| News | |||||||||||||||

|

|

|||||||||||||||

Minutes of the Monetary Policy Committee Meeting June 4-6, 2018 [Under Section 45ZL of the Reserve Bank of India Act, 1934] |

|||||||||||||||

| 20-6-2018 | |||||||||||||||

The eleventh meeting of the Monetary Policy Committee (MPC), constituted under section 45ZB of the amended Reserve Bank of India Act, 1934, was held from June 4 to 6, 2018 at the Reserve Bank of India, Mumbai. 2. The meeting was attended by all the members - Dr. Chetan Ghate, Professor, Indian Statistical Institute; Dr. Pami Dua, Director, Delhi School of Economics; Dr. Ravindra H. Dholakia, former Professor, Indian Institute of Management, Ahmedabad; Dr. Michael Debabrata Patra, Executive Director (the officer of the Reserve Bank nominated by the Central Board under Section 45ZB(2)(c) of the Reserve Bank of India Act, 1934); Dr. Viral V. Acharya, Deputy Governor in charge of monetary policy - and was chaired by Dr. Urjit R. Patel, Governor. 3. According to Section 45ZL of the amended Reserve Bank of India Act, 1934, the Reserve Bank shall publish, on the fourteenth day after every meeting of the Monetary Policy Committee, the minutes of the proceedings of the meeting which shall include the following, namely:– (a) the resolution adopted at the meeting of the Monetary Policy Committee; (b) the vote of each member of the Monetary Policy Committee, ascribed to such member, on the resolution adopted in the said meeting; and (c) the statement of each member of the Monetary Policy Committee under sub-section (11) of section 45ZI on the resolution adopted in the said meeting. 4. The MPC reviewed the surveys conducted by the Reserve Bank to gauge consumer confidence, households’ inflation expectations, corporate sector performance, credit conditions, the outlook for the industrial, services and infrastructure sectors, and the projections of professional forecasters. The MPC also reviewed in detail staff’s macroeconomic projections, and alternative scenarios around various risks to the outlook. Drawing on the above and after extensive discussions on the stance of monetary policy, the MPC adopted the resolution that is set out below. Resolution 5. On the basis of an assessment of the current and evolving macroeconomic situation at its meeting today, the Monetary Policy Committee (MPC) decided to:

Consequently, the reverse repo rate under the LAF stands adjusted to 6.0 per cent, and the marginal standing facility (MSF) rate and the Bank Rate to 6.50 per cent. The decision of the MPC is consistent with the neutral stance of monetary policy in consonance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4 per cent within a band of +/- 2 per cent, while supporting growth. The main considerations underlying the decision are set out in the statement below. Assessment 6. Since the last meeting of the MPC in April, global economic activity has continued to expand, though there has been some easing of momentum. Among advanced economies (AEs), the US economy began the year on a weak note on soft private spending and reduced residential investment; however, there seems to be a rebound in Q2:2018 with strong retail sales and improved employment data. The Euro Area growth decelerated in Q1; recent industrial production data as well as weak consumer and business sentiment suggest a loss of pace. The Japanese economy contracted in Q1, though it is expected to turn around in Q2 as indicated by recent data prints on exports and the manufacturing purchasing managers’ index (PMI). 7. Economic activity in major emerging market economies (EMEs) remained largely resilient. The Chinese economy maintained a strong momentum in Q1; more recent data on industrial production and PMI suggest that growth is likely to hold steady in Q2. The Russian economy appears to have picked up in recent months after a soft end to 2017; both manufacturing and services PMI rose in April. In South Africa, growth prospects have improved with the return of political stability as reflected in consumer confidence, manufacturing PMI and retail sales. In contrast, a stream of poor data from Brazil on high unemployment and soft industrial production show that the effects of recession linger. 8. Global trade growth has continued to strengthen, though geo-political tensions have contributed recently to declining export orders and air freight. Crude oil prices rose sharply till May 24 on heightened geo-political tensions, but moderated thereafter on expectations of easing of supplies by the Organisation of Petroleum Exporting Countries (OPEC) and Russia. Base metal prices, especially aluminium, have risen on account of US sanctions on Russia. Gold has witnessed selling pressure on a stronger dollar, but the metal gained last week on political uncertainty in the Euro Area. Inflation pressures have emerged in some key advanced and emerging economies, driven in part by rising commodity prices. 9. Financial markets have been driven mainly by monetary policy expectations and geo-political developments. Equity market performance has varied across regions with modest gains in the AEs on strong Q1 earnings and abating of trade tensions, while stocks in major EMEs have faced sell offs on a rising dollar and expectations of further rate hikes by the Fed. The 10-year sovereign yield in the US crossed 3 per cent in mid-May on strong economic data as well as expectations of tighter monetary policy and fiscal expansion, but softened subsequently on safe haven demand; yields softened in other key AEs as well. In most EMEs, however, bond yields have risen on reduced foreign appetite for their debt due to growing dollar shortage in the global market and on prospects of higher interest rates in AEs. In currency markets, the US dollar touched its highest level in May since December 2017. The euro depreciated significantly against the dollar reflecting a combination of factors, including soft growth data for the Euro Area, which suggested that monetary policy normalisation by the European Central Bank could be delayed, and political uncertainty in its southern periphery. EME currencies have, by and large, depreciated against the US dollar. 10. On the domestic front, the Central Statistics Office (CSO) released on May 31 the quarterly estimates of national income accounts for Q4:2017-18 and provisional estimates for 2017-18. Gross domestic product (GDP) growth for 2017-18 has been estimated at 6.7 per cent, up by 0.1 percentage point from the second advance estimates released on February 28. This increase in growth has been underpinned by a significant upward revision in private final consumption expenditure (PFCE) due especially to improved rural demand on the back of a bumper harvest and the government’s thrust on rural housing and infrastructure. Quarterly data suggest that the economy grew at 7.7 per cent in Q4:2017-18 – the fastest pace in the last seven quarters. Gross fixed capital formation (GFCF) growth accelerated for three consecutive quarters up to Q4. 11. On the supply side, estimates of agriculture and allied activities have been revised upwards, supported by an all-time high production of foodgrains and horticulture during the year. On a quarterly basis, agriculture growth increased sharply in Q4:2017-18. On April 16, the India Meteorological Department (IMD) forecast a normal south-west monsoon rainfall, which was reaffirmed on May 30. This augurs well for the agricultural sector. 12. Industrial growth also strengthened, reflecting the robust performance of manufacturing, which accelerated for three consecutive quarters in Q4. Capacity utilisation by manufacturing firms increased significantly in Q4:2017-18 as revealed in the latest round of the Reserve Bank’s order books, inventories and capacity utilisation survey (OBICUS). The output of eight core industries accelerated in April on account of a sharp expansion in coal production, which reached a 42-month peak. Cement output also posted double-digit growth for the sixth consecutive month in April. However, electricity generation slowed down. As per the early results of the Reserve Bank’s April-June round of the industrial outlook survey (IOS), activity is expected to expand at a lower rate in Q1:2018-19 due to a significant rise in input prices and perceptions of softening domestic and external demand conditions. However, the manufacturing PMI remained in an expansionary mode for the tenth consecutive month in May on the back of new domestic orders and exports. 13. Although services sector growth was revised downwards on account of lower growth in some constituents such as trade, hotels, transport & communication, and financial services, it remained robust. Construction activity recorded the highest growth in Q4 in the new series (base 2011-12). Various high frequency indicators also suggest resilient performance of the services sector. Improving sales of tractors and two-wheelers suggest strengthening of rural demand. Commercial vehicle sales also accelerated in April. Revenue-earning freight traffic of railways picked up, driven by improved movement in coal, fertilisers, and cement. Growth in passenger vehicle sales accelerated but port traffic decelerated for the third successive month in April. Domestic air passenger traffic rose significantly in April. Two key indicators of construction activity showed improvement – cement production growth accelerated and steel consumption turned around. Services PMI moved slightly into contraction in May, reflecting decline in business activity and stagnation in new orders. 14. Retail inflation, measured by the year-on-year change in the CPI, rose sharply to 4.6 per cent in April, driven mainly by a significant increase in inflation excluding food and fuel. Excluding the estimated impact of an increase in house rent allowances (HRAs) for central government employees, headline inflation was at 4.2 per cent in April, up from 3.9 per cent in March. Food inflation moderated for the fourth successive month, pulled down by vegetables due to lower than the usual seasonal increase in their prices, and pulses and sugar which continued to experience deflation. However, within the food group, inflation increased in respect of cereals, fruits, prepared meals, meat and fish. 15. Fuel group inflation declined for the fifth month in a row in April mainly on account of a fall in the inflation of liquefied petroleum gas in line with international prices, and electricity. However, inflation in other major items of fuel such as firewood and chips, dung cake, kerosene and coal inched up. Inflation in the transport and communication sub-group accelerated due to the firming up of international crude oil prices, even though the domestic pass-through to petrol and diesel was incomplete. Inflation also picked up in clothing, household goods and services, health, recreation, education, and personal care and effects. 16. The May 2018 round of the Reserve Bank’s survey of households reported a significant rise in households’ inflation expectations of 90 basis points (bps) and 130 bps, respectively, for three-month and one-year ahead horizons. Manufacturing firms polled in the Reserve Bank’s IOS reported input price pressures and an increase in selling prices in Q1:2018-19. Firms polled for the manufacturing PMI in May also showed a sharp increase in input and output prices. Farm inputs and industrial raw material costs have risen sequentially. Wage pressures in the rural sector moderated; however, those in the organised sectors remained firm. 17. Liquidity in the system remained generally in surplus during April-May 2018. During April, the Reserve Bank absorbed surplus liquidity of ₹496 billion on a daily net average basis due to increased government spending, especially in the second half of the month. Reflecting easy liquidity conditions, the weighted average call rate (WACR) softened to 5.89 per cent in April (from 5.96 per cent in March). However, surplus liquidity in the system moderated considerably in the first half of May and the system moved into deficit in the third week of May mainly due to inflows on account of the goods and services tax (GST). The Reserve Bank conducted an open market operation purchase auction on May 17, 2018 to inject liquidity of ₹100 billion into the system. The system again turned into surplus in the last week of May reflecting mainly the payment of food subsidies. Surplus liquidity absorbed under the LAF on a daily net average basis declined to ₹142 billion in May. The WACR in May at 5.88 per cent remained broadly at the April 2018 level. 18. India’s exports grew in April 2018 after a marginal dip in the preceding month, supported mainly by non-oil exports, particularly engineering goods and chemicals. Import growth decelerated sequentially in April 2018; a significant decline in imports of gold as well as pearl and precious stones more than offset the impact of rising crude oil prices. Nevertheless, the trade deficit expanded in March and April from its level a year ago. External financing remained comfortable in 2017-18. While net foreign direct investment in 2017-18 was broadly comparable with the previous year, net foreign portfolio flows were stronger due to a sharp turnaround in debt inflows. However, foreign portfolio investors withdrew US$ 6.7 billion on a net basis from the domestic capital market in 2018-19 (up to June 4) reflecting volatility in global financial markets. India’s foreign exchange reserves were at US$ 412 billion on June 1, 2018. Outlook 19. The first bi-monthly resolution of 2018-19 in April projected CPI inflation in the range of 4.7-5.1 per cent in H1:2018-19 and 4.4 per cent in H2, including the HRA impact for central government employees with risks tilted to the upside. Excluding the impact of HRA revisions, CPI inflation was projected at 4.4-4.7 per cent in H1:2018-19 and 4.4 per cent in H2. Actual inflation outcomes since the April policy have evolved broadly on the lines of the projected trajectory. However, there has been an important compositional shift. While the summer momentum in vegetable prices was weaker than the usual pattern, there was an abrupt acceleration in CPI inflation excluding food and fuel. 20. The headline inflation outlook is driven primarily by two countervailing effects. On the one hand, CPI inflation excluding food and fuel rose sharply in April over March by 80 basis points to reach an ex-HRA level of 5.3 per cent, suggesting a hardening of underlying inflationary pressures. Furthermore, since the MPC’s meeting in early April, the price of Indian basket of crude surged from US$ 66 a barrel to US$ 74. This, along with an increase in other global commodity prices and recent global financial market developments, has resulted in a firming up of input cost pressures, as also confirmed in the Reserve Bank’s IOS for manufacturing firms in Q2:2018-19. The resulting pick-up in the momentum of inflation excluding food, fuel and HRA has imparted persistence into higher CPI projections for 2018-19. On the other hand, food inflation has remained muted over the past few months and the usual seasonal pickup delayed, softening the projections in the short run. Taking these effects into account, projected CPI inflation for 2018-19 is revised to 4.8-4.9 per cent in H1 and 4.7 per cent in H2, including the HRA impact for central government employees, with risks tilted to the upside (Chart 1). Excluding the impact of HRA revisions, CPI inflation is projected at 4.6 per cent in H1 and 4.7 per cent in H2. 21. Turning to the growth outlook, the CSO’s provisional estimates have placed GDP growth for Q4:2017-18 at 7.7 per cent – 70 basis points higher than that in Q3 – given the sharp acceleration in investment and construction activity. With improving capacity utilisation and credit offtake, investment activity is expected to remain robust even as there has been some tightening of financing conditions in recent months. Global demand has also been buoyant, which should encourage exports and provide a further thrust to investment. The sharp rise in petroleum product prices, however, is likely to impact disposable incomes. Consumption, both rural and urban, remains healthy and is expected to strengthen further. According to the early results of the Reserve Bank’s IOS, activity in the manufacturing sector is expected to moderate marginally in Q2:2018-19 on account of deterioration in the overall business situation and order book. On the basis of an overall assessment, GDP growth for 2018-19 is retained at 7.4 per cent as in the April policy. GDP growth is projected in the range of 7.5-7.6 per cent in H1 and 7.3-7.4 per cent in H2, with risks evenly balanced (Chart 2).   22. A major upside risk to the baseline inflation path in the April resolution has materialised, viz., 12 per cent increase in the price of Indian crude basket, which was sharper, earlier than expected and seems to be durable. Crude oil prices have been volatile recently and this imparts considerable uncertainty to the inflation outlook – both on the upside and the downside. Several other risks remain. First, global financial market developments have emerged as another important source of uncertainty. Second, the significant rise in households’ inflation expectations as gathered in the May 2018 round of the Reserve Bank’s survey could feed into wages and input costs in the coming months. However, the pass-through to output prices remains muted presently. Third, the staggered impact of HRA revisions by various state governments may push headline inflation up. While the statistical impact of HRA revisions will be looked through, there is a need to watch out for any second round impact on inflation. Fourth, the impact of the revision in the MSP formula for kharif crops is not possible to assess at this stage in the absence of adequate details. Fifth, as forecast by the IMD, if the monsoon is normal and well-distributed temporally and spatially, it may help keep food inflation benign. 23. Against the above backdrop, the MPC decided to increase the policy repo rate by 25 basis points and keep the stance neutral. The MPC reiterates its commitment to achieving the medium-term target for headline inflation of 4 per cent on a durable basis. 24. The MPC notes that domestic economic activity has exhibited sustained revival in recent quarters and the output gap has almost closed. Investment activity, in particular, is recovering well and could receive a further boost from swift resolution of distressed sectors of the economy under the Insolvency and Bankruptcy Code. Geo-political risks, global financial market volatility and the threat of trade protectionism pose headwinds to the domestic recovery. It is important that public finances do not crowd out private sector investment activity at this crucial juncture. Adherence to budgetary targets by the Centre and the States – which appears to be the case thus far – will also ease upside risks to the inflation outlook considerably. 25. Dr. Chetan Ghate, Dr. Pami Dua, Dr. Ravindra H. Dholakia, Dr. Michael Debabrata Patra, Dr. Viral V. Acharya and Dr. Urjit R. Patel voted in favour of the decision. The minutes of the MPC’s meeting will be published by June 20, 2018. 26. The next meeting of the MPC is scheduled on July 31 and August 1, 2018. Voting on the Resolution to increase the policy repo rate by 25 bps to 6.25 per cent

Statement by Dr. Chetan Ghate 27. Since the adoption of flexible inflation targeting in India (de facto in 2014 and de jure in 2016), the “great-disinflation” experienced by the Indian economy is a major accomplishment. After several years of high inflation in the run-up to 2014, the March 2018 CPI headline inflation (ex-HRA) rate of 3.9% is a testimony to the successful conduct of monetary policy given its consistency with the 4 +/- 2 percent target recommended by the Urjit Patel Committee report in 2014 and enshrined in the Reserve Bank of India Act, 1934 in 2016. Both the Reserve Bank of India and the Government of India should be congratulated in calibrating a monetary-fiscal mix that has helped engender this disinflation. Good luck helped with this outcome but so did good policy. 28. Inflation targeting however can truly become successful if the inflation target and the inflation forecast become identical on a durable basis. Locking in the 4 percent medium target therefore requires continual vigilance. 29. Since the last review, demand conditions have continued to remain robust. Q4: 2017-2018 headline growth of 7.7% was the highest in 7 quarters. While capacity utilization increased throughout 2017-18, the pick-up since Q3 (74.1%) appears to be decisive. The successful resolution of cases under the Insolvency and Bankruptcy Code will further assist capacity utilization without requiring new investment. 30. Despite the PMIs for services being somewhat fragile, overall corporate profits remain strong. While consumption (PFCE) growth remains tepid (the Q4 growth print was close to the average of the last 7 quarters), the strong revival of investment demand, manufacturing, and construction gives me more confidence about the durability of the growth recovery. Even though the high growth print of Q4:2017-2018 is pushed up by a base effect, I am more certain that the ongoing cyclical recovery in growth will sustain and this will lead to a faster closing of the output gap. 31. The revival of growth brings new inflationary risks that need to be carefully watched. The RBI’s enterprise surveys suggest that upward pressures in input and staff costs are being marked by an increase in selling prices. Staff costs in services increased by 6.6%, and 11.6% in manufacturing compared to the last round of the survey. Food inflation continues to be maverick with a 4th consecutive month decline: the usual seasonal uptick in April uncharacteristically surprised on the downside. CPI inflation ex food and fuel, which in April, sustained close to 6%, with strong momentum effects is worryingly becoming the main driver of inflation. Almost all components of CPI ex food fuel registered upticks suggesting that demand-pull forces are creeping into CPI headline inflation. 32. A major upside risk to the one-year ahead CPI projections has been the price of oil. This has been on a durable rise over the past six months, reflecting stronger global growth and the increasing costs of creating capacity in substitutes. While a strong dollar and the price of oil usually follows an inverse relationship, the usual “coupling” has been confounded by geo-political events in recent months. The volatility in the price of oil needs to be carefully watched, especially because higher fuel prices have helped harden inflationary expectations (both the 3- month ahead and 1-year ahead) to their highest level since September 2016. 33. The combination of cost-push and demand-pull factors at the current juncture has put one-year ahead inflation projections significantly above 4%. This warrants a monetary policy response. However, because of uncertainty surrounding the price of oil, and the nascent recovery of the economy, it would be opportune to take small steps. 34. I await details on the MSP policy. The outcome of a simultaneous twin terms of trade shock to the Indian economy as explained in my minutes of the April MPC meeting needs to be carefully watched. 35. I vote for an increase in the policy repo rate by 25 basis points at today’s meeting of the Monetary Policy Committee. Statement by Dr. Pami Dua 36. Headline inflation rose to 4.6% in April from 4.3% in March and 4.4% in February, despite subdued food inflation. This was primarily due to a broad-based hardening of inflation excluding food and fuel with inflation rising in transport and communication, housing, health, recreation, education and personal care and effects. Even after excluding the estimated impact of the HRA adjustment for central government employees, inflation showed an uptick between March and April. 37. Furthermore, both qualitative and quantitative responses from the May round of the Reserve Bank’s Inflation Expectations Survey of Households reflect a hardening of inflation expectations. In particular, the survey reports a rise in households’ inflation expectations for three-month and one-year horizons. The May round of the Consumer Confidence Survey also shows a deteriorating outlook with respect to the price situation. The Reserve Bank of India’s Industrial Outlook Survey (IOS) reports pressures in input costs and selling prices. Firms surveyed for the manufacturing Purchasing Managers’ Index also indicate an increase in input and output prices. 38. The upside risks to inflation include geopolitical risks associated with crude oil prices, increase in other global commodity prices, implementation of HRA revisions (state governments), increase in kharif minimum support prices, fiscal slippage and a weaker Indian rupee. The downside risks include forecast of a normal monsoon, and moderation in global commodity prices due to slowdown in global growth. 39. On the output side, the provisional estimates of GDP released recently show that the Indian economy grew at 6.7% in 2017-18 and the performance of the economy in Q4, 2017-18 was strong with GDP growth at 7.7%, although this partly reflects a favourable base effect. Improving growth in the economy is also reflected in the rising capacity utilization of manufacturing firms as per the RBI’s Order Books, Inventories and Capacity Utilization Survey (OBICUS) as well as acceleration of growth in cement and steel production, upward revision of agricultural growth and resilience of the services sector. Industrial growth has also been robust, as is reflected in the strong performance in manufacturing for the past three consecutive quarters. 40. However, global growth is losing steam, as anticipated earlier by the long leading indexes of international growth maintained by the Economic Cycle Research Institute (ECRI), New York. In particular, quarter-over-quarter GDP growth turned negative in Japan, and declined in the Eurozone, the U.K. and the U.S. in the first quarter of 2018. While U.S. GDP growth is expected to improve in the current quarter, ECRI’s forward-looking indexes still point to fading global growth prospects. Also, the global manufacturing Purchasing Managers’ Index fell to a nine-month low in May, underscoring a moderating global industrial growth outlook. Furthermore, growth in ECRI’s Indian Leading Exports Index is in a deepening cyclical downswing, suggesting that Indian export growth will remain in a cyclical downtrend at least for the next couple of quarters. Moreover, India’s domestic growth outlook is lacklustre, at best, according to ECRI’s Indian Leading Index. 41. In the meantime, with underlying inflation pressures in a cyclical upswing, according to ECRI’s U.S. Future Inflation Gauge, U.S. inflation has also been on the rise, and is now at the Federal Reserve’s 2% inflation target. At the same time, the unemployment rate has dropped to an 18-year low, spurring the Fed to keep tightening monetary policy. 42. In India, with hardening of actual inflation, rising inflation expectations along with prevailing upside risks to inflation, I vote for an increase in the repo rate by 25 basis points while retaining the neutral stance. Statement by Dr. Ravindra H. Dholakia 43. After the last MPC meeting (5th April, 2018), several macroeconomic uncertainties have reduced and a clearer picture is emerging. However, some basic uncertainties still remain on geo-politics, international trade policies and ability of some advanced economies to pursue interest rate hikes. More specifically, I consider the following factors for the repo rate decision in the present policy: (i) Oil prices have further firmed up and geo-political developments indicate no respite likely on that count soon. For the next 12-18 months, the oil prices are likely to stay at higher level adding to the twin deficits (fiscal and current account) and inflationary pressures. (ii) RBI survey of households for inflationary expectations in the May 2018 round shows a significant increase of about 90 bps and 130 bps respectively for 3 months and 12 months ahead compared to the March 2018 round. We may note that the impact on consumers’ inflationary expectations of an oil price increase is almost 4 to 5 times higher than the similar increase in food prices and, therefore, we have to consider these numbers cautiously. (iii) RBI consumer confidence survey in April-May 2018 shows improvement in employment and household income outlook during the coming year. This indicates building up of demand pressures. (iv) IIM Ahmedabad survey of businesses in April 2018 also shows a substantial increase of about 60 bps in their expectation of headline CPI inflation 12 months ahead compared to February 2018 and is around 4.7 per cent. (v) Capacity utilization has increased substantially as revealed by different surveys. Growth in capital formation has also picked up. GDP growth at 7.7 per cent for 2017-18 Q4 assures that the Indian economy is firmly on the recovery path. All this indicates that the output gap has started closing. However, it has still not started exercising any pressure on unemployment and wage scenario and thereby on inflation. In this context, it is important to recognize that while the average growth during 2018-19 is likely to be around 7.4 per cent, in none of the quarters it is projected to exceed the 7.7 per cent mark observed in 2017-18 Q4. Growing protectionism around the globe and oil prices staying high can pose genuine downside risk to our growth. (vi) RBI’s latest inflation forecast considering the CPI prints up to April 2018 for 2018-19Q4 stands 30 bps higher than its last forecast based on CPI data up to February 2018. It is forcasted at 4.7 per cent for 2018-19Q4, which is the same as expected by the businesses and is, therefore, more credible. Inflation rate likely to stay consistently above 4 – 4.5 per cent is a cause of concern, particularly when there are some upside risks. It brings down the expected real policy rate in India that is substantially less than our comparator countries like Brazil, Mexico, China and South Africa though it is negative for most other G20 countries. Most of the advanced G20 countries where the real policy rates are negative are committed to rate hikes over the coming year. Now when the economic growth is firmly on the path of strong recovery in India, growing inflation concerns need to be addressed. 44. The upside risks to inflation such as MSP revision and HRA revision implementation by states are likely to be countered by reconfirmed normal monsoon forecasts and the lack of fiscal space in several states. Oil prices could turn on either side and hence present a genuine risk. There are chances that headline CPI prints in the coming months (H1) may turn out to be lower than expected by RBI (i.e. 4.8-4.9 per cent inflation) and in such a case, the inflation forecast 12 months ahead may come down. Although such possibilities are not ruled out, their chances are less. Under such circumstances, I believe that prudence lies in retaining the neutral policy stance, but increase the policy rate by 25 bps for now. Future course of action should depend on how the scenario on growth and inflation develops. Statement by Dr. Michael Debabrata Patra 45. This time, I would imbue urgency into my vote to raise the policy rate by 25 basis points and align the operating target. 46. In my view, the prolonged period of staying on hold is denting the credibility of the MPC's commitment to maintaining inflation at the centre of the target band. There is a rising risk that the public may start discounting this commitment: if it begins to believe that the MPC is willing to tolerate inflation in higher reaches, inflation expectations can be set adrift. The status quo is also dissipating the hard earned reputational bonus that accrued to the RBI for breaking the back of the high inflation episode of 2009-13. There was a lot of good luck then as international commodity prices collapsed, but good policy too as we set out a glide path of disinflation that took India out of the fragile five. 47. The major upside risks to inflation that the MPC has worried about in past resolutions are crystallising on an ongoing basis. Moreover, the early warning indicators – households' inflation expectations; professional forecasters' projections; input and selling prices captured in the RBI’s surveys and polled by purchasing managers; various input costs, farm and non-farm, including corporate staff costs; erosion in consumer confidence on the price situation – are all flashing amber or red. Markets and financial institutions are already getting ahead of the curve. Continuing policy inaction is running the danger of allowing inflation outcomes to slip away from the centre of the target band. The gains of macroeconomic stability that have defined the recent period as its greatest achievement could get frittered away. 48. Turning to growth, the economy is gathering speed. Buoyant sales growth, depleting inventories, rising capacity utilization and rising consumer optimism on spending, especially on discretionary items, all suggest that slack in the economy is being pulled in and the output gap is set to close. Consequently, demand-pull components are showing up in recent inflation readings. In this finely poised situation, inflation volatility can hamstring the new impulses of investment growth that have sprung up in recent quarters. 49. In my view, the time has come for the MPC to act unanimously to raise the policy rate by 25 basis points in a closing sliver of opportunity. This will demonstrate our resolve to return inflation to the centre of the target band. Monetary policy has to step in before it is too late and guide the economy along a non-accelerating inflation growth path. Statement by Dr. Viral V. Acharya 50. In the Minutes of the April 2018 Monetary Policy Committee (MPC) meeting, I had indicated my growing concern around underlying inflationary pressures. These pressures have been manifesting as a strengthening of Consumer Price Index (CPI) inflation excluding food and fuel even after adjusting for the impact of Centre’s House Rent Allowances (HRA). There has been a rise in input costs due to supply shocks such as the sharp oil price surge witnessed over the past nine months. The strengthening of inflation also reflects aggregate demand pressures, which are confirmed in the now almost-closed output gap, improved capacity utilization figures, and a significant pick up in credit growth. As a result, the projection for medium-term headline CPI inflation has become firmer on the upside; it has moved closer to 5% and away from 4%, the latter being the mandated target of the MPC. 51. The inflationary pressure also seems to be experienced by the common man. The Reserve Bank of India (RBI)’s Inflation Expectations Survey (IES) of households reveals a uniform picture of hardening of inflation expectations whichever way one looks at the data. Most notably, the 3-month ahead and 12-month ahead inflation expectations have increased sharply by 90 basis points (bps) and 130 bps, respectively, since the last survey. They are likely explained by the fact that petrol and diesel prices carry salience: fuel prices are in the face and generalise rapidly through transportation costs into prices of general goods and services. 52. A key uncertainty at present relates to the oil price development over medium-term horizon that monetary policy operates at. Robust global growth, OPEC and Russian supply cuts, supply shock in Venezuela, and geo-political uncertainty around the Iranian supply have all pushed international crude prices uncomfortably high in a short span of time. The shape of Brent futures curve (now in “backwardation”, i.e., buying oil forward is cheaper than buying it in spot) suggests the markets are pricing in the risk of a “stock out” – not having access to supply when it is needed. The US shale gas response appears to not have been enough as of yet to dampen this stock-out risk since some of the supply faces pipeline-infrastructure headwinds in reaching the markets. 53. The one respite for headline inflation prints has been the continuing benign food inflation where seasonal pickup has remained muted due to a collapse in the prices of onions and tomatoes. This has imparted a short-run softening to inflation projections keeping them contained in the first half of 2018-19 in spite of the rising momentum in CPI ex-food, fuel and HRA. However, if the seasonal pick-up does manifest in the first half at some point, then the headline prints will have little abatement from any of its constituents. Under such a scenario, any upward pressure on food prices such as through generous minimum support prices (MSPs) would exacerbate headline inflation pressures. 54. Factoring in these considerations, there is no alternative to raising the policy rate by 25 bps so as to signal concern about underlying inflation, manage inflation expectations, and guard proactively against a further increase in inflation. However, considerable uncertainties around oil and food prices as well as the playing out of trade wars and global financial market outcomes led me to keep the stance neutral. It will allow the MPC to determine in a flexible manner what further monetary policy response is warranted based on an ongoing assessment of the inflation situation, inflation expectations and growth prints in the coming months. Statement by Dr. Urjit R. Patel 55. A key risk to inflation cited in the MPC’s April 2018 resolution has since materialised; crude oil prices have risen sharply by over 12 per cent even as there was some moderation in recent days. On the positive side, food inflation has continued to be benign. On the whole, inflation in March and April has behaved more or less on the lines of the path projected in the April resolution. Two developments are noteworthy from the standpoint of price stability. First, inflation (CPI ex-HRA) has averaged 4.4 per cent since November 2017. Second, inflation expectations of households have risen significantly as reflected in the May 2018 round of the Reserve Bank’s survey. 56. Looking ahead, projected inflation for Q4:2018-19 (at 4.7 percent) is 30 bps higher than that in the April resolution. The baseline inflation path faces several uncertainties, viz., (i) the outlook for oil prices; (ii) continuing volatility in global financial markets; (iii) the risk of the significant rise in households’ inflation expectations feeding into wages and input costs, even as the pass-through to output prices has remained muted so far; (iv) the impact of the likely revision in the MSP formula; and (v) second round impact on inflation on account of the staggered impact of HRA revisions by various state governments, though the direct statistical impact of HRA revisions will be looked through. However, a normal monsoon, by keeping food inflation benign, could act as a mitigating factor. 57. Domestic growth has strengthened with the Q4:2017-18 print at a seven-quarter high and now appears to be on a sustainable path. Investment activity, in particular, has accelerated. There has also been a pick-up in manufacturing and this is manifested in an increase in capacity utilisation. The services sector has been resilient with several high frequency indicators continuing to show robust growth in recent months even as PMI services moved slightly into contraction in May. Bank credit growth has continued to improve. The recent increase in oil prices, by impacting disposable incomes, may have some adverse impact on private consumption. On the whole, however, economic activity continues to be resilient with GDP growth for 2018-19 projected at 7.4 per cent, same as in the April policy. 58. Inflation risks have increased since the April policy. I, therefore, vote for an increase in the policy repo rate by 25 basis points. In view of prevailing uncertainties, it is apposite to maintain the neutral stance so as to respond to the evolving situation in a flexible manner. Jose J. Kattoor

|

|||||||||||||||

9911796707

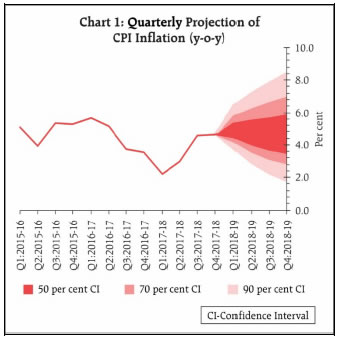

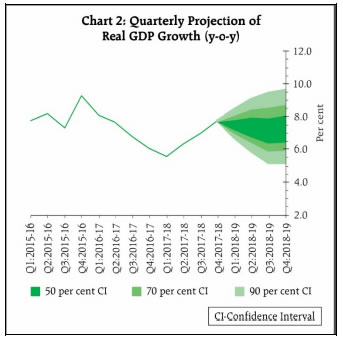

9911796707