Jurisdiction - proper officer to issue summons and conduct ...

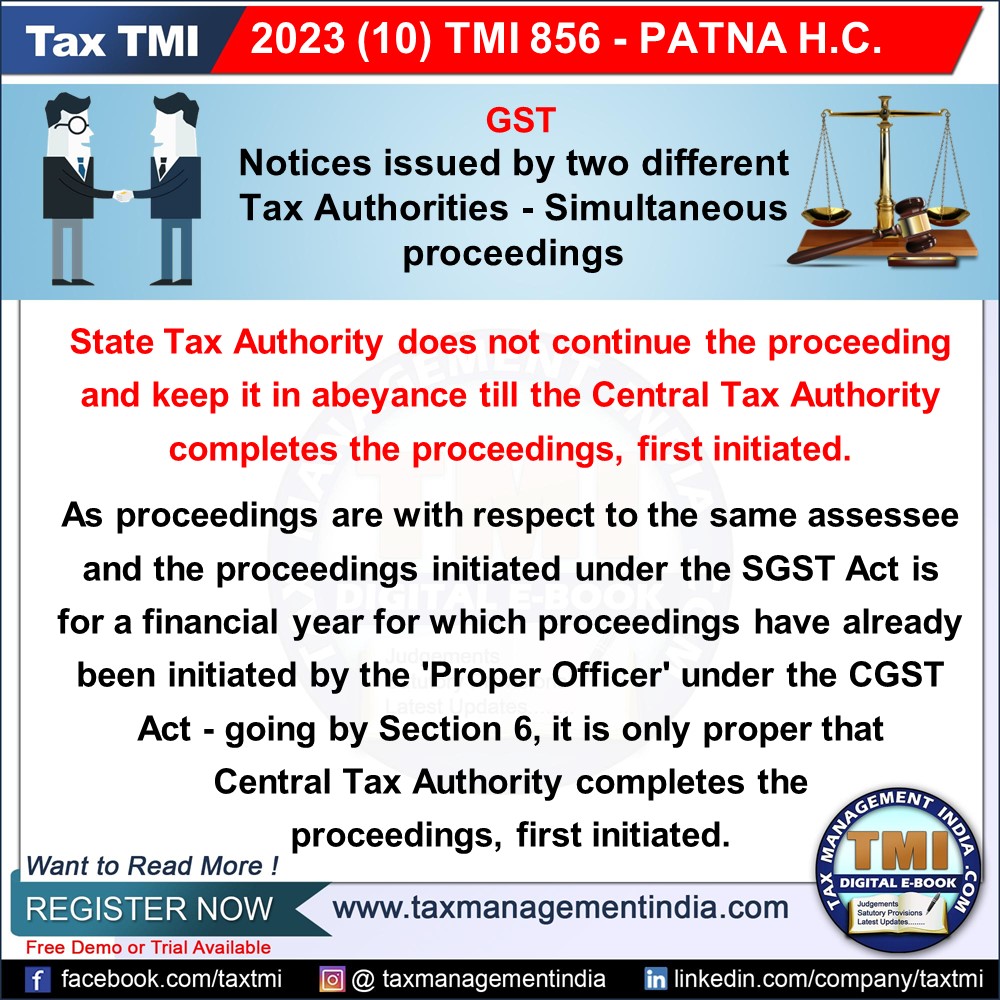

High Court Puts State GST Proceedings on Hold Due to Central Authority's Prior Action for Same Period.

October 19, 2023

Case Laws GST HC

Jurisdiction - proper officer to issue summons and conduct inquiry - Investigation / Enquiry proceedings initiation by different authorities of state and central GST - The proceedings as initiated against Annexure-1 dated 04.02.2022 by the State Tax Authority, is at the notice stage and with respect to one of the years on which the Central Tax Authority has already initiated proceedings. Annexure-1, hence, shall be kept in abeyance. - HC

View Source