and completely centralized systems. A common base and common rates (across goods and services) and very similar rates (across States and between Centre and States) will facilitate administration and improve compliance while also rendering manageable the collection of taxes on inter-state sales. At the same time, the exceptions-in the form of permissible additional excise taxes on sin goods (petroleum and tobacco for the Centre, petroleum and alcohol for the States)-will provide the requisite fiscal autonomy to the States. Indeed, even if they are brought within the scope of the GST, the states will retain autonomy in being able to levy top-up taxes on these “sin/demerit” goods. 1.6 Provided it can be reasonably well-designed, the Indian GST will be the 21st century standard for VAT in federal systems. 1.7 It is, therefore, imperative to ensure that the design and implementation of this policy is done right. And, one important, perhaps critical, dimension of this is the level and structure of tax rates on which this Committee has been asked to make recommendations. II.BENEFITS OF PROPOSED GST 2.1 Many benefits are claimed for the GST: that it will increase growth1; that it will increase investment by making it easier to take advantage of input tax credits for capital goods; and that it will reduce cascading.2 While these are important, in our view three benefits stand out in today’s context: governance/institutional reform and “Make in India by Making one India,” which are two key pillars of the government’s reform efforts. The investment, and hence growth, benefits could also be substantial. Governance 2.2 The government has placed a great deal of emphasis on curbing black money reflected in the Black Money Bill. These measures can be very significantly complemented by a GST, which, especially if it is extended to as many goods and services as possible (especially alcohol, real estate and precious metals), can be a less intrusive, more self-policing, and hence more effective way of reducing corruption and rent-seeking. 2.3 Under the GST, this can happen in two ways. The first relates to the self-policing incentive inherent to a valued added tax. To claim input tax credit, each dealer has an incentive to request documentation from the dealer behind him in the value-added/tax chain. Provided, the chain is not broken through wide ranging exemptions, especially on intermediate goods, this self-policing feature can work very powerfully in the GST. 2.4 According to Pomeranz (2013), “The Value Added Tax (VAT) is a stark example of a tax believed to facilitate enforcement through a built-in incentive structure that generates a third party reported paper trail on transactions between firms, which makes it harder to hide the transaction from the government (e.g. Tait, 1972; Burgess and Stern, 1993; Agha and Haughton, 1996; Kopczuk and Slemrod, 2006). This belief has contributed to one of the most significant developments in tax policy of recent decades (Keen and Lockwood, 2010): a striking increase in VAT adoption from 47 countries in 1990 to over 140 today (Bird and Gendron, 2007).” 2.5 The best evidence of the impact of the paper trail on evasion comes from an experiment in Chile which shows that firms that are part of the VAT chain are less responsive (in terms of evasion) to announcements of an increase in audit, suggesting that being part of the VAT itself performs the self-auditing function (Pomeranz, 2013). Moreover, the study finds that increasing the audit probability of firms suspected of evasion generates spillovers up the VAT paper trail that lead to an increase of their suppliers' tax payments. In a sense, the supplier, because of the paper trail left by the VAT, knows that his evasion will be more likely to be detected once his client is audited. 2.6 Second, the GST will in effect have a dual monitoring structure-one by the States and one by the Centre. Hence, there will be a greater probability that evasion will be detected. Even if one set of tax authorities overlooks and/or fails to detect evasion, there is the possibility that the other overseeing authority may not. Make in India by Making one India 2.7 The current tax structure unmakes India, by fragmenting Indian markets along state lines. This has the collateral consequence of also undermining Make in India, by favouring imports and disfavouring domestic production. The GST would rectify it not by increasing protection but by eliminating the negative protection favouring imports and disfavouring domestic manufacturing. 2.8 These distortions are caused by three features of the current system: the central sales tax (CST) on inter-state sales of goods; other numerous inter-state taxes that will be replaced by the (one) GST; and the extensive nature of countervailing duty (CVD) exemptions. CST3 2.9 The 2 per cent CST on inter-state sales of goods leads to inefficiencies in supply chain of goods. Goods produced locally within the jurisdiction of consumption attract lower tax than those produced outside. This tax encourages geographic fragmentation of production. The tax can be avoided partially through branch/stock transfers by manufacturers. However, the tax savings from branch transfers get substantially offset by the incremental costs of logistics and warehousing of goods in multiple locations. 2.10 Consider a simple example, where intermediate goods produced in Maharashtra go to Andhra Pradesh for production of a final good which in turn is sold in Tamil Nadu. Effectively, the goods will face an additional tax of 4 per cent, which will reduce the competitiveness of the goods produced in Andhra Pradesh compared with goods that can be imported directly to say Chennai from South and East Asian sources. 2.11 How quantitatively significant is the impact of the CST? We have some suggestive evidence based on data provided by six States: Maharashtra, Andhra Pradesh, Karnataka, Gujarat, Tamil Nadu and Kerala. In these States, stock transfers, on average, account for as much of inter-state trade as the trade subject to the CST (in the case of Gujarat and Andhra Pradesh, stock transfers are more than twice as much) (Table 2). In other words, the distortion affects fifty per cent of the total trade that flows between States.

Eliminating other inter-state taxes 2.12 Currently, there are a number of inter-state taxes that are levied by the States in addition to the CST. These include: entry tax not in lieu of octroi and entry tax in lieu of octroi. 2.13 Under the GST, all these taxes would be folded into the GST with enormous benefits. What are the benefits? 2.14 There is ample evidence to suggest that logistical costs within India are high. One study suggests that, for example, in one day, trucks in India drive just one-third of the distance of trucks in the US (280 kms vs 800 kms). This raises direct costs (wages to drivers, passed on to firms), indirect costs (firms keeping larger inventory), and location choices (locating closer to suppliers/customers instead of lowest-cost location in terms of wages, rent, etc.). Further, only about 40 per cent of the total travel time is spent driving, check points and other official stoppages take up almost one-quarter of total travel time. Eliminating check point delays could keep trucks moving almost 6 hours more per day, equivalent to additional 164 kms per day –pulling India above global average and to the level of Brazil. So, logistics costs (broadly defined, and including firms’ estimates of lost sales) are higher than the wage bill or the cost of power, and 3-4 times the international benchmarks. 4 2.15 Another study shows that inter-state trade costs exceed intra-state trade costs by a factor of 7-16, thus pointing to clear existence of border barriers to inter-state movement of goods. Further, inter-state trade costs in India exceed inter-state costs in the US by a factor of 6, suggesting that India’s border effects are large by international comparison. Bringing India’s inter-state trade costs down to the US level (reducing by a factor of 6) increases welfare by 15 per cent; conversely, completely eliminating intra-state trade frictions raises welfare by 5 per cent.5 2.16 All of these barriers to inter-state trade become even more important in India because the share of roads in freight traffic is high (about 72 per cent) and much higher than in comparable countries and rising over time because of under-investment in the Railways (Economic Survey, 2015, pp.92-94). The implication is that it is especially important for India to reduce costs to inter-state trade because of the excessive reliance on roads for movement of goods. 2.17 Now, all of these costs are not due to taxes. But, the World Bank estimates that about 20-30 per cent are (World Bank).6 It is these costs that can be expected to decline with the introduction of the GST, providing a boost to inter-state trade and hence productivity growth within India.7 CVD and SAD Exemptions 2.18 It is insufficiently appreciated that India’s border tax arrangements undermine Indian manufacturing and the “Make in India” initiative. Eliminating exemptions in the countervailing duties (CVD) and special additional duties (SAD) levied on imports will address this problem. How so? 2.19 It is a well-accepted proposition in tax theory that achieving neutrality of incentives between domestic production and imports requires that all domestic indirect taxes also be levied on imports. So, if a country levies a sales tax, VAT, or excise or GST on domestic sales/production, it should also be levied on imports. In India, this is achieved through the CVD/SAD which is levied on imports to offset the impact of the excise duty levied on domestically manufactured goods. 2.20 However, CVD/SAD exemptions act perversely to favour foreign production over domestically produced goods; that is, they provide negative protection for Indian manufacturing. Table-3 illustrates the impact of CVD/SAD and excise exemptions. When there are no CVD/SAD and excise exemptions (Scenario 1), neutrality of incentives between domestic goods and imports is achieved which is desirable. In scenario 2, there is no excise exemption but there is a CVD/SAD exemption which results in a large penalty on domestic producers (of 12.36 per cent under certain assumptions about costs). But the important and subtle point relates to scenario 3 when the excise and CVD/SAD are both exempted. This may seem apparently neutral between domestic production and imports but it is not. The imported good enters the market without the CVD/SAD imposed on it; and, because it is zero-rated in the source country, is not burdened by any embedded input taxes on it. The corresponding domestic good does not face the excise duty, but since it has been exempted, the input tax credit cannot be claimed. The domestic good is thus less competitive vis-à-vis the foreign good because it bears input taxes which the foreign good does not. In the example, the penalty on domestic producers is over 6 per cent. In effect, a policy designed to promote domestic manufacturing through excise exemption creates a perverse incentive for the exempt industry and its eventual decline. 2.21 The CVD/SAD, which is levied to offset the excise duty imposed on domestic producers, is not applied on a whole range of imports. These exemptions can be quantified. The effective rate of excise on domestically-produced non-oil goods is about 9 per cent. The effective collection rate of CVDs should theoretically be the same but is in actual fact only about 6 per cent. The difference not only represents the fiscal cost to the government of ₹ 40,000 crore, it also represents the negative protection in favour of foreign produced goods over domestically produced goods. 2.22 Two defenses of CVD exemptions are typically made. First, that CVD exemptions on inputs help manufacturers by reducing their input costs. But under the current system and in future when the GST is implemented, the CVD on inputs can always be reclaimed as an input tax credit. So, CVD exemptions do not provide additional relief. In fact, they help collection efficiency because they are levied at customs. 8 2.23 The second rationale advanced for exempting many imported goods from CVD is that there is no competing domestic production. This argument is faulty because the absence of competing domestic production may itself be the result of not having the neutrality of incentives that the CVD creates. Domestic producers may have chosen not to enter because the playing field is not level.

2.24 Indian tax policy is therefore effectively penalising domestic manufacturing. How can this anomaly be remedied? Simply by enacting an exemptions-free GST. In one stroke the penalties on domestic manufacturing would be eliminated because the GST (central and state) would automatically be levied on imports to ensure neutrality of incentives. In effect, India would be promoting domestic manufacturing without becoming protectionist and without violating any of its international trade obligations under the World Trade Organization (WTO) or under India’s free trade agreements (FTAs). 2.25 In the meantime, the effect of the GST can be partially simulated even now by eliminating the exemptions applied to CVD/SAD. The default situation should be an exemptions-free regime. If particular sectors seek relief from the CVD/SAD, they should be required to make their case at the appropriate forums. 2.26 In a sense, India finds itself in a de facto state of negative protection on the one hand, and calls for higher tariffs on the other. It is win-win to resist these calls that would burnish India’s openness credentials and instead eliminate the unnecessary and costly penalty on domestic producers. 2.27 All these three sets of costs-the CST, the CVD exemptions, and other inter-state taxes-should be viewed as undermining Make in India because in all cases, they favour foreign production to domestic production. GST can then be thought of as a trade and productivity shock and one that can be harnessed without recourse to protectionism: in effect, the GST will be eliminating negative protectionism. 2.28 This increase in inter-state trade will then have another powerful consequence. A common market will help attain convergence within India because production can be based on comparative advantage. In other words, implementing the GST will help the lagging regions catch up with the more advanced regions by making the former more profitable production destinations. The growth effect via the boost to investment 2.29 Under the current tax system, while the Union excise duties and State VAT applies to all capital goods, input tax credits are generally limited to manufacturing plant and equipment. For example, no input tax credits are allowed for the Union excise duties on capital equipment acquired for use in transportation, infrastructure, distribution, or construction sectors because these sectors are all outside the scope of excise duties which are applicable to manufacturing only. Similarly, no credit is allowed for the State VAT on capital goods acquired by the service sector (e.g., telecommunications, transportation, finance, insurance, and IT services). 2.30 Estimates vary on how much of current investment in a given year suffers from noncredtable excise duties and/or VAT. For example, indirect tax collection data for 2014-15 indicate that the total amount of capital goods purchases for which CENVAT credit was claimed was ₹ 1.6 lakh crore, divided between goods (Rs. 1 lakh crore) and services (Rs. 0.6 lakh crore). National income accounts data suggests that investment in plant and equipment for the same year by the non-government, non-household sector was about ₹ 7.4 lakh crore. Apparently, the blocked input taxes could amount to as much as 75 per cent of total investment. What could account for the difference and could the GST fill this gap? 2.31 If the GST could provide for a more seamless and efficient crediting of taxes paid on capital goods, then capital goods prices would become effectively 12-14 per cent cheaper (because they are taxed at the standard rate of 12.5 per cent currently by the Centre), increasing the demand for capital goods, raising investment and hence growth. 2.32 Assuming an elasticity of investment demand with respect to price to be -0.5, GST, by allowing full input tax credit for capital goods, could higher investment in capital goods by 6 per cent, resulting in 2 per cent higher investment (as machinery and equipment account for around one-third of total investment), which in turn could lead to incremental GDP of 0.5 per cent, assuming an incremental capital output ratio of 4. 2.33 Prior to the introduction of GST in 1991, Canada also had an excise duty regime similar to that in India. Studies for Canada estimated this beneficial impact of GST to be 0.5 per cent as a result of the GST at the federal level only. The extent of tax cascading in India is much greater because of more stringent rules in India for claiming tax credits. 2.34 In sum, investment is discouraged under the current system through the application of excise duties and VAT to capital goods, for which no set off or input tax credit is provided. This increases the cost of capital goods and reduces investment, which in turn leads to lower employment and output. III. CURRENT STRUCTURE OF INDIRECT TAXES: HIGHLIGHTS 3.1 This section describes briefly the structure of current rates of domestic indirect taxes at the Centre and the States. The key takeaways are that the current tax structure is highly complex, highly leaky (riddled with exemptions in goods that we estimate to be about 2.7 per cent of GDP for the Centre and States together) characterized by significant differences between the Centre and the States, and by a rate structure that does not confirm to what the evidence suggests might be good policy. The GST, therefore, affords a unique opportunity to simplify and rationalize the structure and also eliminate serious anomalies to make it consistent with policy objectives (see paragraphs 5.56 to 5.60 and Box 3). 3.2 The details, also summarized in the Table 4, are the following: Centre 3.3 In relation to goods, the Centre has a very complicated tax structure (Table-4), more complex than that of most of the States, characterized by:

3.4 In relation to services too, the Centre has a complicated rate structure. Although there is one statutory rate, in practice, there are 10 other rates because of so-called “abatement” which amounts to fixing a rate different from the standard rate and not allowing further input tax credits. Abatement is necessitated in some part because of uncertainty in the base, and specifically being unable to distinguish “goods” from “services.” The exemptions threshold is ₹ 10 lakh. 3.5 At the Centre, there is incomplete provision of input tax crediting for goods, and incomplete cross-crediting between goods and services. States 3.6 In relation to goods, the States have structures characterized by:

Centre and States 3.7 Another key difference between the Centre and the States, with implications for any future standard rate is that the States have a much larger portion of the base (more than 65 per cent) 10 taxed at the lower rate while the comparable number for the Centre is about 40 per cent. One reason is that States typically place intermediate goods in the lower rate category. The higher standard rate is therefore almost compelled by the fact of placing so much of the base at the lower rate. 3.8 One corollary is that the weighted average statutory rate for goods is 8.4 per cent and 7.5 per cent for the Centre and States, respectively.

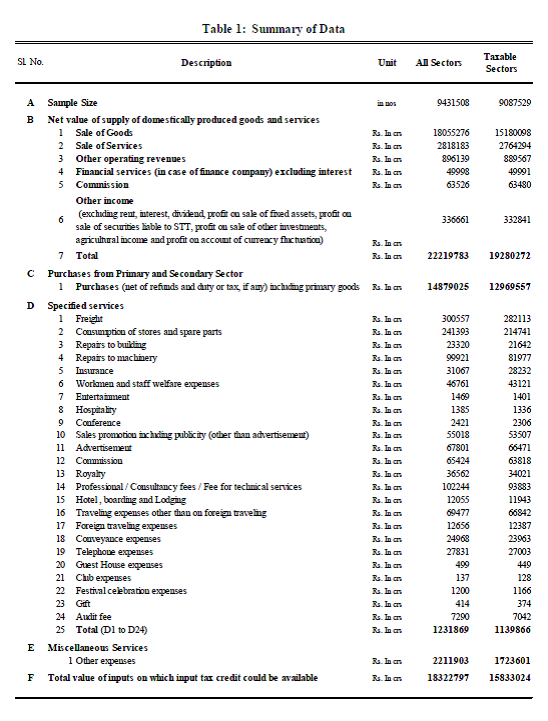

IV.ESTIMATING INDIA’S REVENUE NEUTRAL RATE (RNR) UNDER THE GST 4.1 The Committee had the benefit of 3 technical approaches to estimating the RNR which are described in detail in Annexes 1-3. These will constitute the basis for the Committee’s recommendations on the RNR.11 These are briefly summarised in this section. 4.2 Before describing the recommendations, it is important to make a point relating to terminology. Throughout this report, the term RNR will refer to that single rate, which preserves revenue at desired (current) levels. In practice, there will be a structure of rates, but for the sake of analytical clarity and precision but also to facilitate comparisons across methodologies, it is more useful and appropriate to think of the RNR as a single rate. It is a given single rate that gets converted into a whole rate structure, depending on policy choices about exemptions, what commodities to charge at a lower rate (if at all), and what to charge at a very high rate. That single rate will be the focal point for the RNR. The RNR should be distinguished from the “standard” rate defined as that rate in a GST regime (which has more than one rate), which is applied to all goods and services whose taxation is not explicitly specified. Typically, the majority of the base will be taxed at the standard rate, although this is not true for the States under the current regime. 4.3 The essence of calculating the RNR is highlighted in the simple equation: t=R/B where t is the RNR, R is equal to revenues (both Centre and state) generated from existing sales and excise taxes, which will be replaced by the GST. The revenues to be replaced are estimated to be ₹ 3.28 lakh crore for the Centre, and ₹ 3.69 lakh crore for the States, including the revenues that will have to be compensated for the elimination of the Central Sales Tax (CST). The total amounts to ₹ 6.97 lakh crore (excluding revenues from petroleum and tobacco for the Centre, and from petroleum and alcohol for the States) or 6.1 per cent of GDP, with all numbers pertaining to 2013-14 (the date chosen for all the technical studies) and for 29 States and 2 UTs. What all the RNR exercises attempt to do is to calculate B, the total tax base for generating the required GST revenues. The three approaches presented to the Committee can be called, respectively, the macro, the indirect tax turnover (ITT), and the direct tax turnover (DTT) based approaches. Macro approach 4.4 The macro approach-presented by the staff of the International Monetary Fund-makes use of national income accounts data and supply-use tables to arrive at the base B. It uses the following formula: 𝐵 = Σ(𝑌 + 𝑀 − 𝑋) − [(1 − 𝑒)Σ(𝑁 + 𝐼)] Where B is the potential GST base; Y is domestic output, (M-X) is net imports (imports minus exports); (N+I) is consumption of intermediate and capital inputs; e is the exempt output ratio (i.e. the tax base associated with inputs used in the production of exempt final consumption); and the summation is over 140 goods and services and 66 sectors, based on the 2011-12 national accounts. The following assumptions were made: (1) full compliance; (2) full pass-through of the GST into prices; (3) no behavioral response; (4) the GST has a single positive rate, and a zero rate on exports. 4.5 Under a standard scenario exempting health, education, financial intermediation and public administration, the GST’s potential base is 59 per cent of GDP. Exempting basic food items in addition (essentially unprocessed foods) reduced the potential base to 55 per cent of GDP. However, exempting petroleum or electricity increases the potential base to 67 per cent of GDP-given that such items are largely consumed as inputs rather than final consumption, their exemption increases the base due to cascading. Assuming that the maximum revenue to be replaced is 6.1 per cent of GDP, these estimates for the GST tax base, ranging from 55 per cent to 67 per cent of GDP, suggest that the GST RNR rate, itself ranges between 9.1 (0.061/0.67) and 11.1 per cent (0.061/.55). 4.6 Losses in the order of 10 to 20 per cent of potential revenues are common in OECD countries; assuming 20 per cent increases the range of the RNR from 9-11 per cent to 11-14 per cent. 4.7 In summary, this analysis suggests that the GST RNR rate ranges between 11 to 14 per cent, depending on key policy choices regarding exemptions. The scenario that corresponds closest to the proposed Constitutional Amendment bill yields an RNR of 11.6 percent after factoring in a compliance rate of about 80 per cent of potential GST revenues. Indirect Tax Turnover Approach 4.8 This approach, presented by the National Institute of Public Finance and Policy, estimates the base in a three step process. First, it estimates the goods base at the level of the States. This base is estimated by converting data on actual collections and statutory rates into a goods base. In other words, the effective rate becomes the basis for the estimation of the goods base. In the absence of data for all the States, the key assumption is that States collect revenues at the three rates (1 per cent, 6 per cent, and 14 per cent) in such a proportion so as to yield a total taxable base of ₹ 30.8 lakh crore. 4.9 In the second stage, the services base is estimated based on turnover data of 3.25 lakh firms from the newly available MCA database (this base is estimated at ₹ 40.8 lakh crore). 4.10 In a third stage, adjustments are made to this base to remove IT-related services, because a large part of them are exported, and to remove most of real estate and financial services from the base because of the manner in which these items will be treated under the GST. This adjusted base is then subject to an input-output analysis to deduct from the base taxable inputs used for service provision and also deduct services used as inputs into taxable manufacturing. All these adjustments result in an incremental services base (incremental to whatever has already been incorporated in goods) of ₹ 8.5 lakh crore and a combined base (goods and services) of ₹ 39.4 lakh crore. 4.11 This base, in turn yields a single RNR of 17.69 per cent under the scenario of having to compensate the States for the 2 per cent CST. The corresponding standard rate under current structures of taxation is estimated at 22.76 per cent. It is worth recalling that an earlier analysis based on the same methodology by NIPFP was presented to the Empowered Committee of the GST in February 2014. That analysis yielded an estimate of the RNR of 18.86 percent and a standard rate of 25 per cent.12 Direct tax turnover Approach 4.12 A third approach-which was described in the Thirteenth Finance Commission--is based on using income tax data which are available for about 94.3 lakh registered entities (including companies, partnerships, and proprietorships but not charitable organizations). The data are classified into 10 sectors and 75 sub-sectors. These data allow the potential base for the GST to be calculated. Unlike the indirect tax turnover approach but like the macro approach, this approach yields a combined base for goods and services, rather than separate bases for goods and services. 4.13 The profit and loss accounts provide data on value of supply of goods and services (which is equivalent to turnover) to which can be added imports of goods and services. This yields the tax base of at about ₹ 222 lakh crore in turnover terms. Deducting the exempt sectors from this base (petroleum, land component of real estate, the interest component of the financial sector, electricity, gem and jewellery, education, health, and agricultural produce) narrows the output tax base down to about ₹ 194 lakh crore. 4.14 Next, purchases are divided into 2 categories, those that reduce the base because of the availability of input tax credits and those that add to the base either because they are purchases by or from exempt sectors.13 The former include intermediate goods and services (Rs. 183 lakh crore) and capital goods (Rs. 6 lakh crore). The latter include purchases by exempt sectors (Rs. 25 lakh crore), purchases of primary goods (Rs. 11 lakh crore) and purchases from unregistered dealers ₹ 24 lakh crore). This yields an input tax base of ₹ 130 lakh crore. 4.15 Further adjustments are made to take account of the value added of firms that will fall below the exemptions threshold (removed from the taxable base); of the alcohol sector (removed from the taxable base); and the rail sector (added to the base because this sector is not part of the data set in the first place). 4.16 Putting all these together gives a potential tax base of ₹ 58.2 lakh crore, yielding a combined RNR of 11.98 per cent. 4.17 Table 5 highlights the estimated GST base and corresponding RNR of the three approaches to estimating RNR. Table 5: Summary of approaches to estimating RNR

Source: Based on three approaches to estimating RNR V. RECOMMENDATIONS 5.1 Consistent with the Committee’s terms of reference, we make recommendations on a number of issues: the RNR; the distribution of RNR between the Centre and States; the structure of rates; and the potential price impact of the GST. In addition, we make recommendations on other relevant issues: the bands for the GST; compensation, the treatment of precious metals, and the tax treatment of certain commodities such as alcohol, electricity, education, and health. The Magnitude of the RNR 5.2 Three different approaches have been presented to determine the RNR. Each has it merits and drawbacks because of the underlying assumptions made and the data used. Coming up with an RNR is as much soft judgement as hard science. We cannot be confident that any one number is the right one. Moreover, there is a certain endogeneity effect-like a Heisenberg Uncertainty Principle-that the very choice of rates could affect the outcome relating to revenues, compliance, convenience, etc. 5.3 We will make our recommendations in two steps. First, we will critically evaluate each of the three approaches both in terms of the methodology and in terms of the results they generate for the RNR. We then present the Committee’s recommendations for the RNR and validate these results against independent benchmarks. These recommendations will be supported by a complementary discussion on the risks associated with our estimates for the RNR. 5.4 Our recommendation for the RNR will not be unduly guided by short-term considerations, for example, relating to compensation. The RNR should be one that achieves the objectives of the government over a horizon that is not short term. If compensation is necessary, it should be found/funded from government resources elsewhere and the GST should not have to bear the long-term burden of having to meet short-term exigencies. 5.5 The estimates presented for the national RNR, range from about 11.6 per cent under the Macro approach to 17.7 per cent under the ITT approach. Where does the truth lie? Critical assessment of the methodology of the three approaches 5.6 Each approach has advantages and shortcomings that are described below. The Empowered Committee of the GST has had the benefit of familiarity only with the ITT approach of the NIPFP and we will dwell to some extent on this analysis. The Committee would underscore that the focus on the ITT approach does not signify that it is superior to the other two; indeed, focusing on one approach can be limiting and misleading. 5.7 Five key features drive the results of the ITT approach: i. The assumptions of collections at the different rates determine the goods base for the States. We have obtained the actual data on such collections for16 States (Karnataka, Maharashtra, Andhra Pradesh, Gujarat, Tamil Nadu, Bihar, Odisha, Chhattisgarh, Delhi, Uttar Pradesh, Jharkhand, Rajasthan, Madhya Pradesh, West Bengal, Haryana and Puducherry) that together account for about 78.5 per cent of all States’ VAT base. These data vary significantly from the assumptions underlying the ITT approach. Specifically, our data suggest that the aggregate base is distributed between the three different rates-1 per cent, 2-6 per cent, 12-15 per cent and higher rate--in the ratio of 11.6 per cent, 55.4 per cent, 28.5 per cent and 4.7 per cent. In contrast, the ITT assumed-without analysing actual data--tax base proportions of 2 per cent, 56.15 per cent, and 41.85 per cent at the 1 per cent, 5 per cent, and 14-15 per cent, respectively. ii. The estimation of the services base by the ITT approach does not make any allowance for purchases from the unorganized sector. Such purchases will lead to an increase in the base-via cascading--because the final value will reflect the embedded taxes which cannot be set off as input tax credit. iii. The estimation of the services base also ignores one potentially important issue. Currently, States tax most intermediate goods at the lower rate. If these goods were shifted to the normal rate-as States have indicated they might be willing to do-there would be an effective expansion of the tax base. It may be noted that taxes on intermediates in a GST system are like withholding-collecting early on in the value added chain but refunding them later on. So, in principle, this shift of intermediate goods should not yield any additional taxes. But to the extent that the unorganized sector buys intermediates from the organized sector, this shifting will result in greater taxes because the withheld taxes on intermediates will not be refunded later in the chain because the buyer is outside the tax chain. The lost base from these two effects-cascading and withholding-is difficult to estimate. But we cannot assume, as the ITT approach does, that this estimate should be zero. Corporate income tax data allows a guesstimate of the cascading effect. iv. A similar withholding type effect would come into play with the elimination of all CVD exemptions which the ITT approach does not fully take into account.14 v. The ITT approach also does not fully incorporate into the base, sugar products and textiles15 that are sold directly to the consumer.16 5.8 The DTT approach on the other hand is subject to two uncertainties: whether the output tax base has sufficiently taken account of exempted sectors, and whether the estimates of purchases from the unorganized sector-a key input that drives the final result-are reasonable. 5.9 The macroeconomic approach of the IMF suffers from being too aggregate in nature and the implied tax base of ₹ 59.9 lakh crore seems to be on the high side. One particular source of worry is that the tax base seems to increase substantially account of the exclusion of electricity and petroleum. This seems unlikely given that in both cases, there is some considerable sales to the final consumer. 5.10 But these two approaches have two important merits. They help provide a cross-check for the ITT approach; perhaps more significantly, they highlight the need to validate the estimates generated by all three approaches. We turn to this validation in the next section. 5.11 All three approaches implicitly assume that there will be no benefits to the base and/or revenues from improving compliance and or improved growth consequent upon implementing the GST. But the macro approach does not assume current levels of compliance-as the other two approaches do-but a theoretical one which may or may not correspond to current reality. Recommendations and validation 5.12 Our recommendation is based first on making adjustments to the ITT approach:17 ₹ 3.12 lakh crore for the data-based revision to the States’ VAT base; ₹ 30,000 crore for the omission of sugar; ₹ 45,000 crore for the cascading effect; and ₹ 95,000 crore for the choice of the statutory rather than effective excise rate in quantifying the base. Then, we add an adjustment for compliance efficiency gains (Rs. 2 lakh crore). 5.13 What is the basis for these adjustments? 5.14 Note that the ITT approach was based on a pure assumption about the States’ VAT base which we have improved upon by collecting the relevant data for 16 States, accounting 78.5 per cent of the entire VAT base of the states. 5.15 The adjustment for sugar is based on the national income estimate for value-added in the sugar sector of ₹ 40,000 crore. We conservatively adjust this down to ₹ 30,000 crore. 5.16 Note that the authors of the ITT approach acknowledge that the withholding, cascading and compliance effects are important. But they chose to ascribe a value of zero to these effects because of uncertainty about arriving at a quantitative estimate. But that is clearly biased downwards as the authors of the approach would themselves acknowledge. We have chosen to address this bias by making some conservative estimates about the magnitude of these effects. 5.17 For the cascading effect, the ITT approach had earlier estimated an addition to the base of 10% of the incremental services base. The DTT approach estimates an addition to the base of about 16%. We, conservatively, estimate that the under-statement of the base would be half that assumed by the ITT approach which amounts to 45,000 crore. 5.18 For the compliance effect we draw upon cross-country experience. In Box 1, econometric analysis of that experience yields an estimate that a 1 percentage point reduction in the standard rate would increase the collection efficiency by 1 percent. The GST would lead to about a 4.1 percentage point reduction in the standard rate (in weighted terms) which would translate into a 4.1 percentage point increase in the C-efficiency or 9.3% increase in collection efficiency (based on the current C-efficiency of 0.44). This is equivalent to an expansion in the tax base of ₹ 4.3 lakh crore. Again, we assumed, conservatively, and after consulting with the CBEC, that just under half of this compliance improvement (Rs. 2 lakh crore) would be realized. 5.19 To summarize, our adjustments to the ITT approach are conservative in the following ways:

5.20 Under GST, the compliance gains would be the following:

5.21 The experience of all countries suggests improvements over time in GST implementation, and in India’s case, a number of design features should contribute to such improvements in efficiency. These are not improvements that will take years to materialize. 5.22 Adding up these adjustments yields a single RNR of 15 per cent. However, we recognize that there may be uncertainty about the adjustments we have made. An alternative scenario is that not all of the adjustments are valid. In this case, the single RNR would be 15.5 percent (Table 6). Table 6: Committee’s recommendations compared with other approaches to estimating RNR

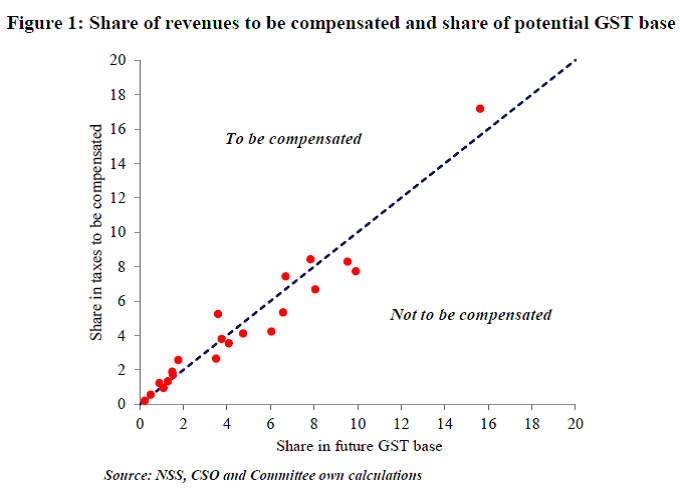

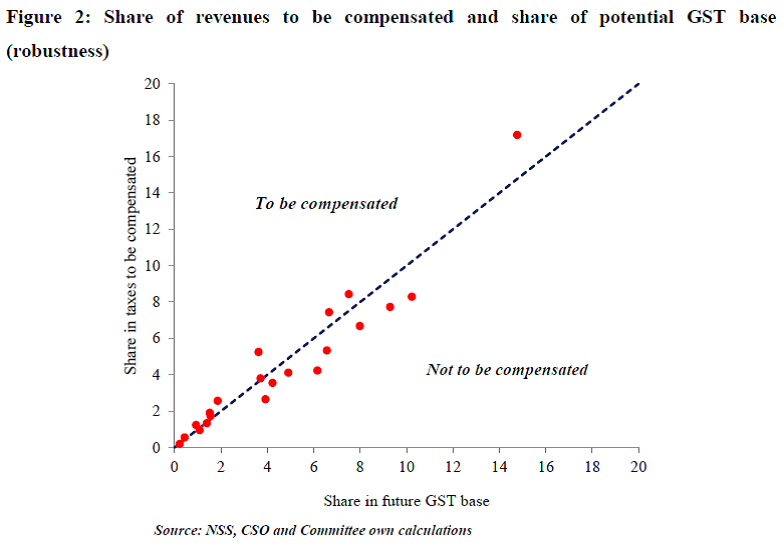

ITT= Indirect Tax Turnover DTT=Direct Tax Turnover Source: Different approaches and committee’s calculation 5.23 Our recommendation for the RNR is, therefore, a range for the RNR of 15-15.5%, with a strong preference for the lower end of that range. 5.24 Next we validate this recommendation. Since there is the possibility of error in all the approaches, including our recommendation, we must independently validate them against other benchmarks. One important benchmark for validation relates to the efficiency of the tax system. A commonly-used measure of performance of a VAT system is to compute a C-efficiency ratio. This is measured as: C-eff=R/(S*C) where R stands for revenues collected, S is the standard rate and C is total final consumption (net of value-added taxes). The denominator is a measure of the potential revenues that can be potentially collected and the numerator actual collections. C-efficiency is simply a measure of comparing actual against potential. The C-efficiency implied by the three approaches and the Committee’s recommendations are then compared against C-efficiency in a number of other countries and this comparison is shown in Figure 1.

5.25 The average C-efficiency is about 0.6 for high income countries and 0.57 for emerging market countries, and 0.31 for low income countries. The C-efficiency implied by the macro and DDT estimates for the RNR (of 0.70 and 0.68 respectively) would place India above other emerging market countries. In contrast, the c-efficiency implied by the ITT approach of 0.40 would put India well below the average of emerging market countries and only somewhat above that for low-income countries. 5.26 Put differently, if the RNR, and the associated standard rate, of the ITT approach were reasonably estimated, it would imply that India has either come up with an effective policy base under the GST that is unusually narrow and/or Indian indirect tax administration is unusually poor relative to comparator countries. This inference would be puzzling, if not problematic, not least for implying that India’s tax efficiency is closer to that of Mali than of Brazil, Chile, Indonesia or Thailand. This cross-country comparison is important evidence that the RNR estimated by the ITT approach is too high. 5.27 In contrast, the RNR estimates for the other two approaches would place India at levels comparable to other countries.19 Our recommendations yield estimates for the RNR that are at or below the average of other EMEs. In that sense, they are conservative estimates for the RNR because they too imply similar levels of efficiency of the Indian tax system. 20 5.28 Another consideration can be invoked to support the RNR of 15-15.5 per cent. Suppose this RNR requires to be operationalized in a two rate GST structure with a lower rate of say 12 per cent and a standard rate of 17-19 per cent, depending on how goods are allocated between the lower and standard rate. 5.29 Figure-2 shows data on the standard rate of VAT in selected high income and large emerging market economies. It shows that the average standard rate for comparable EMEs is 14.4 per cent and the highest standard rate is 19 per cent; and even for the high-spending and therefore high-taxing advanced economies it is 16.8 per cent. An RNR of anything beyond 15 - 15.5 per cent will likely result in a standard rate of about 19-21 per cent which would make India an outlier amongst comparable emerging economies. For example, the ITT approach’s RNR of 17.7 per cent would translate into a standard rate of 22.8 per cent, identifying India as having the highest GST tax rate amongst emerging market economies. Our recommendations would still place India at the upper end of the standard rates found across comparable countries. It is worth emphasizing that the GST is intrinsically a regressive tax and the higher the rate the greater the regressivity. Countries that have well developed social safety nets can better offset this regressivity but India at a lower level of development is less able to do so and hence needs to be especially mindful of rates that are out of line with international ones.

A risk analysis 5.30 Since we cannot be certain of the RNR-it is after all our best assessment or best guess-a risk assessment framework poses the question: should we err on the side of an RNR that is a little low or a little high? 5.31 One risk of setting an RNR that is low is the re-emergence of a trust deficit between the Centre and the States as happened in relation to compensation for lost CST revenues after the global financial crisis. If revenues fall short, and the fiscal position of the Centre and States is affected, the Centre will face a double whammy, with weak revenues for itself and an additional burden of having to compensate the States. And, if as a result, compensation is delayed or diluted, a trust deficit could re-emerge. 5.32 The second risk of setting a low RNR is that it could interact with slower growth and/or weaker buoyancy going forward to magnify the revenue shortfall. 5.33 On the other hand, some of these risks can be overcome. In the event of a revenue shortfall, the Centre and the States can both raise non-GST taxes (petroleum, tobacco and tobacco products, and alcohol); they can together raise GST rates; and, as a last resort, the Centre could even afford to relax its deficit target, based on the fact that was actually an investment for implementing unprecedentedly ambitious tax reform with enormous long-run gains; moreover, a moderately higher deficit due to a low GST will benefit consumers, especially poorer ones. 5.34 Second, given the unavoidable teething troubles that will afflict GST implementation, it seems inadvisable to further burden the initial stages of implementation with higher rates that will increase taxpayer displeasure, reduce compliance and increase disaffection. On balance, lower rates will facilitate compliance as our evidence in Box 1 shows. The econometric analysis suggests that a 1 percentage point reduction in the standard rate will lead to an improvement in administrative efficiency (and compliance) of 1 percentage point which in the GST setting would translate into an efficiency gain of about 15 percent. 5.35 Further, the improvement in compliance will not be restricted to indirect tax collections. The paper trail of the GST will also help direct tax administration and improve compliance in collections of corporate income taxes. 5.36 Third, the price consequences of a GST will be small, especially under a dual rate structure with essential food items exempted. As the analysis in Section V reveals, an RNR in the 15-15.5 per cent range with a lower rate of 12 per cent and a standard rate of 18 per cent would have no aggregate inflation impact. But a higher RNR with a lower rate of 12 per cent and a standard rate of 22 per cent would increase inflation by between 0.3-0.7 percent. Care will have to be taken to ensure that the GST does not become the target of popular disaffection on the grounds that it fed higher inflation. In that respect a lower RNR is safer than a higher one, especially considering that the GST is inherently regressive relative to direct income taxes. 5.37 Fourth, there is also a perception issue. Today’s GST rate is 14.36 per cent for services (now nearly 15 per cent with the Swacch Bharat cess). If the RNR is greater than 15-15.5 per cent, the rate for services will be in the 20-22 percent range which will make the GST seem like a substantial tax increase when it strictly speaking is not and should not (after all, the new rate should be revenue neutral). Optically, the GST as a rate hike should be avoided to the greatest extent possible. A lower rate will be seen as more politically acceptable and will help taxpayer compliance. 5.38 Fifth, even if the proposed RNR is on the side of being a little low, all the evidence suggests that over time, compliance will improve, so that the GST will become a buoyant source of revenue. This could happen even in the short run as discussed earlier. A marginally lower rate, if it turns out to be that way, will signal the government’s confidence in the GST as a medium term tax reform. This would re-inforce the signal that the government has already sent-in a sense under-writing the GST-by committing to compensation for five years (despite the fact that when the state VATs were implemented, compensation was not required beyond the second year.) Allocation of RNR between Centre and States 5.39 The Committee’s recommendations on rates are all national rates, comprising the sum of central and state GST rates. How these combined rates are allocated between the center and states will be determined by the GST Council. This allocation must reflect the revenue requirements of the Centre and states so that revenues are protected. For example, a standard rate of 17% would lead to rates at the Centre and states of say 8 percent and 9 percent, respectively because that is roughly the ratio of GST revenues that would have to be generated by the centre and states assuming that the 2013-14 data on which these estimates are calculated remain valid. It would be preferable to keep all other rates identical between the center and states to minimize distortions and facilitate compliance. The structure of rates Exemptions 5.40 Given the historic opportunity afforded by the GST, the aim should be to clean up an Indian tax system that has effectively become an “exemptions raj” with serious consequences for revenues but also governance. According to the government’s own figures, excise tax exemptions (and taxing goods at low rates) result in foregone revenues of ₹ 1.8 lakh crore or nearly 80 per cent of actual collections. Tentative estimates by the Committee suggest that the comparable figure for the States is about ₹ 1.5 lakh crore. Together, India loses about 2.7 per cent of GDP because of exemptions. 5.41 The Committee cannot state this in any stronger terms: if the GST is to be a success-with an uninterrupted value chain that facilitates compliance and a buoyant source of revenue-these exemptions must be plugged. Using exemptions as selective industrial policy has led to generous un-selective policy, and proliferating exemptions. The road to exemptions hell is paved with the good initial intention of restricting exemptions to a few industries. 5.42 It is also worth emphasizing that exemptions need not, and often do not, result in low or zero tax burdens. If a product is exempted, the effective tax burden will depend on all the embedded taxes on inputs going into that product. If the move to the GST results in lower rates of taxation, it is possible that eliminating exemptions might actually reduce the effective tax burden. This is especially likely in relation to small scale industries (SSIs) which are likely to come within the scope of the GST because of reductions in the exemptions thresholds. The combination of input tax credits that they can reap combined with lower standard rates might result in SSIs facing lower tax burdens. Another hidden cost of exemptions is that it leads to effective tax burdens that can vary widely across goods, leading to a multiplicity of effective tax rates. 5.43 We would recommend that:

5.44 For the dual GST system to be a success, the tax base must be common across the Centre and States, otherwise tax administration becomes fiendishly complicated. Hence the importance of the recommendation that the exemptions list be common across the Centre and the States. Lower, standard and “demerit” rates 5.45 Ideally, the GST should aspire to a single rate, which would then also be the standard rate. Since 2000, about 90 per cent of countries that have adopted a VAT have chosen to have a single rate. The tax administration benefits of having a single rate are substantial. However, in the years ahead, it may not be feasible to adopt a single rate GST system for social reasons. A 2-rate structure (or a modified 2-rate structure) may therefore be adopted. What should be the lower rate and the standard rate, and the demerit rate which would apply to a small group of luxury items? 5.46 Consider the following simple formula for determining the structure of rates: R = αLG + βSG + γSS + μDG Where R is the RNR, LG is the lower rate on goods, SG is the standard rate on goods, SS the standard rate on services; and DG the demerit rate on goods; α, β, γ, and μ are the respective shares of these four rates in the underlying tax base, and together add up to 1. 5.47 The first point to note is that the standard rate for goods and services must be the same because that is the raison d’etre of the GST-to provide a common base for goods and services, obviating the need for defining goods and services separately. Thus: SG = SS = (R - αLG - μDG) / (β + γ) 5.48 The next point to note is that for any given RNR (that has been estimated), and a given higher rate (discussed below), the lower is the lower rate, the higher will be the standard rate. 5.49 Ideally, the lower rate should not be far lower than the RNR for two reasons. The lower the rate and the more the commodities that are taxed at this lower rate, the higher will be the standard rate just as a matter of arithmetic. In fact, this is the pattern in the States. Lower rates of 4-5 per cent with a large part of the base taxed at these rates (about 60-70 per cent) results in the necessity of high standard rates of 14-15 per cent. High standard rates make compliance considerably more difficult. 5.50 The second reason for having lower rates that are close to the RNR relates to political economy. The temptation to push commodities to the lower rate increases the lower is the low rate. The benefit for any industry group of seeking to reduce the tax on its output is directly proportional to the tax advantage: moving a product from 14 per cent to 6 per cent is worth more than moving a product from 14 to 12 per cent. And in fact the pattern in the States reflects this political economy at work. 5.51 So, if the RNR is close to 15 per cent, the effort should be to keep the low rate at about 12 (6 +6 each for the Centre and States) per cent. 5.52 As discussed earlier, a lot will depend on the magnitude of exemptions and decisions about what goods are taxed at the lower rate and at the demerit rate. One of the major items either exempted or taxed at a very low rate currently is gold, silver, and precious metals. If the Centre moves to the smaller list as recommended and the States shift more of their tax base, especially intermediate goods, toward the standard rate also as recommended, the pattern of standard rates will look roughly as follows in table 7. 5.53 To illustrate the impact of policy choices on the standard rate, we present in Table 7, the consequences for the standard rate (for the given RNR of 15 per cent) of the treatment of gold and precious metals (for details on the tax treatment of these commodities, see Box 3). As the table shows, the lower the rate that these commodities are taxed, the higher will be the standard rate that is applied to all commodities. For example, if gold is taxed at 4 percent the standard rate will be 17.3 percent. In contrast, if gold is taxed at 6 per cent, the standard rate can come down to as much as 16.9 per cent (table-8). Table 7: RNR and Standard Rate structure for center and states (per cent)

Source: Committee’s calculation. a: This corresponds to committee’s preferred scenario with rate on precious metal at 6per cent. Table 8: Gold rate and it impact on Standard Rate

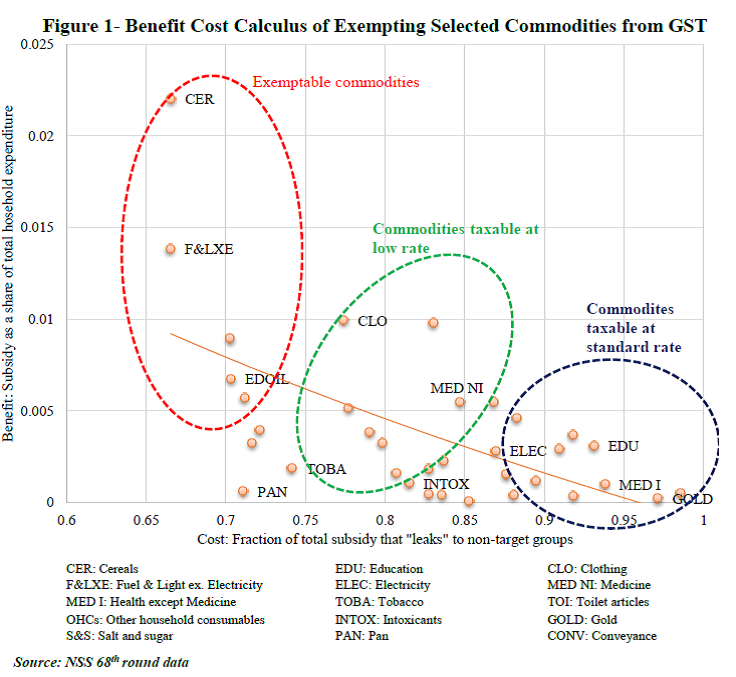

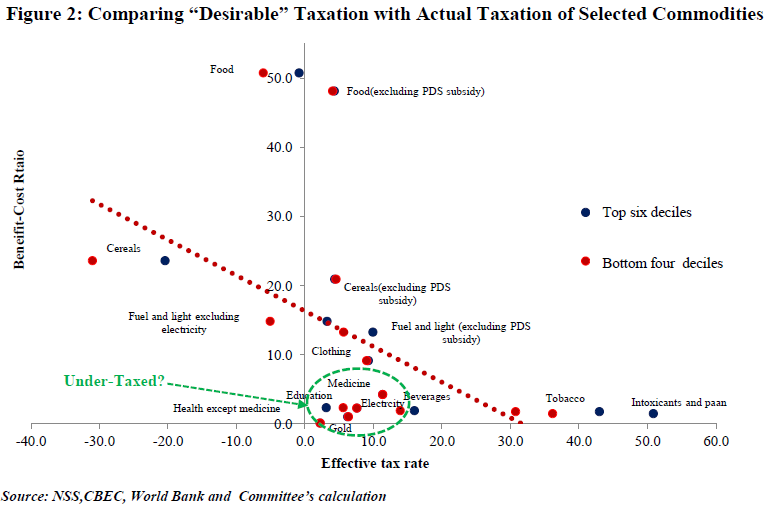

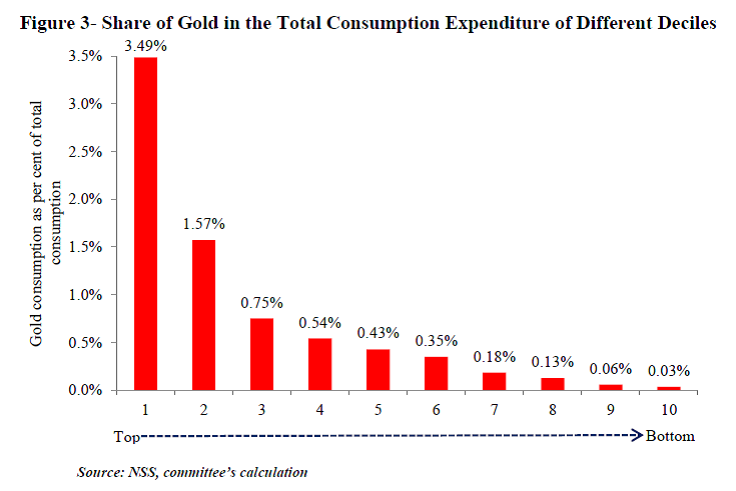

Source: Committee’s calculation. 5.54 It is now growing international practice to levy sin/demerit rates-in the form of excises outside the scope of the GST--on goods and services that create negative externalities for the economy (for example, carbon taxes, taxes on cars that create environmental pollution, taxes to address health concerns etc.). As currently envisaged, such demerit rates-other than for alcohol and petroleum (for the states) and tobacco and petroleum (for the Centre)-will have to be provided for within the structure of the GST. The foregone flexibility for the center and the states is balanced by the greater scrutiny that will be required because such taxes have to be done within the GST context and hence subject to discussions in the GST Council. 5.55 We recommend one demerit rate and that rate should be such that the current revenues from that high rate are preserved. Accordingly, we recommend that this sin/demerit rate be fixed at about 40 percent (Centre plus States) and apply to luxury cars, aerated beverages, paan masala, and tobacco and tobacco products (for the states). The Centre can, of course, levy an additional excise on tobacco and tobacco products over and above this high rate. These goods are final consumer goods and should be of high value (so that small retail outlets are not burdened with the complication of having to deal with multiple rates) and clearly identifiable so that there are no issues related to classification that could complicate tax compliance. Assigning products to rates 5.56 Typically, the assignment of goods to different tax categories will be motivated by considerations of equity. Goods that account for a large share of expenditures of poorer households-for example, food-- will typically be merit goods and will either be exempt or placed in a lower rate category. A related feature will be that this share will decline for richer households. 5.57 But even if a good is a merit good, warranting an exemption or lower rate, policy makers will want to ask how effective that decision will be based on how well targeted the implicit subsidy will be, where the implicit subsidy is the difference between taxing a good at the standard tax rate and the lower or zero rate: if the poor also account for a large fraction of total expenditure on the merit good, then the subsidy will be well targeted; if, on the other hand, they account for a small share of the total expenditure, then the subsidy decision will come with the cost that most of the benefits of the subsidy will accrue to the relatively better off. 22 5.58 So, one can think of a commodity-wise benefit-cost analysis for determining the rate structure. The benefit could be thought of as the subsidy rate for the target group, say the bottom four deciles of the population.23 The subsidy essentially measures how much the expenditure of the target group would be increased by exempting a good rather than taxing it at the standard rate. 5.59 The cost could be measured in relation to the principle of effective targeting. The cost is simply that proportion of the total subsidy for any particular good that does not reach the target group and instead “leaks” to the non-target group, in this case, the top 6 deciles. 5.60 When we do a benefit-cost analysis of different commodities and compare it against the actual structure of rates, a few broad policy conclusions emerge captured in Figure 3 (Box 3 has a detailed analysis).

Exemptions threshold 5.61 The current situation and proposed thresholds are described in Table 8. (Compounding refers to the exemption of firms from the VAT chain; instead they are charged a small turnover tax without allowing for any input tax credits). Setting an exemptions threshold has to balance three considerations. 5.62 First, minimizing the burden on small taxpayers would call for higher thresholds. Second, a high threshold also achieves social objectives because poorer households are more likely to buy from smaller outlets (such as kirana shops). Third, on the other hand, a high threshold not only risks foregoing revenues but also undermines the value-added chain that is so critical for the governance benefits of having a GST. The current proposal is to have a common threshold of ₹ 25 lakh for goods and services combined but raising this threshold say upto ₹ 40 lakh may be considered. Table 9: Exemption Thresholds: Current and Proposed

Source: Department of Revenue 5.63 Corporate income tax data suggests that between for turnover in the ₹ 25-40 lakh crore range, there are 3.26 lakh registered entities (0.22 corporate and 3.04 non-corporates), accounting for just over ₹ 1.04 lakh crore in total turnover. The benefit cost ratio of minimizing the compliance burden relative to the revenue foregone may need to be considered. Also, the option should be given to firms to be part of the GST chain even if they are below the exemption threshold. 5.64 That said, the concern that reducing the threshold will raise the tax burden faced by small scale industries (SSIs) may need to be reviewed. Under plausible scenarios, the effective burden on SSI plants can actually decline, if the standard rate (currently around 25-26% in goods for the center and States combined) comes down, as envisaged by the Committee (see the illustrative example in the Annex Table). Rates or Rate Bands and the issue of fiscal autonomy of States under the GST 5.65 The proposed GST bill provides for States to have a band of 2 per cent above the standard GST rate so that they have some fiscal flexibility to adapt to state-level conditions. There are two reasons why this flexibility may need to be reassessed. First, the argument for fiscal flexibility/autonomy becomes less compelling: under the proposed GST, the States still retain considerable flexibility because alcohol and petroleum-the biggest sources of revenues for the States about 29 per cent of overall States’ indirect tax revenue and about 41.8 per cent of the total revenue of States to be subsumed under GST-as well as power, real estate, health and education remain outside the scope of the GST. Even if petroleum, alcohol and tobacco are subsumed in the GST, States will retain the right to levy top-up excises on them. 5.66 In other words, the design of the GST is such that states will continue to have considerable autonomy under the proposed GST either in its current form (which has a number of exemptions and exclusions) or in a future GST regime that reduces these exemptions and exclusions because there will be scope for states to levy top-up excises. That is the sense in which, the Committee argued earlier that the Indian GST has the potential to marry the best of centralized and decentralized features of VATs in large federal systems. 5.67 Second, if States exercise this flexibility, there would be varying rates for a given product, which would create distortions across States and reduce efficiency and increase compliance costs, especially for companies planning multi-state activities. These distortions and costs must be seen against the fact that they will not lead any meaningful additional fiscal autonomy to the states. 5.68 Rate bands would also create another complication for administering the CVD: under World Trade Organization (WTO) rules, the CVD has to be the lowest of the state rates. Supposing one state charged 8 per cent and another 12 per cent. The CVD would have to be based on 8 per cent, which would immediately disadvantage production in the state charging the higher rate, undermining Make in India programme. Potential price impact of GST24 5.69 In principle, the GST should have no aggregate impact on inflation and the price level because the new rate will be a revenue neutral one. Revenue neutrality may, however, not be enough to guarantee that there will be no price impact across all categories of goods and services. This is because the weights of commodities in the consumption basket (on which the CPI is based) are different from their contribution to indirect tax collections. The impact on particular goods and services will depend on the current structure of taxation (including exemptions) and the future structure of the GST both at the Center and the states. To estimate the impact on future inflation, we need to begin with understanding the current structure of taxes. Current taxes on the consumption basket 5.70 The average effective tax rate on consumption as measured by the Consumer Price Index (CPI) is 10.4%. Excluding items outside GST coverage, the rate drops to 7%, as the excluded items (e.g. alcohol, petrol and diesel) have very high tax rates. This relatively low rate reflects a number of key features. 5.71 First, categories like food and beverages, rent and clothing have large weights in CPI basket (Figure 4). These are categories that are either exempted or taxed at low rates. For example, 75% of CPI is exempt from excise, and 47% of CPI is exempt from sales tax (Figure 5)25. Excluding taxed items that are outside GST (e.g. alcohol, petrol and diesel), 54% of the CPI would be GST exempt. 5.72 Second, most items, where not exempted are taxed at a lower rate. Thus, in addition to exempted commodities, a further 32% is taxed at a low rate, and only 15% at a normal rate (Figure 6). The 4% taxed at a high rate are mostly the items excluded from GST, like petrol, diesel and alcohol.

5.73 The taxation of some essential commodities in the CPI is shown in Figure 7. Most of the categories with a large CPI weight have traditionally been taxed at low rates to reflect distributional concerns; that is, these are goods and services which are important for poorer sections of society and hence are taxed at zero or low rates. In some cases, while the headline tax rate is zero, the effective tax rate is higher given the taxes on inputs. For example, the headline average tax rate on cereals is 2.3%, and vegetables and fruits is 0.5%, but adjusted for the taxes paid on inputs, the effective tax rate on cereals and vegetables rises to 4.8% and 1.1% respectively. The same holds true for electricity: this is not taxed explicitly, but the effective tax rate is 8.8%. Even after these adjustments however, these effective rates are low. Further, to some extent, even these numbers do not truly reflect the net tax burden because of the subsidies provided by the public distribution system (PDS) as described below.

Distribution of taxes by income groups 5.74 These commodity-specific taxes can in turn be disaggregated by broad income groups using consumption data from the 2011-12 NSS. Figures 8 and 9 present these for the top 60 (T60) per cent of the population and bottom 40 per cent (B40) of the population, respectively. 5.75 Taxes on food are about 4 per cent for both groups. This is because even though many food items are exempt in most states, there are embedded taxes in food items such as fuel. This is an important point to emphasize: exemptions do not lead to zero taxation because embedded taxes via inputs cascade into the final product. 5.76 Because of the PDS, however, these taxes are offset by food subsidies so that the net tax rate is negative for the B40 and close to zero for the T60. The magnitude of the impact of the PDS, however, varies by states-high in Tamil Nadu and low in Gujarat. A similar pattern of negative net taxes on the B40 can be observed in fuel and light because the PDS covers kerosene. 5.77 Taxes on health turn out to be among the highest (Figure 8): and the burden is higher for the bottom 40 per cent, as bulk of healthcare expenditure is on medicines (which are taxed at a higher rate than medical services), and particularly so for the bottom 40 per cent (Figure 9). Education taxes also turn out to be regressive, as the consumption of books and school supplies is a higher part of education spend for the bottom 40%, and tuition (mostly tax exempt) is a higher spend for the top 60%. 5.78 For clothing the average tax rates are relatively similar-about 9 %--between the two groups, and across states. In fuel and light, overall taxes are progressive but because electricity comprises a higher share of consumption of the top 60%, the exemption given to electricity benefits the top 60% more than the bottom 40%.

The price impact of the GST Regime 5.79 We analyse scenarios for both a single rate (of 14%) and two scenarios involving a dual rate GST (12% and 18%; and 12% and 22%, respectively). In the dual rate scenarios, we apply a high tax rate of 35% to about 1% of CPI (that relate to luxury goods). 5.80 In the single rate scenario, we assume that whatever attracts any duty right now would be taxed. In the dual rate scenarios, we assume that most food items are exempt except where processing is involved (e.g. cooked meals, biscuits, sugar, tea, papad, bhujia). We assume that processed food is taxed at the low rate of 12% (this is 9.6% of the 45.9% of CPI that is food & beverages). We also assume that textiles and clothing are taxed at a low rate. We find that the normal tax rate would then apply to about 11.2% of CPI. 5.81 The category-wise effective tax rates for major categories in these scenarios are shown in Annex-5 (Figures 1-2), and the inflation impacts in Figures 10-14. 5.82 While assessing inflation, for each scenario we look at two outcomes: one if there is no input-tax credit26, and the second with input-tax credit. In each of the three scenarios, we assume that a change in the tax rate would drive the supplier to change pricing. In some cases, even if the headline tax rate does not change (particularly for the exempt categories) if the taxes on inputs go up, the producer may be motivated to raise prices. For example, if taxes on fertilizers go up, the rice or cotton producer may take price increases. The reality may fall between the two alternatives: even if GST credits start flowing in relatively fast, some producers may still price on the headline rate. 5.83 We have also not factored in producers’ pricing power in assessing the impact on inflation: some may not have the pricing power to take price increases (e.g. prices that are determined globally, say a cotton farmer that sees an increase in input prices), while others, like producers of personal products, may not cut prices even if they see a reduction in their tax rates.

5.84 Single-rate GST: The higher the single rate, the greater the price impact. For example, a 14% rate would drive CPI higher by 1.0% if the producers don't factor in the input-tax credit and 0.7% if they do. An 18% single rate would increase prices by 2.5% with or without input tax credits. (Figure 10 shows the sensitivity to various rates). The items that may see the largest increase in prices are clothing and medicines (Figure 11). The (small) increase in food and beverages is largely because a number of even primary food items are currently taxed in some states (though not in all). As we have assumed the current tax rate to be an average of state tax rates, the average tax rate jumps from low single digits to the RNR, a substantial increase. 5.85 Dual-rate GST with a lower rate of 12 per cent and a standard rate of 18 per cent: This rate structure would correspond broadly to an RNR of about 15-15.5 per cent. As one can expect, this has low inflation impact given the small part of CPI that gets taxed at the normal tax rate (Figure 12 shows the sensitivity). An 18% standard rate would impact CPI by -0.1% if all producers reacted to headline tax changes and 0% if they reacted after adjusting for input tax credits as well. Under this dual rate structure, food and beverages would see virtually no price increase and neither would fuel and light, which would be especially important for protecting poorer consumers (Figure 13).

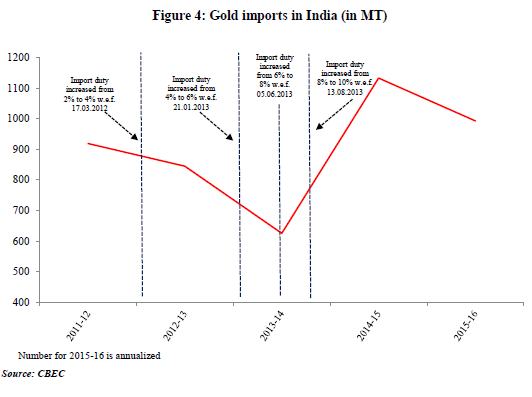

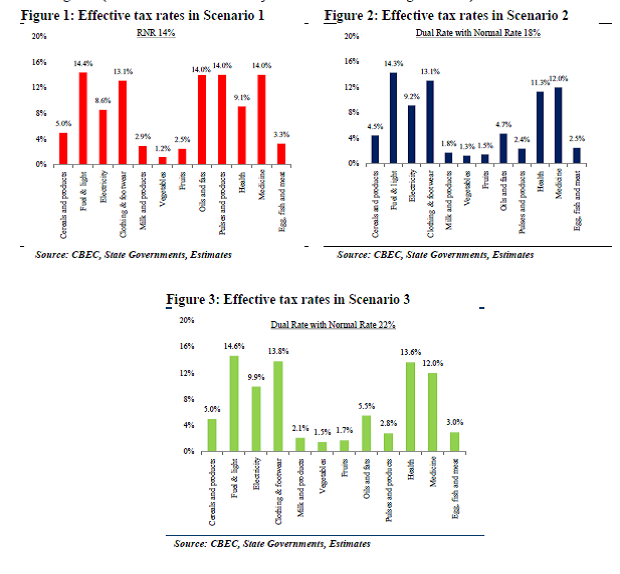

5.86 Dual-rate GST with a lower rate of 12% and standard rate of 22%: This rate structure would correspond broadly to an RNR of about 17-18%. The inflation impact in this scenario lies in between the first and second scenarios: a 22% standard rate would drive a CPI increase of 0.3% if all producers reacted to headline tax changes and by 0.7% if they adjusted for input taxes: the increase is a reflection of hidden taxation, i.e. the headline taxes may be low, but an increase in input taxes would raise inflation. Health (excluding medicines) would see the highest increases (Figure 14).