| News | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

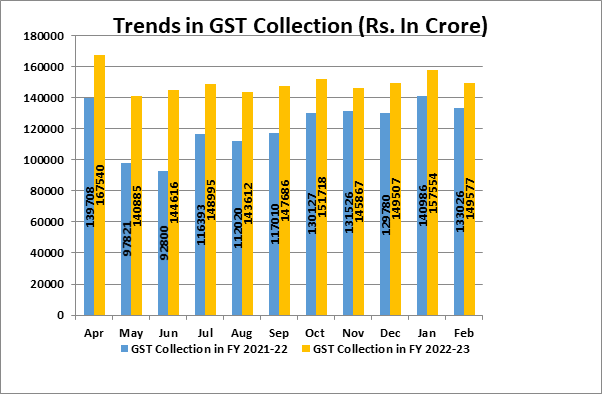

₹1,49,577 crore gross GST revenue collected in February 2023; 12% higher than GST revenues in same month last year |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1-3-2023 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

₹1,49,577 crore gross GST revenue collected in February 2023; 12% higher than GST revenues in same month last year Monthly GST revenues more than Rs 1.4 lakh crore for 12 straight months in a row The gross GST revenue collected in the month of February 2023 is ₹1,49,577 crore of which CGST is ₹27,662 crore, SGST is ₹34,915 crore, IGST is ₹75,069 crore (including ₹35,689 crore collected on import of goods) and Cess is ₹11,931 crore (including ₹792 crore collected on import of goods) The government has settled ₹34,770 crore to CGST and ₹29,054 crore to SGST from IGST as regular settlement. The total revenue of Centre and the States after regular settlements in the month of February 2023 is ₹62,432 crore for CGST and ₹63,969 crore for the SGST. In addition, Centre had also released balance GST compensation of ₹16,982 crore for the month of June 2022 and ₹16,524 crore to States/UTs which have sent AG certified figures for previous period. The revenues for the month of February 2023 are 12% higher than the GST revenues in the same month last year, which was Rs. 1,33,026 crore. During the month, revenues from import of goods was 6% higher and the revenues from domestic transaction (including import of services) are 15% higher than the revenues from these sources during the same month last year. This month witnessed the highest cess collection of ₹11,931 crore since implementation of GST. Normally, February being a 28 day month, witnesses a relatively lower collection of revenue. The chart below shows trends in monthly gross GST revenues during the current year. The table shows the state-wise figures of GST collected in each State during the month of February 2023 as compared to February 2022.

State-wise growth of GST Revenues during February 2023 1

1Does not include GST on import of goods |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

9911796707

9911796707