| News | |||||||||||||||

|

|

|||||||||||||||

NO INCOME TAX ON ANNUAL INCOME UPTO Rs. 12 LAKH UNDER NEW TAX REGIME |

|||||||||||||||

| 1-2-2025 | |||||||||||||||

LIMIT TO BE Rs. 12.75 LAKH FOR SALARIED TAX PAYERS, WITH STANDARD DEDUCTION OF RS. 75,000

|

|||||||||||||||

|

0-4 lakh rupees |

Nil |

|

4-8 lakh rupees |

5 per cent |

|

8-12 lakh rupees |

10 per cent |

|

12-16 lakh rupees |

15 per cent |

|

16-20 lakh rupees |

20 per cent |

|

20- 24 lakh rupees |

25 per cent |

|

Above 24 lakh rupees |

30 per cent |

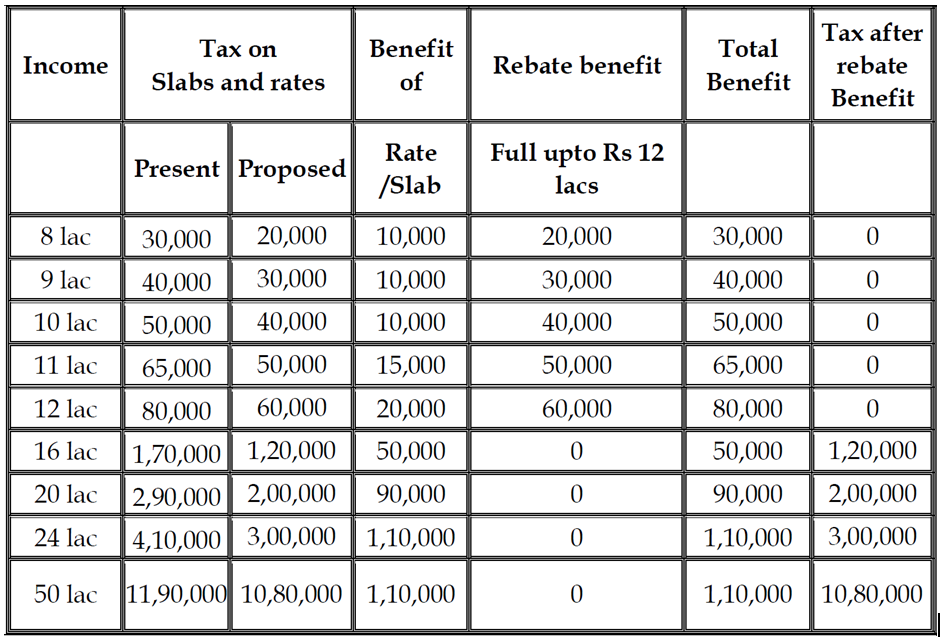

The total tax benefit of slab rate changes and rebate at different income levels can be illustrated in the table below:

While underlining Taxation Reforms as one of key reforms to realize the vision of Viksit Bharat, Smt. Sitharaman stated that the new income-tax bill will carry forward the spirit of ‘Nyaya’. The new regime will be simple to understand for taxpayers and tax administration, leading to tax certainty and reduced litigation, she informed.

Quoting Verse 542 from The Thirukkural, the Finance Minister stated, “Just as living beings live expecting rains, Citizens live expecting good governance.” Reforms are a means to achieve good governance for the people and economy. Providing good governance primarily involves being responsive. The tax proposals detail just how the Government under the guidance of Prime Minister Shri Narendra Modi has taken steps to understand and address the needs voiced by our citizens, Smt. Sitharaman added.

9911796707

9911796707