| Discussions Forum | ||||||||||||||||||||||||||||||||||||||||||||||||||

Home  Forum Forum  Goods and Services Tax - GST Goods and Services Tax - GST  This This

A Public Forum.

Submit new Issue / Query

My Issues

My Replies

|

||||||||||||||||||||||||||||||||||||||||||||||||||

Goods and GST Bill passed, Goods and Services Tax - GST |

||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||

Goods and GST Bill passed |

||||||||||||||||||||||||||||||||||||||||||||||||||

Dear All, GST Bill is passed in Rajya Sabha on 03. 08.2016. A panel under chief economic adviser Arvind Subramanian has recommended a revenue-neutral rate of 15-15.5%, with a standard rate of 17-18% be levied on most goods and all services. But, there has been no agreement yet on rates of various goods and services, which remains a tricky issue. According to the Bill, passed in the Lok Sabha in May 2015, the rates were to be decided by a GST council headed by the central finance minister with state finance ministers as members. Let us wait. Thanks. Posts / Replies Showing Replies 31 to 55 of 1401 Records

CBEC to be renamed as CBIT under GST regime.

The Government is making all its effort to implement GST w.e.f. 01.04.2017. The review of GST preparedness is being done by Prime Minister. Thanks. The assessee need to gear up for GST. The time has come now. It was discussed that atleast 6months time would be required from the date of GST Act coming into effect and to the date of implementation. Let's hope for the good time to come. Thanks.

GST rollout must be ready 'before' April 1, PM emphasizes to top officials.

Taxpayers to get a feel of GST next monthBeginning next month, the Goods and Services Tax Network (GSTN) will start migrating over 80 lakh taxpayers onto its system. This will facilitate the smooth implementation of the GST regime. “The first part of our software will be ready by end October. Existing taxpayers of value added tax, service tax and central excise will be migrated to GSTN,” said Navin Kumar, Chairman, GSTN.

GST Council is fighting against timeThe government plans to bring in GST from 1 April 2017 and supporting legislation in the winter session, leaving only around two months for the council to finalize all issues

India's Reincarnation As A Unified Marketplace Of 1.2 Billion Participants http://seekingalpha.com/article/4006469-indias-reincarnation-unified-marketplace-1_2-billion-participantsEarlier in August, as U.S. investors were preoccupied with domestic news on the elections and markets, an interesting development happened halfway around the globe. India's legislature, after a notoriously long process, approved one of the most ambitious tax reforms in history - the Goods and Services Tax (GST) bill. Overall, GST is India's attempt to create the largest marketplace with standardized tax rates ever. It is also a reminder of the Modi government's serious push for reforms to make it easier to do business in India. Most of India's macro factors have improved recently, earnings of corporate India are steadily improving and the central government is gradually pushing positive policy changes. So, let's take a look at what GST is and how it affects various sectors of the Indian economy. What Is GST? Broadly speaking, governments collect revenues/taxes in two categories:

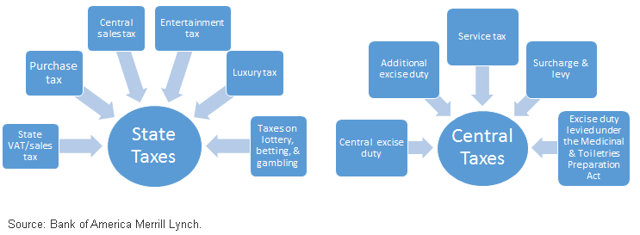

Typically, in developing countries, indirect taxes make up a greater portion of total taxes. In the U.S., taxes on goods and services are 5%1 of total tax collection, while in India they account for over 30%.2 India's GST is a bold attempt to streamline these indirect taxes and increase tax compliance. Taxes in India are split into an array of federal and state taxes. Not only does every state have its own rate, but each could also levy extra taxes depending on the category of sale (e.g., luxury taxes on high-end hotels, entertainment taxes on movies). GST aims to subsume these taxes under two distinct categories of central and state tax, as shown in the chart below.

Chasing the GST deadline: Early movers can capitalise on options and benefit most Under the GST regime, the credit eligibility of a company will largely depend upon suppliers’ GST compliances. Therefore, companies would prefer to engage with suppliers having GST compliance as their top-most priority.

GST rollout a hell of a challenge, says Infosys CEO Vishal SikkaSikka admitted that the IT backbone of GST is an extremely complex and ambitious exercise as it involves banks, small businesses and states.

Proud to be part of GST, network project very complex, says Infosys CEO Vishal Sikka Vishal Sikka, Infosys CEO, on Thursday said that the GST network project was very complex, but was proud to be part of it. Speaking to reporters after making a presentation to Finance Minister Arun Jaitley, Sikka said that there is some weakness in technology preparedness for GST network.

Congress on Wednesday said the "God and the Devil lies in the detail" of the GST and would not like to prejudice the decision of the Council, even as took a dig at the Centre for its "self-congratulatory patting" at beginning of GST journey as nine-tenth of its details are yet to come. "We have merely passed an empowering and enabling legislation. We have not passed an enforceable tax regime. So unless things are decided, there should not be any interface by me from this podium, by pre-empting the decision of that council by a political party."But certainly there should be no self-congratulatory patting the back by the central government when nine-tenths of the details are yet to come. As we all know, both God and the Devil lies in the details. Let the process start," Congress spokesperson Abhishek Singhvi told reporters. He said there has been a lot of self-congratulatory patting in the back by the Centre, which is failing to realise that "we are at the beginning of the GST journey, not at the end." The GST Council will consist of Union Finance Minister, Minister of State in charge of Revenue Department and state Finance ministers.

I am thankful to both experts for updating on GST. It has saved not only my time but also others' who visit this forum.

Finance minister Arun Jaitley admitted the other day that the target date of April 1, 2017, for operationalising the goods and services tax (GST) was “very stiff”. This is probably the understatement of the year. Even if Prime Minister Narendra Modi were to agree to relax the deadline, it would still remain “stiff”.

The mechanics of implementation –getting the GST Network up and running, training tax officials to handle the new system, and nudging companies to install the necessary software and hardware at their ends – will be hard enough.

Currently, it has been assumed that there will be only three basic rates – a standard rate, a merit rate and a luxury rate. Then there will be zero-rated essentials.

“Industry bodies have been asking for more time. They want it to be delayed by a quarter or two. They would like to see the fine print and then prepare for the GST regime,” said Mahesh Jaising, partner, BMR & Associates LLP.

The GST Council will make recommendations on matters such as standard GST rate, model GST laws, principles that will govern the place of supply, threshold limits, goods and services that could be exempted from the levy and other matters relating to the indirect tax.

Two bills related to biggest tax reform will be taken up in the Parliament’s next session – Central GST and the Integrated GST bill. States will approve their own GST bills.

The concern is other than VAT, will the other local taxes too get subsumed in GST or not. Because a major issue, we feel is the Mandi tax – Market fees, which is prevalent in many States. It ranges from 1.5-2 per cent to even 4 per cent in states like Punjab and Haryana. So, if this Mandi Tax is not going to get subsumed in GST, this will add to the burden. Mandi tax – a state subject – is one area, where the States can have their own views and end up taxing it and defeating the very purpose of the GST. The Government has to look at it seriously as it will add to the prices of the commodity. This is something, which the state council or the GST council needs to address. It certainly is a concern for the industry just like high taxation is a concern for the industry. We feel being an essential commodity, the taxation should be minimum on the essential commodities. Source :: http://www.thehindubusinessline.com/economy/agri-business/mandi-tax-will-be-a-serious-concern-post-gst-rollout/article9103404.ece

With the implementation of GST, auto manufacturers will certainly feel the ease in doing business. It’s not just us saying it, but the industry. In fact, the biggest concern for most is the percentage of tax that will be levied. Dr.Pawan Goenka – Executive Director, Mahindra & Mahindra said, “The Industry is looking forward to that (GST) but more than what, it’s the rate which will be of utmost importance. I mean it could be 18 per cent, 20 per cent, 22 per cent but that’s just a number in some sense.”

Vinod Dasari, MD, Ashok Leyland goes one step ahead to talk about how it’ll help the GDP. He says, “I think it’s a fabulous achievement by the government, Its been over 7 years we have been talking about GST and finally its coming so I’m very excited about it. It will give a boost to the over all GDP, People expect 1-2% increase in GDP.” Source: NDTV.com

http://www.financialexpress.com/fe-columnist/taxpayers-should-assess-which-approach-they-will-use-to-interact-with-the-gstn-system/373987/

The rate of GST applicable on pharmaceutical formulations is yet to be finalised, but it is expected that the said goods could be covered the under lower tax bracket of around 12% GST, thereby ensuring that the cost of medicines to the patients could be construed as status quo given that the generic rate applicable under the current law is typically around the same range. The pharma industry will look forward to continuation of exemption for certain life-saving drugs and Active Pharmaceutical Ingredients used in manufacture of life saving drugs. Source: ey.com

Since the rolling out of GST seems to be closer to reality with a target date of April 1, 2017, companies have already commenced working towards the transition to GST, and for the ones that have not yet started, would need to have a plan to address the challenges of crash-landing into the GST regime. Given the far-reaching impact of GST across the business organisation and its value-chain across businesses, as part of the process towards effective GST transition, companies may need to adopt a comprehensive business transformation approach. This would involve a business impact analysis, reviewing business delivery and supply-chain models, engaging with the government on issues of representation, preparing IT systems to be GST-compliant, reviewing and aligning the policies, processes and controls across the business organisation to GST requirements, and plan an effective change management programme. This would ensure zero business disruption and 100% GST compliance. Source ey.com

Tax cost on ‘goods’ The indirect tax cost on most goods is currently on the higher side. This is for the reason that most goods (for e.g. beauty products, most consumer electronics, non-luxury automobiles) attract an excise duty of 12.5% and a VAT of 12.5% to 15% depending on the State. Further, there are numerous cascading of taxes on account of levy of CST, input tax credit retention under the VAT laws, levy of entry tax/ Octroi/ local body tax, etc till the time the product reaches the end customer. A combined effect of the same leads to an effective indirect tax rate 25% to 30% in the hands of the end customer. If the standard rate of GST is 18%, then for most goods there would be a significant reduction in the overall indirect tax cost. This reduction in indirect tax cost can lead to reduction in production cost and increase in base line profits, giving headroom for reducing prices and benefiting end-users. However, for some other goods (for e.g. textiles, edible oil, low value footwear) the rate of excise duty is nil whereas VAT in most States is 5%. Thus, the overall tax cost for these kind of goods (after factoring the non-creditable taxes) is about 8 to 9%. If these goods are kept at the standard GST rate of 18% then there would be significant increase in cost for the end customers. Even if these goods are kept at the lower GST rate of 12% there would be an increase in cost for the end customers. GST’s impact on the ordinary consumerAugust 2016The Financial Express By Abhishek Jain

Old Query - New Comments are closed. |

||||||||||||||||||||||||||||||||||||||||||||||||||

9911796707

9911796707

.jpg)