| News | |||||||||||||||

|

Home |

|||||||||||||||

|

|

|||||||||||||||

Minutes of the Monetary Policy Committee Meeting, December 6 to 8, 2023 [Under Section 45ZL of the Reserve Bank of India Act, 1934] |

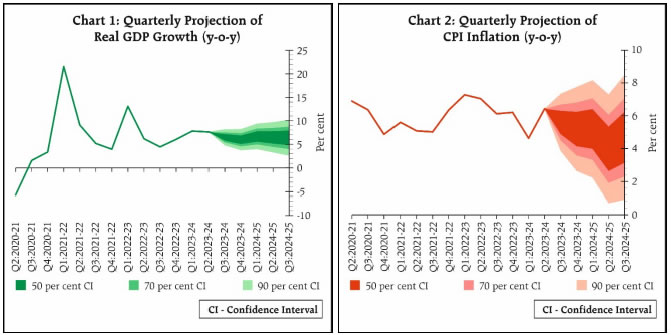

|||||||||||||||

| 23-12-2023 | |||||||||||||||

The forty sixth meeting of the Monetary Policy Committee (MPC), constituted under Section 45ZB of the Reserve Bank of India Act, 1934, was held during December 6 to 8, 2023. 2. The meeting was attended by all the members – Dr. Shashanka Bhide, Honorary Senior Advisor, National Council of Applied Economic Research, Delhi; Dr. Ashima Goyal, Emeritus Professor, Indira Gandhi Institute of Development Research, Mumbai; Prof. Jayanth R. Varma, Professor, Indian Institute of Management, Ahmedabad; Dr. Rajiv Ranjan, Executive Director (the officer of the Reserve Bank nominated by the Central Board under Section 45ZB(2)(c) of the Reserve Bank of India Act, 1934); Dr. Michael Debabrata Patra, Deputy Governor in charge of monetary policy – and was chaired by Shri Shaktikanta Das, Governor. 3. According to Section 45ZL of the Reserve Bank of India Act, 1934, the Reserve Bank shall publish, on the fourteenth day after every meeting of the Monetary Policy Committee, the minutes of the proceedings of the meeting which shall include the following, namely:

4. The MPC reviewed the surveys conducted by the Reserve Bank to gauge consumer confidence, households’ inflation expectations, corporate sector performance, credit conditions, the outlook for the industrial, services and infrastructure sectors, and the projections of professional forecasters. The MPC also reviewed in detail the staff’s macroeconomic projections, and alternative scenarios around various risks to the outlook. Drawing on the above and after extensive discussions on the stance of monetary policy, the MPC adopted the resolution that is set out below. Resolution 5. On the basis of an assessment of the current and evolving macroeconomic situation, the Monetary Policy Committee (MPC) at its meeting today (December 8, 2023) decided to:

The standing deposit facility (SDF) rate remains unchanged at 6.25 per cent and the marginal standing facility (MSF) rate and the Bank Rate at 6.75 per cent.

These decisions are in consonance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4 per cent within a band of +/- 2 per cent, while supporting growth. Assessment and Outlook 6. Global growth is slowing at a divergent pace across economies. Inflation continues to ebb though it remains above target with underlying inflationary pressures staying relatively stubborn. Market sentiments have improved since the last MPC meeting – sovereign bond yields have declined, the US dollar has depreciated, and global equity markets have strengthened. Emerging market economies (EMEs) continue to face volatile capital flows. 7. Domestic economic activity is exhibiting resilience. Real gross domestic product (GDP) grew year-on-year (y-o-y) by 7.6 per cent in Q2:2023-24, underpinned by robust investment and government consumption, which cushioned the drag from net external demand. On the supply side, gross value added (GVA) rose by 7.4 per cent in Q2, driven by buoyant manufacturing and construction activities. 8. Continued strengthening of manufacturing activity, buoyancy in construction, and gradual recovery in the rural sector are expected to brighten the prospects of household consumption. Healthy balance sheets of banks and corporates, supply chain normalisation, improving business optimism, and rise in public and private capex should bolster investment going forward. With improvement in exports, the drag from external demand is expected to moderate. Headwinds from the geopolitical turmoil, volatility in international financial markets and geoeconomic fragmentation pose risks to the outlook. Taking all these factors into consideration, real GDP growth for 2023-24 is projected at 7.0 per cent with Q3 at 6.5 per cent; and Q4 at 6.0 per cent. Real GDP growth for Q1:2024-25 is projected at 6.7 per cent; Q2 at 6.5 per cent; and Q3 at 6.4 per cent (Chart 1). The risks are evenly balanced. 9. CPI headline inflation fell by about 2 percentage points since the last meeting of the MPC to 4.9 per cent in October 2023 on sharp correction in prices of certain vegetables, deflation in fuel and a broad-based moderation in core inflation (CPI inflation excluding food and fuel). 10. Uncertainties in food prices along with unfavourable base effects are likely to lead to a pick-up in headline inflation in November-December. Kharif harvest arrivals and progress in rabi sowing together with El Niño weather conditions need to be monitored. Adequate buffer stocks for cereals and a sharp moderation in international food prices, along with pro-active supply side interventions by the Government may keep these food price pressures under check. Crude oil prices may remain volatile. Early results from the firms polled in the Reserve Bank’s enterprise surveys indicate softer growth in input costs and selling prices for the manufacturing firms in Q4 relative to the previous quarter, while price pressures persist for services and infrastructure firms. Taking into account these factors, CPI inflation is projected at 5.4 per cent for 2023-24, with Q3 at 5.6 per cent; and Q4 at 5.2 per cent. Assuming a normal monsoon next year, CPI inflation for Q1:2024-25 is projected at 5.2 per cent; Q2 at 4.0 per cent; and Q3 at 4.7 per cent (Chart 2). The risks are evenly balanced.

11. The MPC observed that recurring food price shocks are impeding the ongoing disinflation process. Core disinflation has been steady, indicative of the impact of past monetary policy actions. Headline inflation, however, remains volatile, with possible implications for the anchoring of expectations. Domestic food inflation unpredictability, and volatility in crude oil prices and financial markets in an uncertain international environment pose risks to the inflation outlook. The path of disinflation needs to be sustained. The MPC will carefully monitor any signs of generalisation of food price pressures which can fritter away the gains in easing of core inflation. On the growth front, improved momentum in investment demand along with business and consumer optimism, would support domestic economic activity and ease supply constraints. As the cumulative policy repo rate hike is still working its way through the economy, the MPC decided to keep the policy repo rate unchanged at 6.50 per cent in this meeting, but with preparedness to undertake appropriate and timely policy actions, should the situation so warrant. Monetary policy must continue to be actively disinflationary to ensure anchoring of inflation expectations and fuller transmission. The MPC will remain resolute in its commitment to aligning inflation to the target. The MPC also decided to remain focused on withdrawal of accommodation to ensure that inflation progressively aligns to the target, while supporting growth. 12. All members of the MPC – Dr. Shashanka Bhide, Dr. Ashima Goyal, Prof. Jayanth R. Varma, Dr. Rajiv Ranjan, Dr. Michael Debabrata Patra and Shri Shaktikanta Das – unanimously voted to keep the policy repo rate unchanged at 6.50 per cent. 13. Dr. Shashanka Bhide, Dr. Ashima Goyal, Dr. Rajiv Ranjan, Dr. Michael Debabrata Patra and Shri Shaktikanta Das voted to remain focused on withdrawal of accommodation to ensure that inflation progressively aligns to the target, while supporting growth. Prof. Jayanth R. Varma expressed reservations on this part of the resolution. 14. The minutes of the MPC’s meeting will be published on December 22, 2023. 15. The next meeting of the MPC is scheduled during February 6-8, 2024. Voting on the Resolution to keep the policy repo rate unchanged at 6.50 per cent

Statement by Dr. Shashanka Bhide 16. The official GDP growth estimate for Q2: 2023-24, YOY basis, turned out to be surprisingly strong at 7.6%, following the growth of 7.8 per cent in Q1. The projected GDP growth for Q2 in the October 2023 MPC meeting was 6.5 per cent, well below the NSO estimates. Manufacturing and construction sectors recorded double digit growth rates of GVA in Q2 offsetting the weak growth in agriculture & allied sectors and services. The QOQ momentum in Q2 in the manufacturing and construction sectors, two drivers of GVA growth, was above their decadal average (2011-12 to 2019-20) for the quarter, pointing to the significant growth momentum in these sectors. 17. Although greater optimism in terms of output demand conditions or business turnover for Q2 by the manufacturing firms relative to the service sector firms was reflected in the RBI’s sample surveys of firms conducted during July-September, the actual growth in GVA in manufacturing has exceeded the expectations. At the aggregate level, GDP growth was in sync with some of the indicators of broader economic activity, such as PMI, non-food credit, GST collections and toll collections. Financial performance of the corporate sector for Q2 indicates improved profit earnings and spending on fixed assets in line with the overall GVA growth and the rise in gross fixed capital formation. We may also note that sharp increase in GVA in manufacturing in Q2 is in contrast to the stable overall capacity utilisation rates for the sector indicating the likely significant improvements in revenue realisations and cost efficiency in the present context. 18. The growth momentum while strong, it points to a few concerns as we go forward. Uneven performance, both on the production and demand fronts is evident. On the production side, the agriculture & allied sector and services registered low and modest rates of growth in Q2. The IIP for consumer durables has shown weak growth. On the demand side, real Private Final Consumption Expenditure registered modest 3.1% YOY growth as compared to 11% growth in real Gross Fixed Capital Formation. The November 2023 round of RBI’s Consumer Confidence Survey shows improvement in total consumer expenditure over the previous round, both on current period and one-year ahead basis. In the recent few rounds of the survey, the year ahead outlook has been marked by consistently positive net response rates on non-essential spending. On the external demand, the recent projections for global output growth in 2024 by IMF (October 2023) are slightly lower than in 2023 but expect world trade volumes to improve significantly. Sustained growth in fixed capital formation may also require maintaining the pace of government capital outlay. 19. Taking into account both the positive drivers of growth and vulnerabilities, the GDP growth projections for the remaining two quarters of 2023-24 are at 6.5 for Q3 and 6.0 per cent for Q4, taking the projections for FY 2023-24 to 7.0 per cent over the previous year. The projected growth for H2: 2023-24 is 6.3 per cent compared to 5.9 per cent for the same period in our October 2023 assessment. The projected GDP growth rates for the first three quarters of 2024-25 are 6.7, 6.5 and 6.4 per cent. 20. The headline inflation dropped to 5 per cent or lower in September (5%) and October (4.9%). Among the three major constituents – food, fuel and core – only food inflation remained above 6% in September and October. CPI Food inflation has remained above 6% since July this year, although pace of the increase has declined. Within the food & beverages category of consumption, cereals, pulses and spices registered double digit percentage price rise YOY basis in October. CPI for Eggs, milk and fruits rose by more than 6 per cent in October. Impact of the unfavourable rainfall conditions during the monsoon season this year has meant likelihood of weak kharif harvest for some of the main crops with implications to food inflation. 21. The weak global demand conditions have kept the commodity and energy prices in the international markets in check. However, continued geopolitical conflicts cast a shadow on supply chains with potential to disrupt global energy and commodity markets and inflation trends. The increased pace of economic activity in the last two quarters, driven mainly by investment spending has not led to rise in core inflation. Supply side policy measures by the government, particularly in the case of food commodities have also helped in reducing the price impact of supply shocks. 22. Inflation expectations survey of urban households conducted by RBI points to the sustained decline in 3 month-ahead inflation expectation since September 2022 up to November 2023, barring a spike in January 2023. The one year-ahead expected inflation rate has moved up marginally in the November round of the survey after following a declining trajectory since September 2022. 23. While the core CPI inflation rate (excluding food and fuel components) fell below 5% in Q2: 2023-24 and dropped to 4.3% in October, price pressures in the non-farm sectors are vulnerable to shocks to input costs. Early results of RBI’s enterprise surveys conducted during the latter part of October and November point to some divergence in the expectations of cost pressures and selling prices between manufacturing and other firms. Larger proportion of sampled manufacturing firms indicate expectations of softening of selling prices in Q4 relative to this proportion in Q3 but larger proportion of firms in the services and infrastructure sectors expect the selling prices to rise in the same period. The inflation expectations survey of business sector conducted by the IIMA in October 2023 points to a slight increase in one year-ahead ‘unit cost based inflation’ from 4.39% in September 2023 to 4.44% in October 20231. 24. The most recent RBI’s Survey of Professional Forecasters projects headline inflation rate for Q3: 2023-24 till Q1: 2024-25 declining from 5.4 per cent to 5.2 per cent and dropping to 3.9 per cent in Q2: 2024-25. The core inflation (CPI excluding items of Food, Pan, Tobacco and Intoxicants and Fuel & Light) is projected to drop from 4.3 per cent in Q3: 2023-24 to 4.1 per cent in Q1: 2024-25 but increase to 4.4 per cent in Q2: 2024-25. 25. Considering a range of factors influencing the inflation pattern in the short-term, the headline inflation is projected at 5.6% and 5.2% in Q3 and Q4: 2023-24, respectively, and 5.2% in Q1: 2024-25 followed by 4% in Q2 and 4.7% in Q3. 26. Overall, the economy presently reflects the impact of strong drivers for growth despite the unfavourable conditions in some respects. As noted earlier, adverse monsoon rainfall conditions, especially distribution of rainfall over the monsoon period and across the regions, have meant slower growth of agricultural output and rural demand. The weak external demand conditions have affected the export sector. The uneven feature of growth points to vulnerabilities. While investment has fuelled growth in demand, private consumption demand has grown much more slowly. One reason for the slower growth in consumption relates to the ‘base effects’ in H1 given the on-going ‘catch up’ overcoming the pandemic shock. But the uneven sectoral growth patterns also point to other factors influencing output noted earlier with respect to agriculture and external demand. 27. Inflation has moderated in the context of the continued pressure the cumulative monetary policy actions as well as supply side measures by the government in crucial consumption sectors have exerted. The weak external demand conditions have also meant favourable input prices in the international markets. However, food inflation is a concern in the short term. There remain significant risks of the impact of the on-going geopolitical conflicts on particularly fuel prices and consequently on both fuel and core inflation rates. 28. Given that inflation remains well above the target over the short term, with the projected headline CPI rate of above 5% up to Q1: 2024-25, there is a need to continue the policy support for sustaining the trajectory to the target. 29. Therefore, I vote: i) to keep the policy repo rate unchanged at 6.50 per cent, and ii) to remain focused on withdrawal of accommodation to ensure that inflation progressively aligns with the target, while supporting growth. Statement by Dr. Ashima Goyal 30. There are more signs that global interest rates may have peaked. Fears that rates may be higher for longer have also faded as the US Fed has recognized that rates are restrictive already and becoming more so as inflation falls. Pointing to the 1970s to justify higher rates is not valid since inflation has not been high for as long as it was then and expectations remain anchored. International oil prices have also softened despite cartel action. But geopolitics continues to remain a threat. 31. Moreover, recent experience has underlined the freedom Indian rate setters have from international rates. Debt and equity inflows returned as rate differentials narrowed. 32. Indian growth has exceeded expectations again. Manufacturing performance is strong. There are more indications of the expected turnaround in private investment. While cement and steel production have been robust for long, IIP and imports of capital goods, banks’ project finance, firms’ investment intentions and fixed assets have also risen. Rising cash and reserves makes firms less dependent on household savings for financing. 33. The recent state election results reduce uncertainty around national elections and policy so more investment plans should be fast-tracked. But areas of weakness remain in consumption, IT and merchandise exports. Employment offers have slowed in IITs. 34. The centre has demonstrated commitment to fiscal consolidation in terms of sticking to the announced path of deficit reduction, higher share of spending on investment and discipline on off-budget items. Buoyant revenues are able to absorb a large post-pandemic subsidy burden. As countercyclical macroeconomic policy smooth’s shocks and delivers a real interest rate less than the real growth rate, the denominator rises, reducing debt and deficit ratios2. 35. Headline inflation is expected to be within the tolerance band at 5.4% in FY24 and to fall to 4% in Q2 FY25 but rise to 4.7 in Q3. Core inflation shows a broad based moderation falling from 6.1 in 2022-23 to 4.8 in Q2 FY24. Professional forecaster’s figure for core inflation in Q3 is at 4.4%. 36. There is a view that stronger growth will raise core inflation. But even with real GDP growth at 7% it does not necessarily imply potential output is reached implying excess demand and pressures on core inflation if reforms are raising structural growth. 37. Some research defines potential output in terms of expected inflation, and this is a forward-looking way to estimate it given India’s large underemployed population and rising investment—output is below potential if core inflation is below acceptable upper limits3. Time series methods of estimating potential output are backward-looking, with too much weight on recent growth. 38. Why has core inflation come in lower than expectations even as growth recovered? 39. There were no second round effects raising wages from the earlier commodity price shocks since Indian labour markets are slack. 40. Currently, falling costs and healthy sales have raised profits, despite factors that are restraining demand in India. Some firms have reversed earlier price increases that passed on higher costs. Higher sales help spread costs. Many firms had restructured during the pandemic to reduce costs. There is evidence that the mark-up on costs is countercyclical4. Lower price and higher volumes is a strategy that delivers profits in India. Moreover, FMCG majors face competition in 2 and 3 tier markets from many new regional entrants. 41. Investment is expanding capacity so that utilization has not increased despite good output growth. 42. There is evidence that firm’s inflation expectations are well-anchored around 4%5. 43. The government continues to take supply-side action to moderate short term price spikes as well as improve capacities in the long-run. 44. Indian oil majors are profitable again despite recent volatility in oil prices and will be able to pass on benefits to consumers if international oil prices fall sustainably below USD 80 per barrel. Current trends are towards this. 45. All this continues to reduce costs for firms. In these circumstances, core inflation should continue to converge towards 4% and headline should converge to a stable core despite any further transient supply shocks. New data affects outcomes within a structure. It is necessary to pay attention to the structure and context. 46. If inflation sustainably approaches 4% by the middle of 2024 real rates can easily become too high if nothing is done. A repo of 6.5% in 2018 and tight liquidity with a headline inflation of around 4%, even though core inflation was around 6%, proved severely deflationary. Both headline and core inflation fell steeply over the next year. 47. In this meeting, however, I vote for keeping the repo rate and the stance unchanged, in order to watch the impact of an expected rise in food inflation over the next couple of months, since repeated supply shocks are a concern. Even so, as yet they have not been able to raise inflation expectations or reverse the decline in core inflation. 48. Despite the stance, I expect the weighted average call rate (WACR) to ease away from the upper end of the LAF corridor towards the repo rate as government cash balances are drawn down and measures are taken to reduce liquidity hoarding by banks. Under inflation targeting, liquidity is endogenous and is expected to adjust to keep short rates near the repo rate set by the MPC. The RBI had clarified6 post inflation targeting that its ‘operating procedure aims at modulating liquidity conditions so as to achieve the operating target, i.e., to anchor the WACR around the policy rate’ and ‘MSF rate and the fixed overnight reverse repo rate define an informal corridor for limiting intra-day variations in the call rate.’ Understanding this should alleviate the markets concern that liquidity can suddenly dry up. While under the current stance WACR may stay largely in the upper half of the LAF corridor, it cannot persistently exceed it. 49. Pass-through continues as old deposits and loans are re-priced, but the stance, as well as credit growth continuing to exceed deposit growth, should persuade banks of the virtues of passing through more of the 250bps repo rate rise to increase their primary liquidity. Statement by Prof. Jayanth R. Varma 50. Current indications are that, after many difficult quarters, the economic environment is turning more benign in terms of both inflation and growth. The challenge for monetary policy is to facilitate this benign outcome where inflation trends down and growth remains robust. 51. This requires two things. First, a restrictive monetary policy must be maintained long enough to glide inflation to its target of 4%. Second, as inflation drops well below the upper tolerance band, it is necessary to prevent the real interest rate from becoming excessive. At present, projected inflation two to four quarters ahead averages below 4.75%. The prevailing money market interest rates of 6.75% (close to the MSF rate) therefore represent a real interest rate of more than 2%. Three years of high inflation do justify a strong anti-inflationary monetary policy, but in my view a real rate of 2% clearly exceeds the optimal rate. In coming months, as we become more confident about the downward trajectory of inflation (apart from transient food price spikes), there would be a compelling case for continually calibrating the nominal policy rate so as to keep the real interest rate slightly below 1.5% (on the basis of projected inflation 3-5 quarters ahead). 52. For these reasons, I vote for maintaining the repo rate at 6.50%, but express my reservations on the stance. I believe that a stance is not needed at all at this stage. If at all there is a stance, it should be neutral. Statement by Dr. Rajiv Ranjan 53. I began my October statement with three global trends to be closely watched – crude oil prices, US yields and US dollar, all of which were rising then. Oil prices have decreased, yields have softened, and the US dollar has weakened since the last policy. Thus, we draw comfort from the reversal of these trends in this December policy. In addition, global commodity prices have eased further. The impact of these dynamics is seen globally in terms of faster than expected decline in inflation of advanced countries and the conjecture that the apprehension of ‘higher for longer’ may not last long. Domestically, improvement in manufacturing profit with easing of input cost pressures and decline in core inflation is clearly observed. Thus, despite continuing overall global uncertainty, the macroeconomic environment in advance and emerging market economies has not been adversely impacted to the same extent as it was expected, not a long time ago. In fact, the global economy seems to have dodged a hard landing, though it continues to remain vulnerable to slow down risks. 54. Since the last policy, we are in a relatively firmer footing on our domestic macros in terms of inflation and growth. The moderation in CPI to 4.9 per cent in October 2023 was driven by the fall in food and core (CPI excluding food and fuel) inflation along with deflation in the fuel group. Since September, core disinflation also gathered pace, softening by about 60 basis point in a span of two months to 4.3 per cent in October or by about 2 percentage points from a peak value of 6.2 per cent in January.7 Even within core, services inflation at 3.6 per cent was at the lowest level since the start of the 2012=100 series. Core goods inflation, from a peak of 7.1 per cent in February 2023 has since then sequentially moderated to 5.0 per cent in October. Various exclusion based and statistical trimmed mean measures of core inflation also softened in the range of 60-120 bps between August and October. Going forward, core inflation pressure could remain muted, as our monetary policy actions play out and softer growth in input costs and selling prices of the manufacturing sector keep price pressures contained. Concerns on elevated food inflation, however, is a major source of uncertainty for the inflation outlook. 55. On the growth front, the economy is running at full steam. Growth has been resilient and continuously surprising us on the upside over last two releases. The seasonally adjusted momentum in Q2 at 4.3 per cent was stronger than Q2 last year (3.2 per cent) and the pre-COVID average for Q2 (1.6 per cent). This momentum is likely to continue in Q3 and Q4 of 2023-24. It is important to note that for the first time in Q2:2023-24, the fault lines in India’s growth story since the pandemic – tepid private investment and rural demand – seem to be gaining traction. This augurs well for the long-term growth trend, particularly, investment plays a larger role in terms of supply augmentation and improving potential growth in the medium to long-term. India has successfully accumulated capital stock over the past decades and continues to invest in capital formation, led by Government capital expenditure, as reflected in the recent GDP data release. Gross Fixed Capital Formation (GFCF), a proxy for investments, increased by 11 per cent in Q2. We are also in an advantageous position in terms of contribution to potential output through labour and total factor productivity (TFP) channels. India is in the forefront of technology-aided digitalisation with increasing internet penetration and mobile phone usage.8 Greater formalisation and digitalisation of our economy is giving a boost to TFP growth. With respect to human capital, India has a perceptible advantage in terms of demographic dividend and the economy could benefit from it.9 Taken together, capital and TFP, along with favourable demographic dividends, could have led to a sustainable increase in the potential level of output of the economy. This change in structural features of the economy could explain to a large extent the observed dynamics of robust growth numbers along with falling core inflation. 56. The best way monetary policy can support this high growth trajectory is by maintaining its commitment to price stability. While monetary policy has succeeded in getting headline inflation into the tolerance band, it is still above the target10 and continues to remain vulnerable to supply shocks. The below 5 per cent print in October 2023 may reverse as early as next month. In essence, while a durable growth path backed by consumption and investment is visible from here on, the same cannot be said about disinflation yet. Hence, monetary policy must continue treading a cautious path and remain prudent in its approach. We need to continue with the pause on the policy rate in this meeting while observing every incoming information impacting growth-inflation dynamics. Given that inflation remains above target, our stance of withdrawal of accommodation also has to continue to aid fuller transmission. Having taken a pause during the last few policies, there could be an argument for a change in stance to neutral. I feel this is not the right time. Apart from being premature, a change to neutral stance may have to bear the brunt of the collateral damage caused by wrong signalling, particularly with looming uncertainties on the horizon and when market expectations are running ahead of policy intent. We need to consolidate the gains achieved so far. Accordingly, I vote for a pause on rate and continue with the stance. Statement by Dr. Michael Debabrata Patra 57. Inflation remains highly vulnerable to food price spikes, as the spurt in momentum in daily data on key food items for the month of November and early December reveal. This repetitive incidence is causing the accumulation of price pressures in the system and could impart persistence, reflected in a left-tailed skew in the distribution of inflation. Households are already wary: although they expect inflation to remain unchanged three months ahead, they are more unsure about this prognosis than they were two months ago. Over the year ahead, however, they are more sure than in the past that inflation will likely rise. Consumers too reveal more pessimism about inflation a year ahead than when they were surveyed in September. Consequently, monetary policy has to remain on high alert with a restrictive stance. 58. In my view, food prices in India are the true underlying component of inflation. They also generate non-trivial external effects that affect other components of inflation as well as expectations. When these spillovers occur and are significant, monetary policy has to pre-emptively act to prevent generalization, irrespective of the fact that the initial shocks emanate from outside the realm of its influence. Hence the stance of withdrawing accommodation and a readiness to take appropriate action must continue until their impact is seen off without second order effects. 59. The recent GDP data release reinforces the view that the output gap in India has turned positive since the beginning of the year and remains so. This points to the likelihood of demand pull shaping the course of inflation outcomes in the period ahead, amplifying future supply shocks. Over the rest of the year, rising momentum of activity will drive growth offset by waning of favourable base effects. Rural demand is gradually improving while urban demand remains ebullient. Investment has emerged as the mainstay of aggregate demand. It remains to be seen if the recent upturn in exports of merchandise sustains. The strength of underlying domestic demand is also being reflected in the pick-up in non-oil non-gold imports after a prolonged contraction. 60. Against this backdrop, the monetary policy reaction function needs to assign a higher weight to inflation relative to growth in a forward-looking sense. Accordingly, I vote to maintain status quo on the policy rate and continue with the stance of withdrawal of accommodation. Statement by Shri Shaktikanta Das 61. The years 2020 to 2023 will perhaps go down in history as a period of ‘Great Volatility’. In this environment, the Indian economy presents a picture of resilience and momentum as reflected in the higher than anticipated GDP growth in Q2:2023-24, surprising everyone on the upside. Reflecting this, our growth projection for the current year has been revised upward to 7 per cent. We expect this growth momentum to continue next year also. 62. The softening of headline inflation to 4.9 per cent in October 2023 gives further credence to the fact that the heightened and generalised inflation pressures seen in the summer of 2022 is behind us. This disinflation is underpinned by steady moderation in CPI core inflation, caused by easing of price momentum across core goods and services. Core inflation in October was the lowest since early 2020 and would show that our monetary policy actions are working. 63. Moving forward, while food inflation has receded from the highs seen in July, it remains elevated. The overall inflation outlook is expected to be clouded by volatile and uncertain food prices and intermittent weather shocks. In the immediate months of November and December, a resurgence of vegetable price inflation is likely to push up food and headline inflation. We have to remain highly alert to any signs of generalisation of price impulses that may derail the ongoing process of disinflation. 64. GDP growth is expected to remain resilient. Financial conditions are stable. Inflation is moderating, but we are still quite a distance away from our goal of reaching 4 per cent CPI on a durable basis. The projected inflation (4.7 per cent) in Q3 of next year, i.e., one year from now, is perilously close to 5 per cent. In these circumstances, monetary policy has to be actively disinflationary. Any shift in policy stance now would be premature and risky. Further, with past rate hikes still working through the economy, it would be desirable to closely monitor their full play out. The conditions ahead could be fickle and call for prudent evaluation of the emerging situation. Considering all the above factors, a pause in rate action and remaining focused on withdrawal of accommodation is considered necessary in this meeting of the MPC. Accordingly, I vote for keeping the policy repo rate unchanged and continuing with the focus on withdrawal of accommodation. We have to remain vigilant and ready to act effectively in our journey towards 4 per cent inflation target. (Yogesh Dayal) --- 1 Business Inflation Expectations Survey (BIES)-October 2023, Misra Centre for Financial Markets and Economy, Indian Institute of Management, Ahmedabad. 2 Goyal, A. 2023. 'Indian Fiscal Policy: A possible escape route.' IGIDR Working Paper no. WP-2023-010. Available at: http://www.igidr.ac.in/pdf/publication/WP-2023-010.pdf 3 Goyal, A. and S. Arora. 2013. ‘Inferring India's Potential Growth and Policy Stance’. Journal of Quantitative Economics, 11(1 & 2): 60-83. January-July; Svensson, L. E.O. Woodford, M. 2003. ‘Indicator variables for optimal policy’, Journal of Monetary Economics, Volume 50, Issue 3, Pages 691-720. 4 Goyal, A. 1994. ‘Industrial Pricing and Growth Fluctuations in the Indian Economy’, Indian Economic Review, Vol. 29(1). 5 The IIM Ahmedabad survey has given firms’ price expectations at around 4% since December 2022. 6 RBI (2015) Monetary Policy Report, April, Box IV.1, pp 26, released after the February 2015 Agreement on Monetary Policy Framework between the Government of India and the RBI, available at https://rbidocs.rbi.org.in/rdocs/Publications/PDFs/2015HYED1215458ES216FE667.pdf 7 Core CPI saar, from 6 per cent in January 2023, has softened to 3.6 per cent in October 2023. Threshold core CPI diffusion indices for price increases of greater than 6 per cent (saar) and 4 per cent (saar) remained in contraction zone over much of 2023-24 so far. 8 https://pib.gov.in/PressReleaseIframePage.aspx?PRID=187655 9 United Nations Population Fund. 10 Refer to my June 2023 statement for the theoretical difference between inflation target and tolerance band around target. |

|||||||||||||||

9911796707

9911796707