| News | |||

|

|

|||

RBI Issues April 2025 Policy Update |

|||

| 9-4-2025 | |||

RBI Cuts Repo Rate to 6%, Projects 6.5% GDP Growth for FY 2025-26 Introduction The Monetary Policy Committee (MPC), in its 54th meeting and the first of the financial year 2025–26, unanimously decided to reduce the policy repo rate by 25 basis points, bringing it down to 6 per cent with immediate effect. The repo rate is the rate at which the Reserve Bank of India (RBI) lends money to commercial banks, and a cut in this rate is aimed at boosting lending and investment. This decision comes at a time when global economic conditions are becoming increasingly uncertain. Trade tensions have resurfaced, leading to a decline in crude oil prices, weakening of the US dollar, softening bond yields, and corrections in equity markets. While central banks across the world are adjusting their policies to address domestic concerns, they are doing so cautiously.

Within India, the outlook has shown signs of improvement. Inflation, particularly food inflation, has declined more than expected, offering some relief, though global and weather-related risks remain. Growth is recovering after a weak first half in the previous financial year, but it still falls short of the country’s potential. The Monetary Policy Report of April 2025, released alongside the MPC resolution, also outlines the GDP growth forecast and inflation projection for the coming months. This year also marks a milestone for the RBI as it completes 90 years since its establishment on 1st April 1935. Over the decades, it has evolved into a full-service central bank, balancing its roles of managing inflation, supporting growth, and ensuring financial stability. Key Policy Decisions

Growth Assessment The Reserve Bank of India has projected real GDP growth at 6.5 per cent for 2025–26, maintaining the same rate as estimated for 2024–25, following a strong expansion of 9.2 per cent in the preceding year. The quarterly projections stand at 6.5 per cent in Q1, 6.7 per cent in Q2, 6.6 per cent in Q3, and 6.3 per cent in Q4. This marks a downward revision of 20 basis points from the February estimate, reflecting heightened global volatility. Agriculture remains on a positive footing, supported by healthy reservoir levels and robust crop production, which is expected to sustain rural demand. Manufacturing is showing early signs of revival amid improved business sentiment, and the services sector continues to demonstrate resilience.

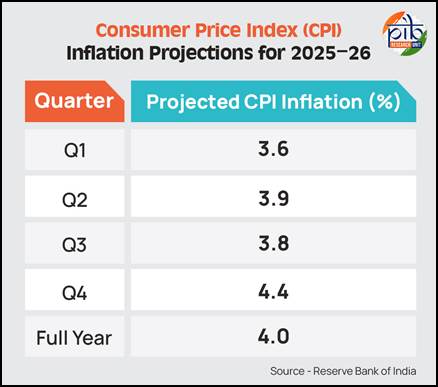

On the investment side, activity is gaining pace on the back of higher capacity utilisation, continued government focus on infrastructure, and strong balance sheets of banks and corporates. Easing financial conditions have also aided this recovery. While services exports are likely to remain steady, merchandise exports could face headwinds from global uncertainties and trade disruptions. Looking ahead, the RBI has projected real GDP growth at 6.7 per cent for 2026–27, suggesting continued recovery momentum. Inflation Outlook Headline inflation eased during January and February 2025, driven by a sharp decline in food prices. With uncertainties around the rabi crop largely resolved, and second advance estimates indicating record wheat output and higher pulse production than last year, food inflation is expected to soften further. This favourable trend is supported by robust kharif arrivals and a sharp fall in inflation expectations over the next three and twelve months, as reflected in recent surveys. The decline in crude oil prices has further strengthened the disinflationary outlook. Accordingly, Consumer Price Index (CPI) inflation for 2025–26 is projected at 4.0 per cent, with quarterly estimates at 3.6 per cent in Q1, 3.9 per cent in Q2, 3.8 per cent in Q3, and 4.4 per cent in Q4.

While the inflation outlook appears stable, global uncertainties and the possibility of weather-related supply shocks continue to pose upside risks to the inflation path. The Reserve Bank of India has assumed a normal monsoon in framing its projections, and it considers the risks to be evenly balanced at this stage. External Sector Snapshot

Liquidity and Financial Market Conditions

Conclusion The Monetary Policy Report of April 2025, released alongside the 54th meeting of the Monetary Policy Committee, reflects a balanced approach by the Reserve Bank of India (RBI) to support growth while maintaining price stability. The decision to cut the policy repo rate by 25 basis points to 6 per cent is underpinned by easing inflation, particularly in food prices, and a gradual recovery in economic activity. With GDP growth for 2025–26 projected at 6.5 per cent and inflation expected to remain within the 4 per cent target band, the report signals cautious optimism despite global uncertainties. On the external front, robust services exports and strong remittance inflows have helped cushion the merchandise trade deficit, keeping the current account deficit at sustainable levels. Meanwhile, improved system liquidity, lower short-term borrowing costs, and stable foreign exchange reserves underscore the resilience of India’s financial system. The RBI has affirmed its commitment to closely monitor evolving conditions and take timely, calibrated measures to preserve macroeconomic and financial stability. References: |

|||

9911796707

9911796707