| News | ||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||

INVESTMENT AND TURNOVER LIMITS FOR CLASSIFICATION OF ALL MSMEs TO BE ENHANCED TO 2.5 AND 2 TIMES RESPECTIVELY |

||||||||||||||||||||||||||

| 1-2-2025 | ||||||||||||||||||||||||||

CREDIT GUARANTEE COVER FOR MICRO AND SMALL ENTERPRISES ENHANCED FROM 5 CRORE TO 10 CRORE

|

||||||||||||||||||||||||||

|

Rs. in Crore |

Investment |

Turnover |

||

|

|

Current |

Revised |

Current |

Revised |

|

Micro Enterprises |

1 |

2.5 |

5 |

10 |

|

Small Enterprises |

10 |

25 |

50 |

100 |

|

Medium Enterprises |

50 |

125 |

250 |

500 |

(Figure 1)

Union Minister for Finance & Corporate Affairs, Smt. Nirmala Sitharaman stated that currently, over 1 crore registered MSMEs, employing 7.5 crore people, and generating 36 per cent of our manufacturing, have come together to position India as a global manufacturing hub. She also remarked “With their quality products, these MSMEs are responsible for 45 per cent of our exports.”

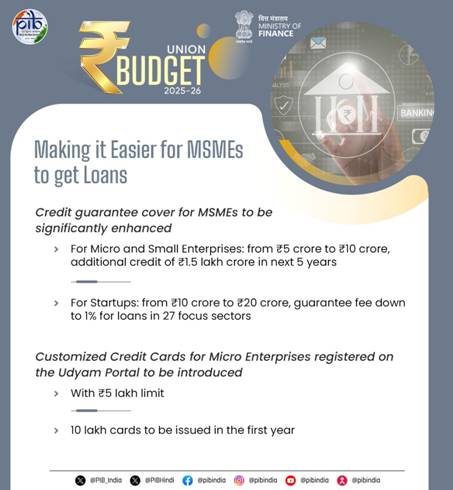

Significant enhancement of credit availability with guarantee cover

Union Minister for Finance & Corporate Affairs, Smt. Nirmala Sitharaman said that to improve access to credit, the credit guarantee cover will be enhanced:

a) For Micro and Small Enterprises, from 5 crore to 10 crore, leading to additional credit of 1.5 lakh crore in the next 5 years;

b) For Startups, from 10 crore to 20 crore, with the guarantee fee being moderated to 1 per cent for loans in 27 focus sectors important for Atmanirbhar Bharat; and

c) For well-run exporter MSMEs, for term loans up to 20 crore.

Credit Cards for Micro Enterprises

Union Minister Smt. Nirmala Sitharaman announced that customized Credit Cards with a 5 lakh limit for micro enterprises registered on Udyam portal will be introduced. She further remarked that in the first year, 10 lakh such cards will be issued.

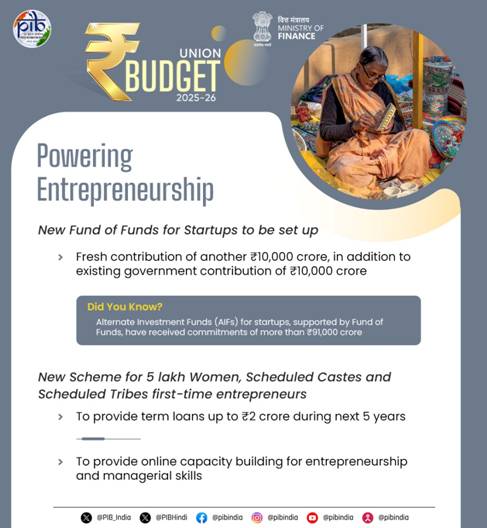

Fund of Funds for Startups

In her Budget speech, Union Minister for Finance & Corporate Affairs, Smt. Nirmala Sitharaman said, “The Alternate Investment Funds (AIFs) for startups have received commitments of more than 91,000 crore. These are supported by the Fund of Funds set up with a Government contribution of 10,000 crore.” She announced that now, a new Fund of Funds, with expanded scope and a fresh contribution of another 10,000 crore will be set up.

Scheme for First-time Entrepreneurs

Union Minister for Finance & Corporate Affairs, Smt. Nirmala Sitharaman announced that a new scheme will be launched for 5 lakh women, Scheduled Castes and Scheduled Tribes first-time entrepreneurs. She informed that this will provide term loans up to 2 crore during the next 5 years. In her speech she said, “The scheme will incorporate lessons from the successful Stand-Up India scheme. Online capacity building for entrepreneurship and managerial skills will also be organized.”

Deep Tech Fund of Funds

Union Minister for Finance & Corporate Affairs, Smt. Nirmala Sitharaman informed that a Deep Tech Fund of Funds will also be explored to catalyze the next generation startups as a part of this initiative.

Export Promotion Mission

Union Minister for Finance & Corporate Affairs, Smt. Nirmala Sitharaman stated that an Export Promotion Mission, with sectoral and ministerial targets, driven jointly by the Ministries of Commerce, MSME, and Finance will be set up. She also informed that the Mission will facilitate easy access to export credit, cross-border factoring support, and support to MSMEs to tackle non-tariff measures in overseas markets.

9911796707

9911796707