PROPOSED PAYMENT PROCESS

PRESENTATION PLAN

- Broad Features

- Tax Types & Modes of Payment

- Stakeholders

- Basic Features

- Workflow for Payment under various Modes

- Features of Accounting Process

- Proposed Accounting system

- Banking arrangements

- Reconciliation of receipts

- Redressal of grievances

BROAD FEATURES

- Electronic payment process- no generation of paper at any stage

- Single point interface for challan generation- GSTN

- Ease of payment three modes including CC/DC & NEFT/RTGS

- Common challan form with auto-population features

- Use of single challan and single payment instrument

- Common set of authorized banks

- Payment through any bank

- Common Accounting Codes

TAX TYPES & MODES OF PAYMENT

- Under GST, 4 types of Taxes to be paid- CGST, IGST, Additional Tax and SGST

- Three Modes of Payment

- Electronic including CC/DC (Mode I)

- Over The Counter Payment (for Payments upto ₹ 10,000/-) (Mode II)

- Payment through RTGS/NEFT (Mode III)

- Payment can be accepted by Departmental officers in enforcement cases only

STAKEHOLDERS

- Taxpayer

- GSTN (Goods and Service Tax Network)

- Authorized banks

- one e- FPB (Electronic Focal Point Branch) for each bank (in Mode I & II) to maintain government account and report all receipts

- all branches for receiving Over the Counter Payments

- one or more front end service branch

…. STAKEHOLDERS

- All Banks- for NEFT/RTGS Mode of payment

- Reserve Bank of India

- e- FPB (in Mode III)

- Aggregator for accountal & reconciliation of receipts

- Accounting Authorities of Centre & States

- Tax Authorities of Centre & States

BASIC FEATURES….

- Electronically generated Challan from GSTN for all 3 modes containing a unique 14-digit Common Portal Identification Number (CPIN) for each challan

- Challan can be generated by

- Taxpayer

- His authorized representative

- Departmental officers

- Any other person paying on behalf of taxpayer

- Certain key details like name, address, email, GSTIN of payer to be auto-populated

- Single challan / instrument for payment of all four types of taxes

- Challan once generated to be valid for 7 days

- Time of payment: from 0000 hrs. to 2000 hrs.

- Proposed workflow of RBI’s e-Kuber model to be followed for payment, accounting and reconciliation:

- Accounting Authorities to interact directly with RBI & not with Authorized banks in case of discrepancies found during reconciliation

- System of electronic Personal Ledger Account (cash ledger) on GSTN for each taxpayer (20 pages)

- One e-FPB per Authorized Bank (in Mode I & II) / RBI (in Mode -III)

- GSTN to be anchor in payment process with responsibility for information flow to various agencies

- RBI to act as aggregator and anchor of flow of fund and information about receipts

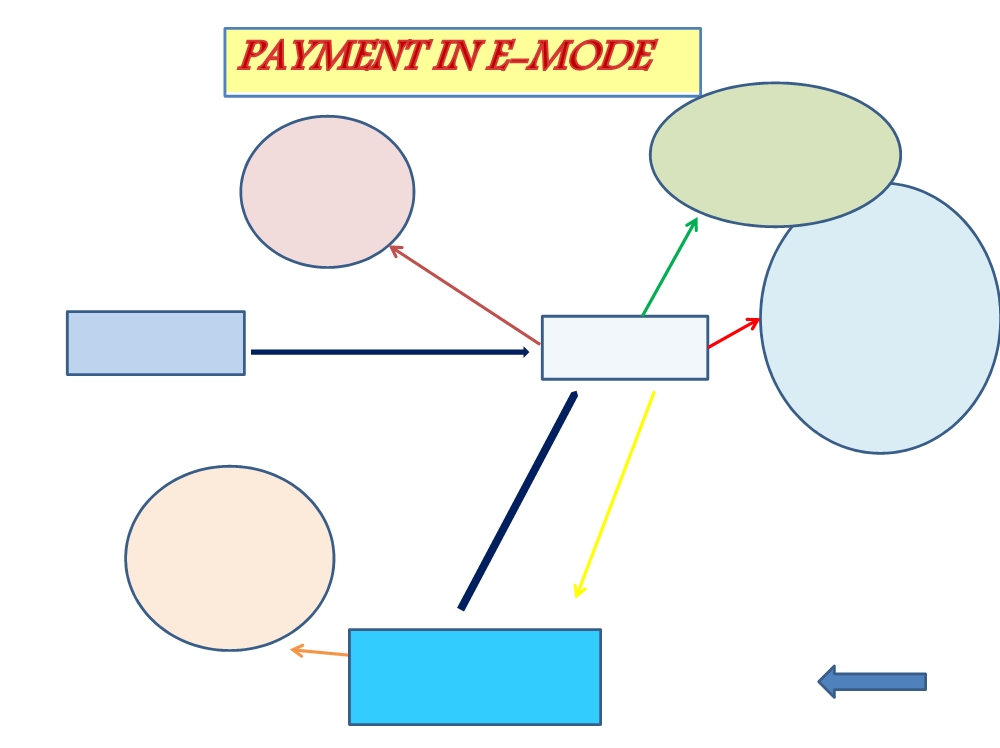

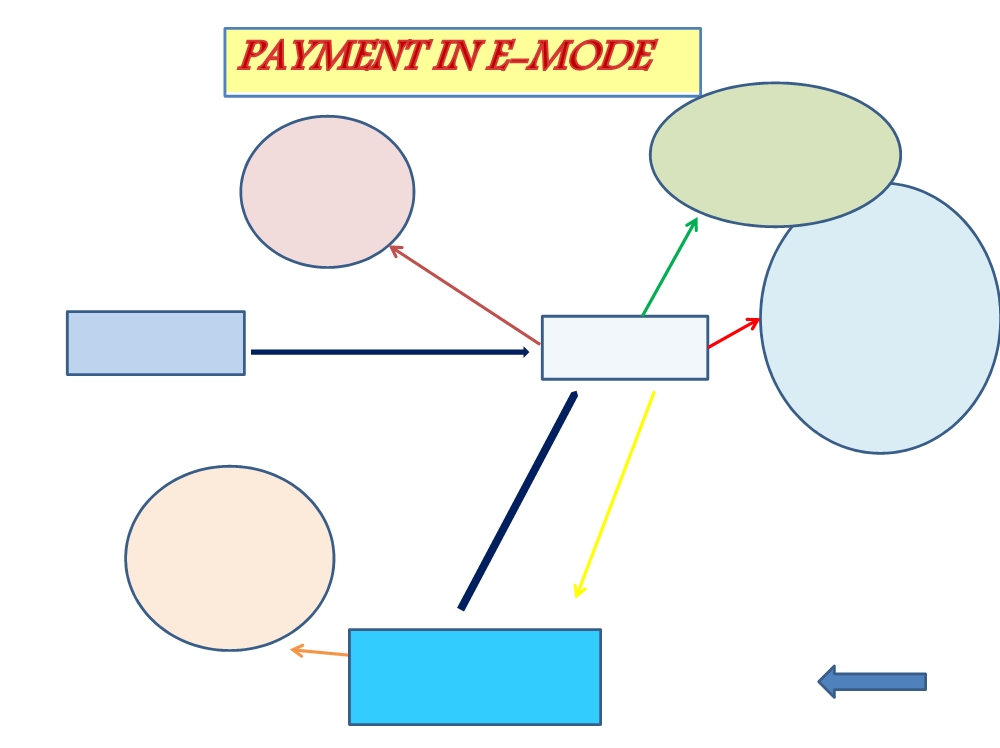

WORK FLOW FOR PAYMENT UNDER MODE -I ….

E-payment mode through authorized banks (internet banking , CC/DC):

- Generation of e-Challan at GSTN

- Tax payer to select e-payment mode

- Net Banking

- Credit/Debit Card of any bank

- Tax Payer to choose Authorized bank in case of Net Banking

- Payment gateway of authorized bank (or their SPVs) in case of CC/DC

- Credit Card proposed to be used by taxpayer to be registered at GSTN - as an additional safety check to eliminate the issue of charge back

- GSTN to direct the taxpayer to the website of selected bank/payment gateway

- Alongside, GSTN to forward an electronic string to the selected bank carrying specified details of challan on real time basis

- Taxpayer to make payment using the USER ID & Password provided by his bank

- On successful completion of transaction, e-FPB of bank to forward a confirmation electronic string (CIN) to GSTN on real time basis

- GSTN to credit the Taxpayer’s ledger

- Copy of paid Challan to be available on GSTN for taxpayer (downloadable/printable)

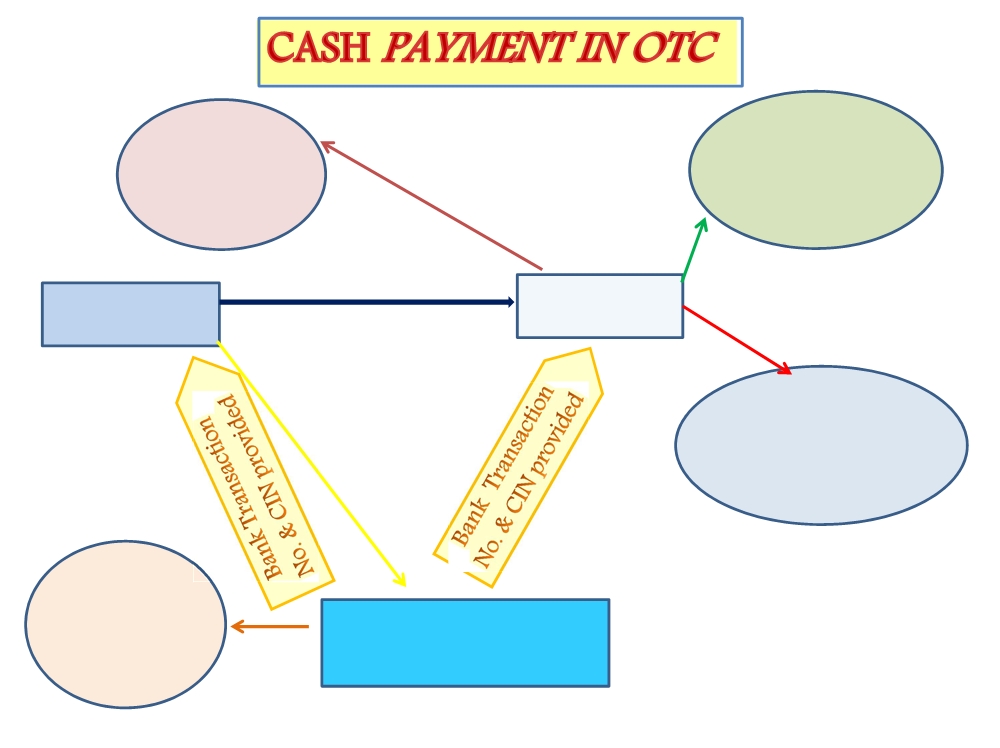

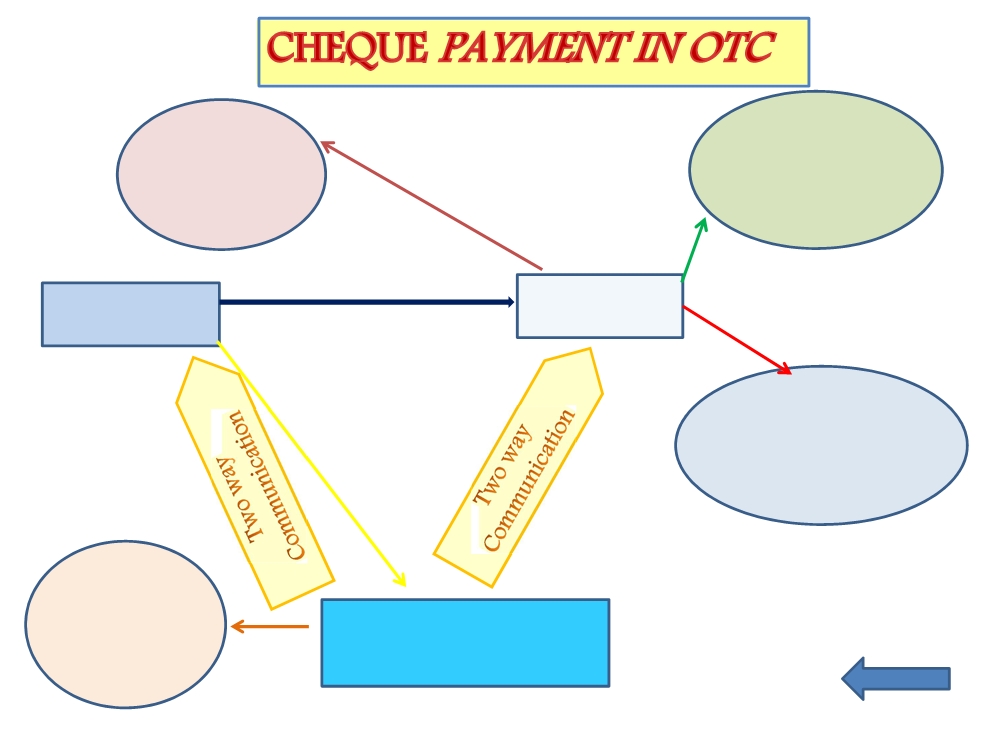

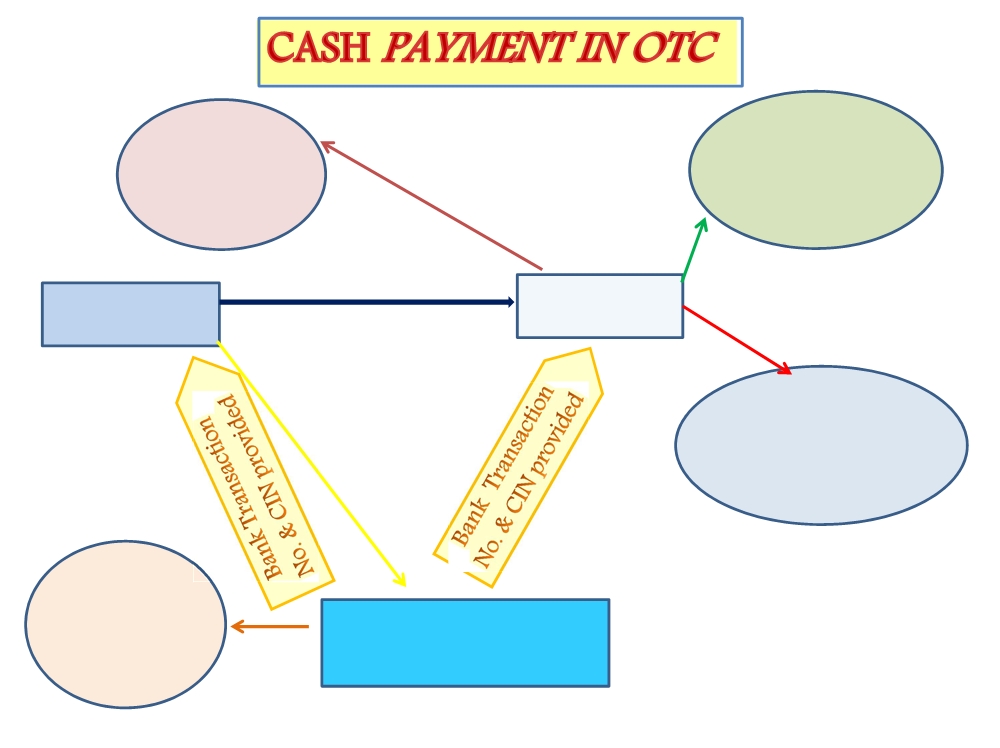

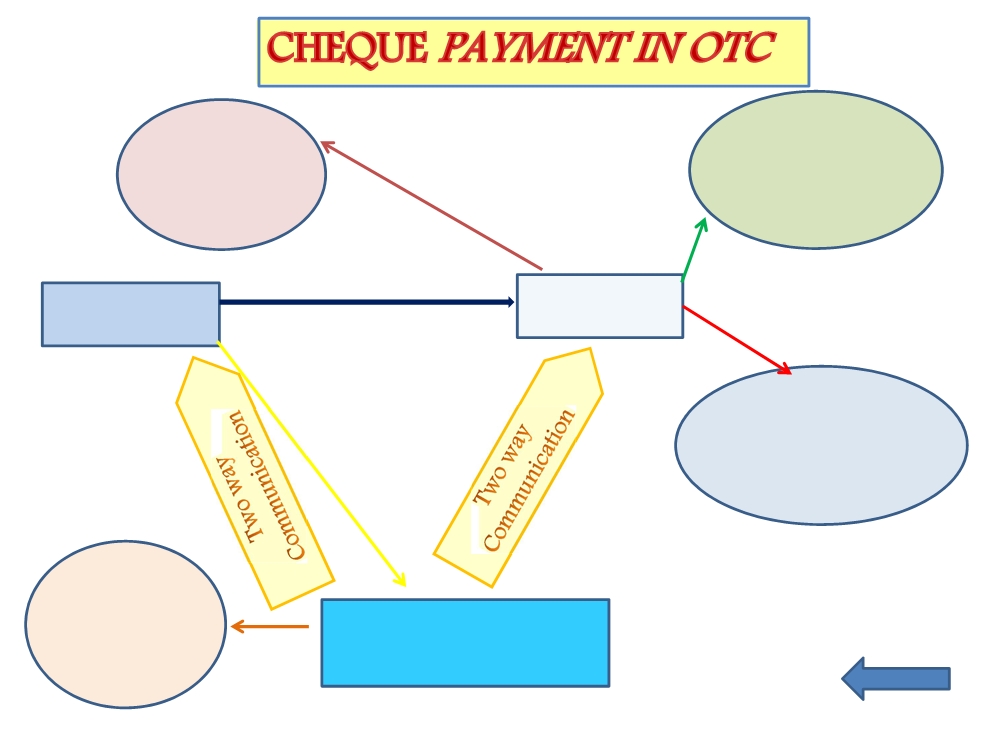

WORK FLOW FOR PAYMENT UNDER MODE -II ….

Over the Counter Payment:

- For small taxpayers for making payment upto ₹ 10,000/- per challan - by cash / DD / cheque drawn on same bank or on another bank in the same city

- Tax payer to tender only one instrument to pay one or more type of tax

- For cheque payment, name of authorized bank & its location to be mandatorily filled in challan

- On real time basis, GSTN to share challan details with Core Banking System (CBS) of the selected authorized Bank

- Taxpayer to approach the branch of the authorized bank for payment of taxes along with the instrument or cash

- In case of cash / same bank instrument a unique transaction number (BTR/BRN) will be generated immediately by the authorized bank’s system and given to taxpayer

- Authorized bank to send receipt information (CIN) to GSTN on real time basis

- In case of instruments drawn on another bank in the same city, payment would not be realized immediately

- Authorized Bank to inform GSTN on real time basis in two stages

- when an instrument is given OTC - to send an electronic string to GSTN containing specified details

- second acknowledgement - after the cheque is realized with 3 additional details

- Similarly, bank to issue acknowledgement to taxpayer in two steps

- Acknowledgment of cheque immediately

- Upon realization of cheque, issuance of BTR / BTN

- GSTN to credit the Taxpayer’s Ledger

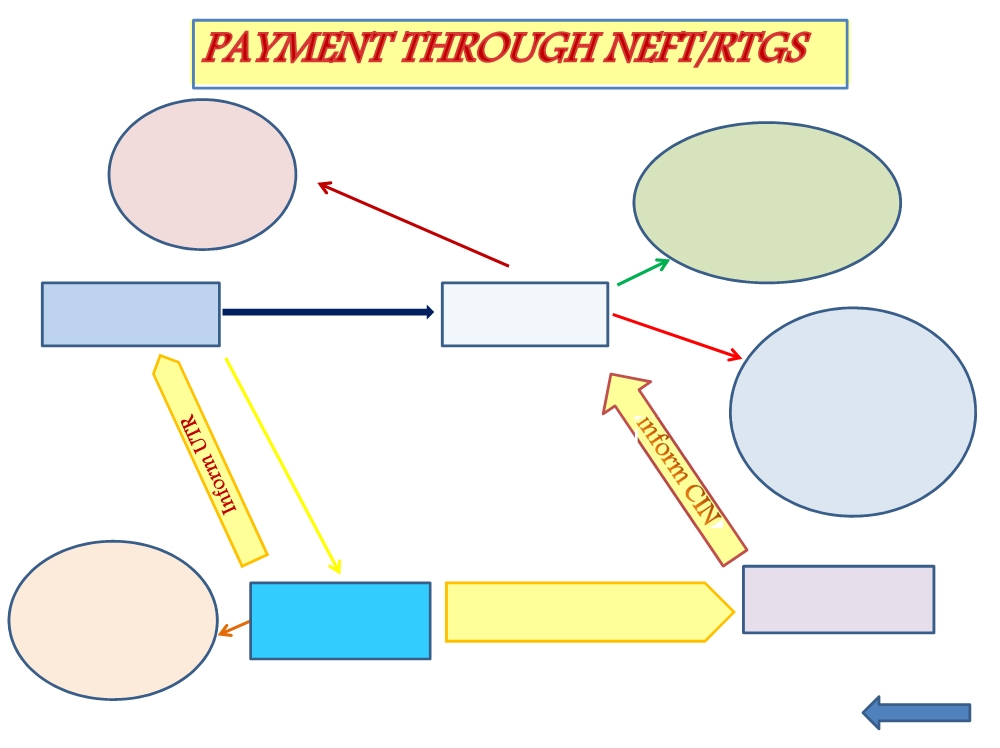

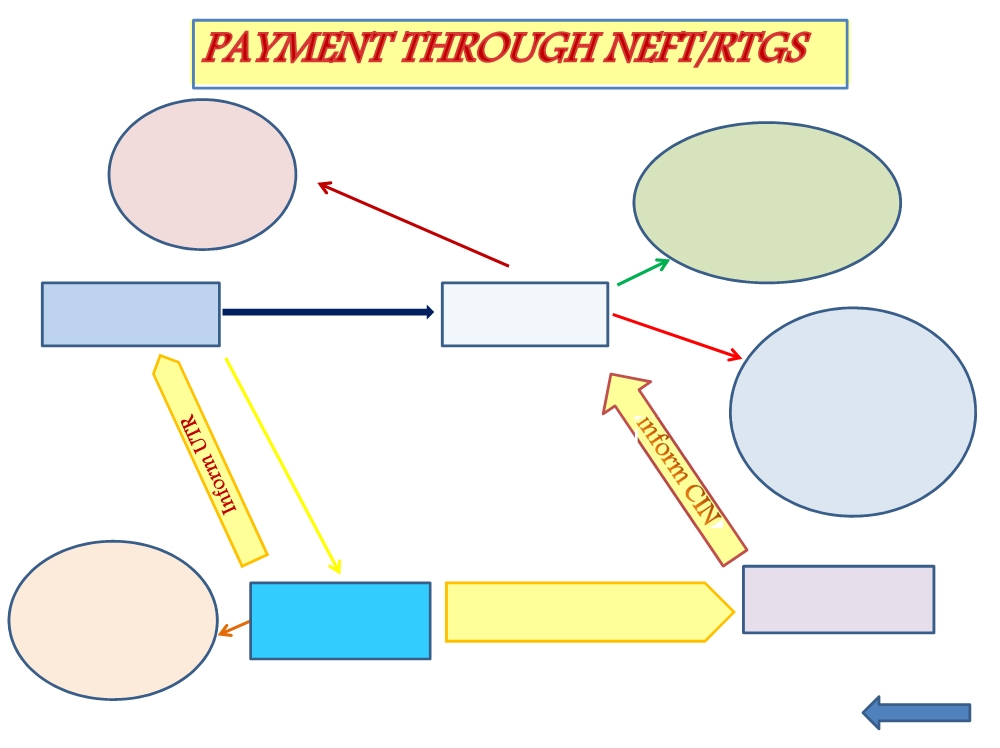

WORK FLOW FOR PAYMENT UNDER MODE -III….

Payment through NEFT/RTGS from any bank

- To be made operational after a pilot run by RBI

- For taxpayers:

- not having a bank account in any of the Authorized Banks

- having a bank account in any of the Authorized Banks

- No limit on amount to be paid through this mode

- Payments to be collected by RBI directly

- RBI to perform the role of e-FPB also

- Challan and NEFT/RTGS mandate form generated on GSTN

- NEFT/RTGS mandate form to have validity period of CPIN printed on it

- In challan, the field for name of Authorized Bank to be auto-populated as RBI

- NEFT/RTGS mandate form will have certain information auto-populated:

- CPIN in “Account Name” field

- ‘GST Payment’ in “Sender to Receiver Information” field

- Taxpayer to print a copy of Challan and NEFT/RTGS mandate form from GSTN & approach his bank for payment

- Amount indicated for remittance to be transferred by bank to the designated account of the government in RBI along with challan details and a Unique Transaction Reference (UTR) Number

- RBI to validate payments against each challan with UTR received from remitter bank

- RBI to report receipt of payment to GSTN (CIN) on real time basis through an electronic string with specified details

- GSTN to credit the Taxpayer’s ledger

FEATURES OF ACCOUNTING PROCESS….

- Authorized Banks to send list of CIN-wise details (electronic luggage file) for each type of Tax (CGST, IGST, AT & SGST) per day to RBI and Accounting Authorities at End of Day (EOD)

- RBI through its e-kuber system to consolidate the lists received from all authorized banks, debit their accounts and correspondingly credit Tax accounts of GOI / respective State Governments

- RBI to send digitally signed one e-scroll for each type of Tax (CGST, IGST, AT & SGST) per day (39) to Accounting Authorities of Central Government and State Governments & GSTN on T+1 basis

- GSTN to send reconciled data (challan data from Authorized Banks and e-scroll from RBI) to Accounting Authorities at EOD

- For any discrepancy noticed, accounting authority to generate a Memorandum of Error (MOE) & send to RBI

- RBI to resolve the discrepancy in consultation with the Authorized Bank

- RBI to report the corrected data to respective Accounting Authority & GSTN

- Taxpayers Master data to be provided by Tax Authorities to Accounting Authorities for mapping of payment details jurisdiction wise

PROPOSED ACCOUNTING SYSTEM

- Four different Major Heads of accounts to be opened for each tax along with underlying Minor Heads to account for various taxes & other receipts like interest, penalty, fees & others

- Standardized uniform Accounting Codes for all taxes under GST regime among Centre, State & UTs to facilitate settlement of IGST on the basis of centralized reporting

- Common Accounting Codes for Centre & States

BANKING ARRANGEMENTS

- Common set of Authorized Banks comprising existing authorized banks of the Central Government & all State Governments/UTs (presently 26)

- Certain minimum standards to be met by banks to become authorized banks

- A system of penalty/incentive proposed for reporting of error free data

- Payments through non-authorized banks permitted (NEFT/RTGS)

RECONCILIATION OF RECEIPTS

- Use of only system generated challans - no re-digitization by any actor in the entire work flow

- CPIN to be generated by GSTN -- to be used as a key identifier up till receipt of payment by Bank

- CIN (actual indicator of receipt of payment) to be generated by collecting Bank -- to be used as a key identifier thereafter for accounting, reconciliation, etc.

- Accounting Authorities to play a paramount role in reconciliation -

- Accounting on the basis of RBI data

- Reconciliation on the basis of GSTN and bank data

GRIEVANCE REDRESSAL

- In OTC mode if cash ledger of taxpayer not credited within three days- approach bank where instrument presented

- In RTGS/NEFT mode if cash ledger of taxpayer not credited within three days- approach bank where taxpayer’s account is

- Each e-FPB required to have front end service branch to resolve payment related issues

9911796707

9911796707