Tax Incentives to International Financial Services Centre - (i) ...

Tax Exemptions Extended for Asset Transfers to IFSC Funds Until 2025; New Rules for Offshore Instrument Holders.

February 3, 2023

Notes Indian Laws

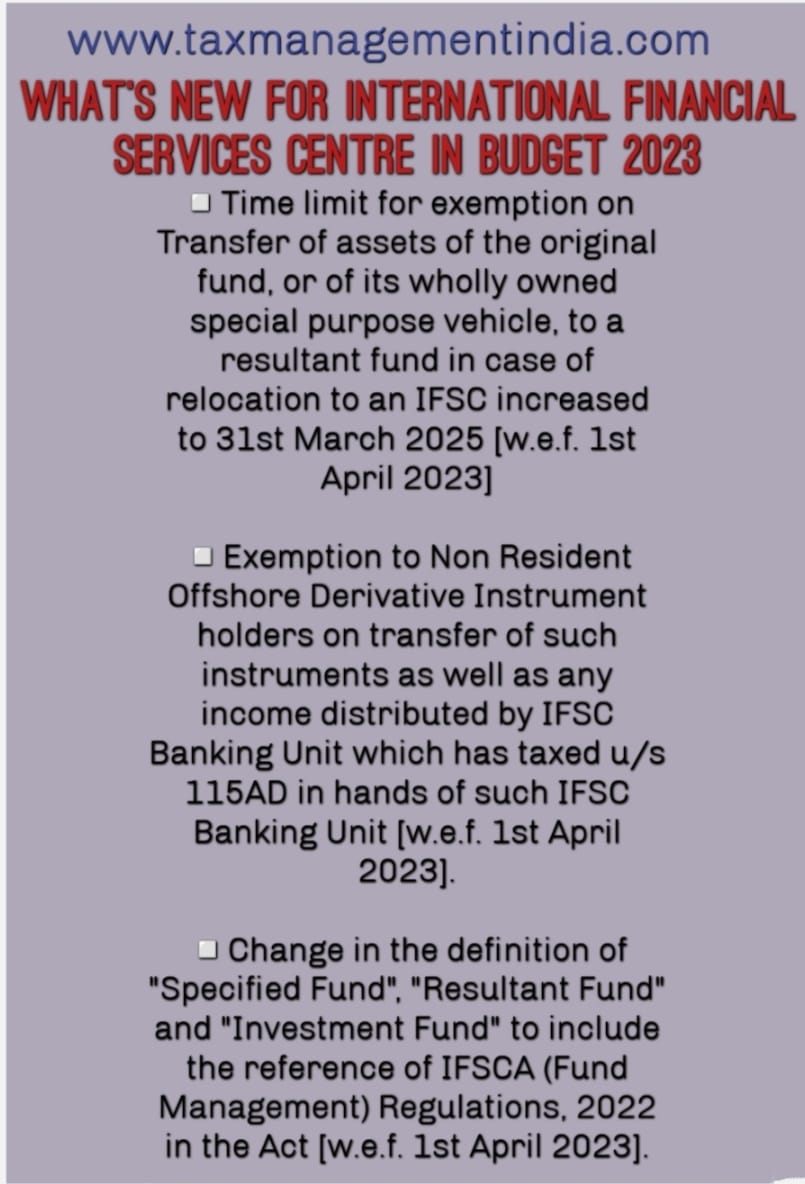

Tax Incentives to International Financial Services Centre - (i) Time limit for exemption on Transfer of assets of the original fund, or its wholly owned SPV to a resultant fund in case of relocation to an IFSC increased to 31st March 2025 [w.e.f. 1st April 2023] (ii) Exemption to Non Resident offshore derivative instrument holders on transfer of such instruments as well as any income distributed by IFSC Banking Unit ehich has taxed u/s 115AD in hands of such IFSC Banking Unit [w.e.f 1st April 2024] (iii) Change in the definition of 'Specified Fund', 'Resultant Fund', and 'Investment Fund' to include reference of IFSCA (fund Management) Regulations, 2022 in the Act [w.e.f. 1st April 2023].

View Source