| News | |||

|

|

|||

'ANGEL TAX' ABOLISHED FOR ALL CLASSES OF INVESTORS |

|||

| 23-7-2024 | |||

CORPORATE TAX RATE ON FOREIGN COMPANIES REDUCED TO 35 PER CENT The Union Minister for Finance and Corporate Affairs, Smt. Nirmala Sitharaman proposed to abolish ‘angel tax’ for all classes of investors, while presenting the Union Budget 2024-25 in Parliament today. She added that this move is aimed to bolster the Indian start-up eco-system, boost the entrepreneurial spirit and support innovation.

The Minister also proposed to reduce the corporate tax rate on foreign companies from 40 to 35 per cent to attract foreign capital for India’s development needs.

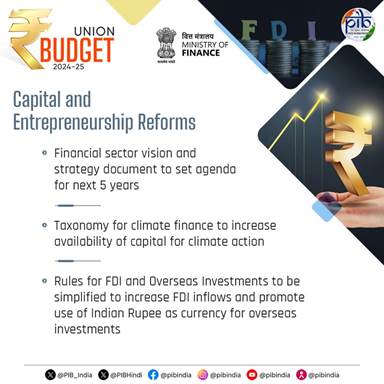

Smt. Sitharaman announced to bring out a financial sector vision and strategy document to meet financing needs of the economy and prepare the sector in terms of size, capacity and skills. She added that this would set the agenda for the upcoming five years and guide the work of the government, regulators, financial institutions and market participants. The Minister further proposed to develop taxonomy for climate finance. This is expected to enhance the availability of capital for climate adaptation and mitigation, which can help achieve India’s climate commitments and green transition. “Our government will seek the required legislative approval for providing an efficient and flexible mode for financing leasing of aircrafts and ships, and pooled funds of private equity through a ‘variable company structure’,” added Smt. Sitharaman. To facilitate foreign direct investments, nudge prioritization, and promote opportunities for using Indian Rupee as a currency for overseas investments, the Finance Minister announced that the rules and regulations for Foreign Direct Investment and Overseas Investments will be simplified. To promote the development of diamond cutting and polishing industry which employs a large number of skilled workers, the Finance Minister proposed to provide for safe harbor rates for foreign mining companies selling raw diamonds. Further, Smt. Sitharaman proposed a simpler tax regime for foreign shipping companies operating domestic cruises in the country. This will help in realizing the tremendous potential of cruise tourism and give a fillip to this employment generating industry in the country. |

|||

9911796707

9911796707