| News | |||

|

|

|||

GOVERNMENT TO STEP UP FUNDING FOR NATIONAL INFRASTRUCTURE PIPELINE |

|||

| 1-2-2021 | |||

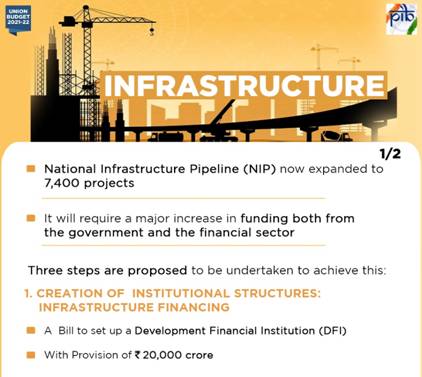

GOVERNMENT TO STEP UP FUNDING FOR NATIONAL INFRASTRUCTURE PIPELINE While presenting the Union Budget 2021-22 in Parliament today the Union Minister for Finance & Corporate Affairs, Smt. Nirmala Sitharaman announced that in order to achieve the target of National Infrastructure Pipeline (NIP) in the coming years the Government proposes following three steps :

The Finance Minister informed that NIP launched in December 2019 with 6835 projects has now expanded to 7,400 projects and around 217 projects worth ₹ 1.10 lakh crore under some key infrastructure Ministries have been completed.

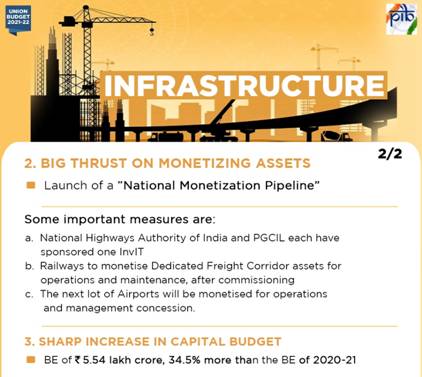

Infrastructure financing - Development Financial Institution (DFI) The Union Finance Minister announced that a sum of ₹ 20,000 crore has been provisioned in the Union Budget to capitalise Development Financial Institution (DFI). The Minister informed that a Bill will be introduced to set up DFI which will act as a provider, enabler and catalyst for infrastructure financing. The ambition is to have a lending portfolio of at least ₹ 5 lakh crore for this DFI in three years time, the Minister added. The Minister further stated that in order to enable Debt Financing of InVITs and REITs by Foreign Portfolio Investors suitable amendments will be done in the relevant legislations. The move is expected to help in augmenting funds for infrastructure and real estate sectors. Asset Monetisation The Union Finance Minister announced launch of a “National Monetization Pipeline” of potential brownfield infrastructure assets stating that Monetizing operating public infrastructure assets is a very important financing option for new infrastructure construction. The Minister informed that an Asset Monetization dashboard will also be created for tracking the progress and to provide visibility to investors. Some important measures in the direction of monetisation are as follows: (a) National Highways Authority of India and PGCIL each have sponsored one InvIT that will attract international and domestic institutional investors. Five operational roads with an estimated enterprise value of ₹ 5,000 crore are being transferred to the NHAIInvIT. Similarily, transmission assets of a value of ₹ 7,000 crore will be transferred to the PGCILInvIT. (b) Railways will monetize Dedicated Freight Corridor assets for operations and maintenance, after commissioning. (c) The next lot of Airports will be monetised for operations and management concession. (d) Other core infrastructure assets that will be rolled out under the Asset Monetization Programme are: (i) NHAI Operational Toll Roads (ii) Transmission Assets of PGCIL (iii) Oil and Gas Pipelines of GAIL, IOCL and HPCL (iv) AAI Airports in Tier II and III cities, (v) Other Railway Infrastructure Assets (vi) Warehousing Assets of CPSEs such as Central Warehousing Corporation and NAFED among others and (vii) Sports Stadiums. |

|||

9911796707

9911796707