| News | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

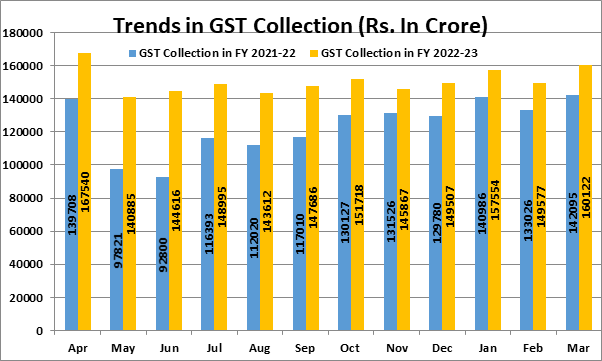

₹1,60,122 crore gross GST revenue collected for March 2023 |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3-4-2023 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

₹1,60,122 crore gross GST revenue collected for March 2023 Second highest collection ever, next only to the collection in April 2022 The gross GST revenue collected in the month of March 2023 is ₹1,60,122 crore of which CGST is ₹29,546 crore, SGST is ₹37,314 crore, IGST is ₹82,907 crore (including ₹42,503 crore collected on import of goods) and cess is ₹10,355 crore (including ₹960 crore collected on import of goods). It is for the fourth time, in the current financial year that the gross GST collection has crossed ₹1.5 lakh crore mark registering second highest collection since implementation of GST. This month witnessed the highest IGST collection ever. The government has settled ₹33,408 crore to CGST and ₹28,187 crore to SGST from IGST as regular settlement. The total revenue of Centre and the States in the month of March 2023 after IGST settlement is ₹62,954 crore for CGST and ₹65,501 crore for the SGST. The revenues for the month of March 2023 are 13% higher than the GST revenues in the same month last year. During the month, revenues from import of goods was 8% higher and the revenues from domestic transaction (including import of services) are 14% higher than the revenues from these sources during the same month last year. The return filing during March 2023 has been highest ever. 93.2% of statement of invoices (in GSTR-1) and 91.4% of returns (in GSTR-3B) of February were filed till March 2023 as compared to 83.1% and 84.7%, respectively same month last year. The total gross collection for 2022-23 stands at ₹18.10 lakh crore and the average gross monthly collection for the full year is ₹1.51 lakh crore. The gross revenues in 2022-23 were 22% higher than that last year. The average monthly gross GST collection for the last quarter of the FY 2022-23 has been ₹1.55 lakh crore against the average monthly collection of ₹1.51 lakh crore, ₹1.46 lakh crore and ₹1.49 lakh crore in the first, second and third quarters respectively. The chart below shows trends in monthly gross GST revenues during the current year. The table shows the state-wise figures of GST collected in each State during the month of March 2023 as compared to March 2022.

State-wise growth of GST Revenues during March 2023[1] (₹ crore)

[1]Does not include GST on import of goods |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

9911796707

9911796707