| Discussions Forum | ||||||||||||||||||||||

Home  Forum Forum  Goods and Services Tax - GST Goods and Services Tax - GST  This This

A Public Forum.

Submit new Issue / Query

My Issues

My Replies

|

||||||||||||||||||||||

GST payable on rental immovable property, Goods and Services Tax - GST |

||||||||||||||||||||||

|

||||||||||||||||||||||

GST payable on rental immovable property |

||||||||||||||||||||||

Dear professionals, If i have rented property in Delhi for commercial purposes but my GST registration is in Uttar Pradesh. Now my query is the land owner will charge CGST , SGST or IGST ? Regards J S Uppal Tax Consultant Posts / Replies Showing Replies 1 to 11 of 11 Records Page: 1

Sir, In respect of renting of immovable peroperty, the service is deemed to be provided at the place where the immovable property is located/situated. Hence the land owner will charge CGST + SGST.

Place of supply in Delhi. Place of consumption is in Delhi. Hence CGST and SGST applicable.

I endorse the views of both the experts.

Services pertaining to immovable properties would be deemed to have provided/consumed at its' location. Hence CGST & SGST would be levied. You may have to take registration.

Yes I ageag with the experts views

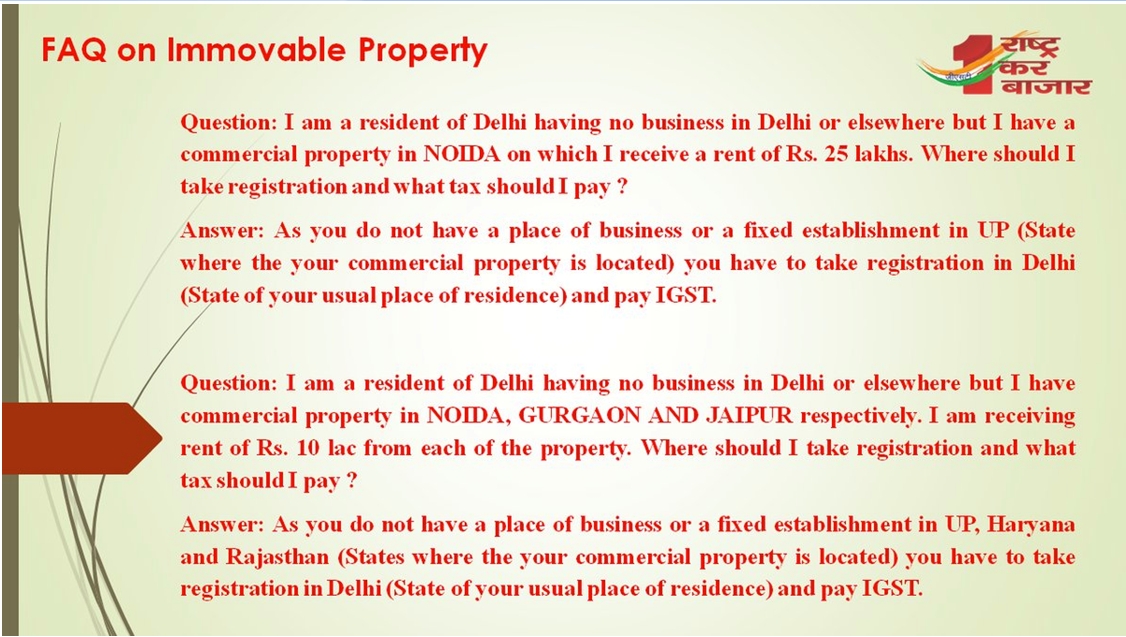

I would respectfully differ with the views of the experts here. In any given situation the determination of "Nature of Supply" shall necessarily be done by following the principles laid down in Chapter IV of the IGST Act. Accordingly, Nature of supply (i.e. whether it is an intra-state or an inter-state supply) will depend on both the factors viz. Place of supply and location of supplier Merely having an immovable property (an asset) in a state doesn't make you liable to obtain registration in that state especially when you are doing every bit of legal compliance from your own resident state. In my humble (but strong) opinion, IGST can be levied in such a case. Also, this goes in line with the departmental view expressed at various fora. Kindly discuss.

M/s.YAGAY AND SUN, Dear Sir, I want your esteemed comments on the issue, especially, keeping in view definition of 'Fixed Establishment in IGST ACT and latest replies posted by experts so that concept should be clear to all. Will you please throw light with examples ? Thanks a lot. K.L.SETHI

Still, In our view, this fixed establishment will create certain level of confusion as it is mentioned in FAQs which are needed to be supported by laws. As the law evolves things would get crystal clear. Time will tell.

It is safer to pay CGST and SGST. When it comes to writing, the department will not hesitate to SCN. IGST corresponds to erstwhile CST (almost).

Dear Professionals, Thank you for the solution provided in the query. Regards J S Uppal Tax Consultant Page: 1 Old Query - New Comments are closed. |

||||||||||||||||||||||

9911796707

9911796707

Advanced Search

Advanced Search

.jpg)