| News | |||

|

|

|||

Advisory on issuance of Notices/Orders without digital signatures of the issuing authorities |

|||

| 26-9-2024 | |||

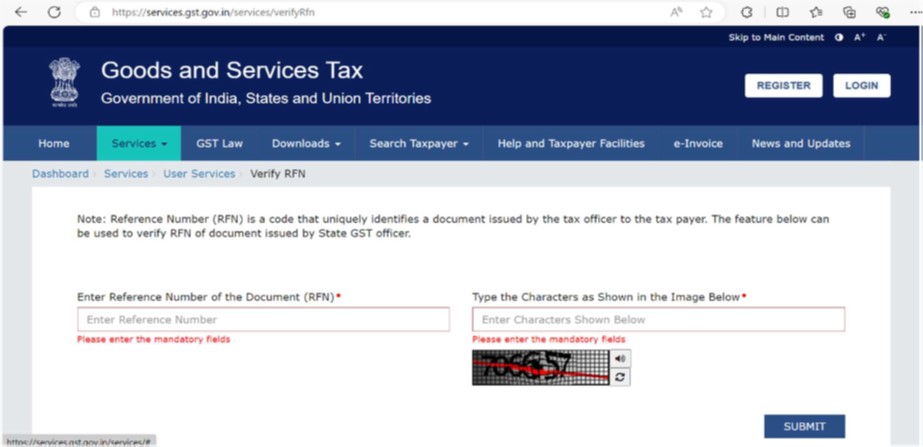

Doubts have been created regarding the validity of documents issued by the tax officers on the common portal viz. Show cause Notices, Order of Assessment, Refund Orders etc. which are not containing the Digital signatures on the pdf. document downloaded from the common portal. In this context, it is to be mentioned that such documents (i.e. SCN/Orders) are generated on the common portal from the login of the officer, who logs in through Digital Signatures. Further, these documents being computer generated on the command of the officer, may not require physical signatures of the officer as these documents can be issued by the officer only after logging into the common portal using Digital Signature. Thus, all these documents in JSON format containing the order details along with the issuing officer details are stored in the GST system with the digital signature of the issuing officer. The validity of the document in question vis-à-vis who and for what purpose these documents have been issued can also be verified by the taxpayer pre-login as well as after login from the GST common portal by navigating to the following path: Post-login: www.gst.gov.in-->Dashboard-->Services-->User Services-->Verify RFN

All communications from the officers to the taxpayer/ any other person initiated through the system can also be verified pre-login through the link https://services.gst.gov.in/services/verifyRfn It is further mentioned that all the critical actions on the part of officers are performed through digital signature authentication of the officer concerned who is authorised for taking that ac on, such as:. 1. Issue of any notice in any module 2. Issue of any order in any module 3. Issue of any refund order Thanks Team GSTN |

|||

9911796707

9911796707