Input tax credit - Leasehold services - The applicant himself ...

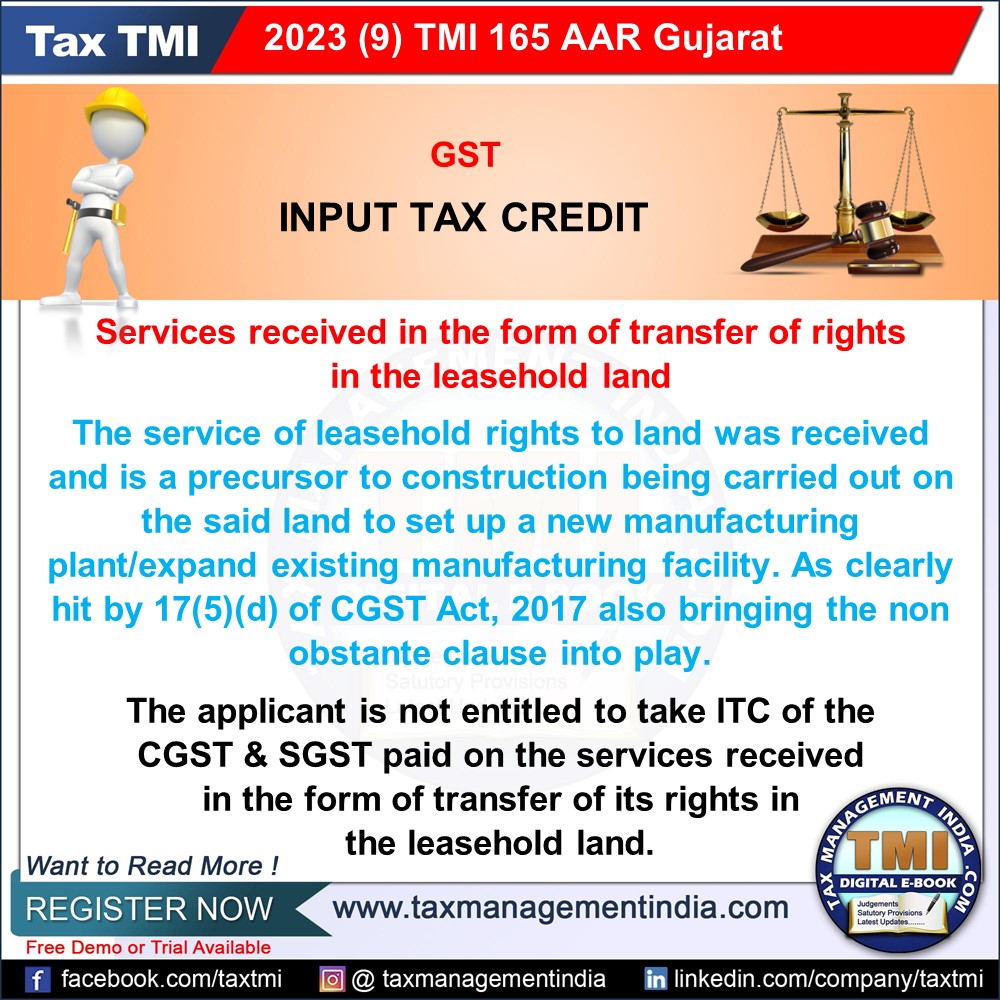

Input Tax Credit Denied for Leasehold Land Acquisition for Chemical Facility Construction Under GST Section 17(5)(d.

September 4, 2023

Case Laws GST AAR

Input tax credit - Leasehold services - The applicant himself has admitted that the leasehold rights of the land have been acquired for setting up/expanding its manufacturing facility for manufacture of chemicals which implies that there will be construction on the said land. This being the case, the services in question is to be utilized subsequently for construction of an immovable property (other than P&M) on his own account. - Credit is hit by section 17(5)(d) - AAR

View Source