₹3.83 lakh crore gross GST revenue collection in FY2024-25 (till May 2024) records 11.3% y-o-y growth

Net Revenue (after refunds) grows 11.6% in FY 2024-25 (till May 2024)

Domestic Gross GST Revenue grows 15.3% in May, 2024

The gross Goods and Services Tax (GST) revenue for the month of May 2024 stood at ₹1.73 lakh crore. This represents a 10% year-on-year growth, driven by a strong increase in domestic transactions (up 15.3%) and slowing of imports (down 4.3%). After accounting for refunds, the net GST revenue for May 2024 stands at ₹1.44 lakh crore, reflecting a growth of 6.9% compared to the same period last year.

Breakdown of May 2024 Collections:

- Central Goods and Services Tax (CGST): ₹32,409 crore;

- State Goods and Services Tax (SGST): ₹40,265 crore;

- Integrated Goods and Services Tax (IGST): ₹87,781 crore, including ₹39,879 crore collected on imported goods;

- Cess: ₹12,284 crore, including ₹1,076 crore collected on imported goods.

The gross GST collections in the FY 2024-25 till May 2024 stood at ₹3.83 lakh crore. This represents an impressive 11.3% year-on-year growth, driven by a strong increase in domestic transactions (up 14.2%) and marginal increase in imports (up 1.4%). After accounting for refunds, the net GST revenue in the FY 2024-25 till May 2024 stands at ₹3.36 lakh crore, reflecting a growth of 11.6% compared to the same period last year.

Breakdown of collections in the FY 2024-25 till May, 2024, are as below:

- Central Goods and Services Tax (CGST): ₹76,255 crore;

- State Goods and Services Tax (SGST): ₹93,804 crore;

- Integrated Goods and Services Tax (IGST): ₹1,87,404 crore, including ₹77,706 crore collected on imported goods;

- Cess: ₹25,544 crore, including ₹2,084 crore collected on imported goods.

Inter-Governmental Settlement:

In the month of May, 2024, the Central Government settled ₹38,519 crore to CGST and ₹32,733 crore to SGST from the net IGST collected of ₹67,204 crore. This translates to a total revenue of ₹70,928 crore for CGST and ₹72,999 crore for SGST in May, 2024, after regular settlement.

Similarly, in the FY 2024-25 till May 2024 the Central Government settled ₹88,827 crore to CGST and ₹74,333 crore to SGST from the net IGST collected of ₹154,671 crore. This translates to a total revenue of ₹1,65,081 crore for CGST and ₹1,68,137 crore for SGST in FY 2024-25 till May 2024 after regular settlement.

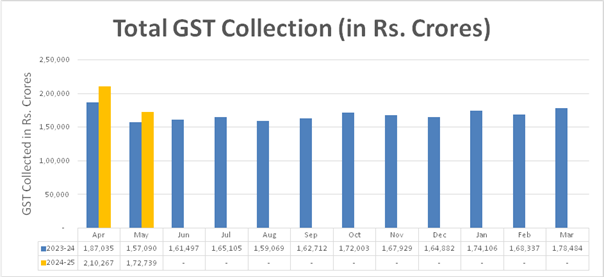

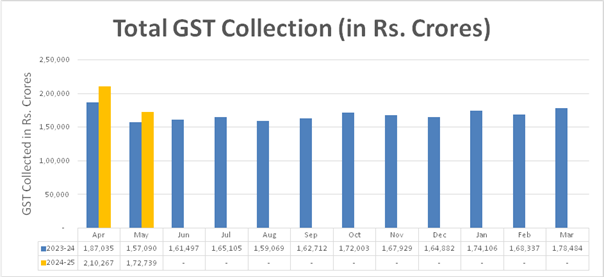

The chart below shows trends in monthly gross GST revenues during the current year. Table-1 shows the state-wise figures of GST collected in each State during the month of May, 2024 as compared to May, 2023. Table-2 shows the state-wise figures of post settlement GST revenue of each State for the month of May, 2024.

Chart: Trends in GST Collection

Table 1: State-wise growth of GST Revenues during May, 2024[1]

|

State/UT

|

May-23

|

May-24

|

Growth (%)

|

|

Jammu and Kashmir

|

422

|

525

|

24%

|

|

Himachal Pradesh

|

828

|

838

|

1%

|

|

Punjab

|

1,744

|

2,190

|

26%

|

|

Chandigarh

|

259

|

237

|

-9%

|

|

Uttarakhand

|

1,431

|

1,837

|

28%

|

|

Haryana

|

7,250

|

9,289

|

28%

|

|

Delhi

|

5,147

|

7,512

|

46%

|

|

Rajasthan

|

3,924

|

4,414

|

13%

|

|

Uttar Pradesh

|

7,468

|

9,091

|

22%

|

|

Bihar

|

1,366

|

1,521

|

11%

|

|

Sikkim

|

334

|

312

|

-7%

|

|

Arunachal Pradesh

|

120

|

98

|

-18%

|

|

Nagaland

|

52

|

45

|

-14%

|

|

Manipur

|

39

|

58

|

48%

|

|

Mizoram

|

38

|

39

|

3%

|

|

Tripura

|

75

|

73

|

-3%

|

|

Meghalaya

|

214

|

172

|

-20%

|

|

Assam

|

1,217

|

1,228

|

1%

|

|

West Bengal

|

5,162

|

5,377

|

4%

|

|

Jharkhand

|

2,584

|

2,700

|

4%

|

|

Odisha

|

4,398

|

5,027

|

14%

|

|

Chhattisgarh

|

2,525

|

2,853

|

13%

|

|

Madhya Pradesh

|

3,381

|

3,402

|

1%

|

|

Gujarat

|

9,800

|

11,325

|

16%

|

|

Dadra and Nagar Haveli and Daman & Diu

|

324

|

375

|

16%

|

|

Maharashtra

|

23,536

|

26,854

|

14%

|

|

Karnataka

|

10,317

|

11,889

|

15%

|

|

Goa

|

523

|

519

|

-1%

|

|

Lakshadweep

|

2

|

1

|

-39%

|

|

Kerala

|

2,297

|

2,594

|

13%

|

|

Tamil Nadu

|

8,953

|

9,768

|

9%

|

|

Puducherry

|

202

|

239

|

18%

|

|

Andaman and Nicobar Islands

|

31

|

37

|

18%

|

|

Telangana

|

4,507

|

4,986

|

11%

|

|

Andhra Pradesh

|

3,373

|

3,890

|

15%

|

|

Ladakh

|

26

|

15

|

-41%

|

|

Other Territory

|

201

|

207

|

3%

|

|

Center Jurisdiction

|

187

|

245

|

30%

|

|

Grand Total

|

1,14,261

|

1,31,783

|

15%

|

Table-2: SGST & SGST portion of IGST settled to States/UTs in May (Rs. in crore)

|

|

Pre-Settlement SGST

|

Post-Settlement SGST[2]

|

|

State/UT

|

May-23

|

May-24

|

Growth

|

May-23

|

May-24

|

Growth

|

|

Jammu and Kashmir

|

178

|

225

|

26%

|

561

|

659

|

17%

|

|

Himachal Pradesh

|

189

|

187

|

-1%

|

435

|

436

|

0%

|

|

Punjab

|

638

|

724

|

14%

|

1,604

|

1,740

|

8%

|

|

Chandigarh

|

48

|

54

|

12%

|

168

|

178

|

6%

|

|

Uttarakhand

|

411

|

476

|

16%

|

666

|

714

|

7%

|

|

Haryana

|

1,544

|

1,950

|

26%

|

2,568

|

3,025

|

18%

|

|

Delhi

|

1,295

|

1,477

|

14%

|

2,539

|

2,630

|

4%

|

|

Rajasthan

|

1,386

|

1,506

|

9%

|

3,020

|

3,315

|

10%

|

|

Uttar Pradesh

|

2,384

|

2,736

|

15%

|

5,687

|

6,848

|

20%

|

|

Bihar

|

623

|

695

|

11%

|

2,058

|

2,298

|

12%

|

|

Sikkim

|

31

|

26

|

-15%

|

84

|

66

|

-21%

|

|

Arunachal Pradesh

|

60

|

45

|

-26%

|

187

|

152

|

-19%

|

|

Nagaland

|

21

|

19

|

-9%

|

83

|

79

|

-4%

|

|

Manipur

|

23

|

32

|

35%

|

77

|

107

|

39%

|

|

Mizoram

|

21

|

22

|

3%

|

79

|

77

|

-3%

|

|

Tripura

|

40

|

36

|

-9%

|

135

|

138

|

2%

|

|

Meghalaya

|

56

|

52

|

-7%

|

158

|

154

|

-3%

|

|

Assam

|

488

|

511

|

5%

|

1,170

|

1,280

|

9%

|

|

West Bengal

|

1,952

|

2,030

|

4%

|

3,407

|

3,628

|

6%

|

|

Jharkhand

|

653

|

735

|

13%

|

976

|

1,135

|

16%

|

|

Odisha

|

1,255

|

1,415

|

13%

|

1,676

|

2,068

|

23%

|

|

Chhattisgarh

|

583

|

661

|

14%

|

833

|

1,033

|

24%

|

|

Madhya Pradesh

|

987

|

1,028

|

4%

|

2,580

|

2,555

|

-1%

|

|

Gujarat

|

3,371

|

3,526

|

5%

|

5,156

|

5,233

|

2%

|

|

Dadra and Nagar Haveli and Daman and Diu

|

47

|

58

|

23%

|

92

|

80

|

-13%

|

|

Maharashtra

|

7,621

|

8,711

|

14%

|

10,952

|

12,397

|

13%

|

|

Karnataka

|

3,022

|

3,441

|

14%

|

5,704

|

6,062

|

6%

|

|

Goa

|

182

|

190

|

4%

|

324

|

321

|

-1%

|

|

Lakshadweep

|

0

|

1

|

478%

|

7

|

5

|

-35%

|

|

Kerala

|

1,040

|

1,209

|

16%

|

2,387

|

2,497

|

5%

|

|

Tamil Nadu

|

3,101

|

3,530

|

14%

|

4,829

|

6,014

|

25%

|

|

Puducherry

|

36

|

41

|

13%

|

99

|

106

|

7%

|

|

Andaman and Nicobar Islands

|

15

|

18

|

17%

|

41

|

44

|

5%

|

|

Telangana

|

1,448

|

1,636

|

13%

|

3,024

|

3,239

|

7%

|

|

Andhra Pradesh

|

1,048

|

1,240

|

18%

|

2,116

|

2,597

|

23%

|

|

Ladakh

|

14

|

8

|

-43%

|

34

|

24

|

-27%

|

|

Other Territory

|

16

|

17

|

8%

|

83

|

66

|

-20%

|

|

Grand Total

|

35,828

|

40,265

|

12%

|

65,597

|

72,999

|

11%

|

|

9911796707

9911796707