| News | |||

|

|

|||

₹ 9000 CRORE FOR REVAMPED CREDIT-GUARANTEE SCHEME TO MSMEs |

|||

| 1-2-2023 | |||

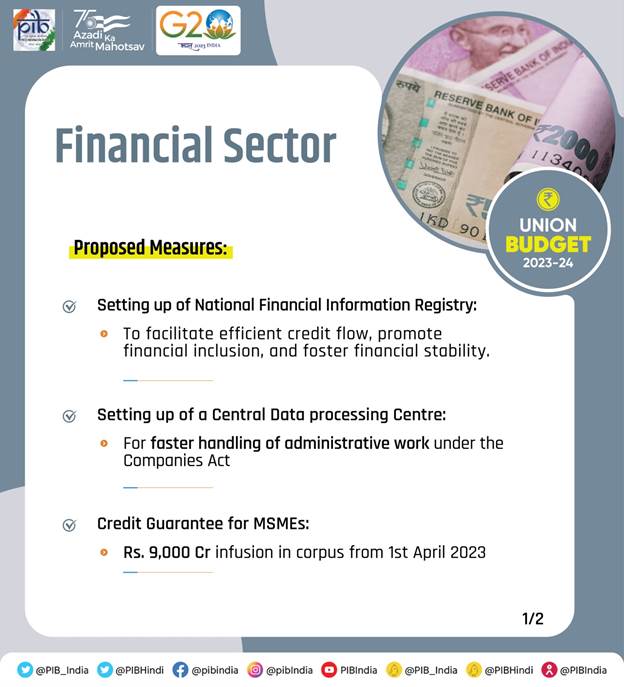

₹ 9000 CRORE FOR REVAMPED CREDIT-GUARANTEE SCHEME TO MSMEs While presenting the Union Budget 2023-24 in Parliament here today, Union Minister for Finance and Corporate Affairs Smt. Nirmala Sitharaman proposed to continue the financial sector reforms and innovative use of technology which have led to financial inclusion at scale, better and faster service delivery, ease of access to credit and participation in financial markets. CREDIT GUARANTEE TO MSMEs Smt. Sitharaman announced that the revamped credit guarantee scheme for MSMEs, proposed in the previous Budget, will take effect from 1st April 2023 through infusion of ₹ 9000 crore in the corpus. “This will enable additional collateral-free guaranteed credit of ₹ 2 lakh crore. Further, the cost of credit will be reduced by about 1%,” she said.

VIVAD SE VISHWAS I – RELIEF FOR MSMEs Giving significant relief to MSMEs, the Finance Minister proposed that in cases of failure by MSMEs to execute contracts during the Covid period, 95 per cent of the forfeited amount relating to bid or performance security, will be returned to them by government and government undertakings. VIVAD SE VISHWAS II – SETTLING CONTRACTUAL DISPUTES To settle contractual disputes of government and government undertakings, wherein arbitral award is under challenge in a court, a voluntary settlement scheme with standardized terms will be introduced. This will be done by offering graded settlement terms depending on pendency level of the dispute. MSMEs AND PROFESSIONALS Stating that MSMEs are growth engines of our economy, the Finance Minister said that micro enterprises with turnover up to ₹2 crore and certain professionals with turnover of up to ₹50 lakh can avail the benefit of presumptive taxation. The Finance Minister proposed to provide enhanced limits of ₹3 crore and ₹75 lakh respectively, to the tax payers whose cash receipts are no more than 5 per cent. Moreover, to support MSMEs in timely receipt of payments, Smt. Sitharaman further proposed to allow deduction for expenditure incurred on payments made to them only when payment is actually made. START-UPS While presenting the Union Budget, the Union Finance Minister said, "Entrepreneurship is vital for a country’s economic development. We have taken a number of measures for start-ups and they have borne results. India is now the third largest ecosystem for start-ups globally, and ranks second in innovation quality among middle-income countries. I propose to extend the date of incorporation for income tax benefits to start-ups from 31.03.23 to 31.3.24. I further propose to provide the benefit of carry forward of losses on change of shareholding of start-ups from seven years of incorporation to ten years."

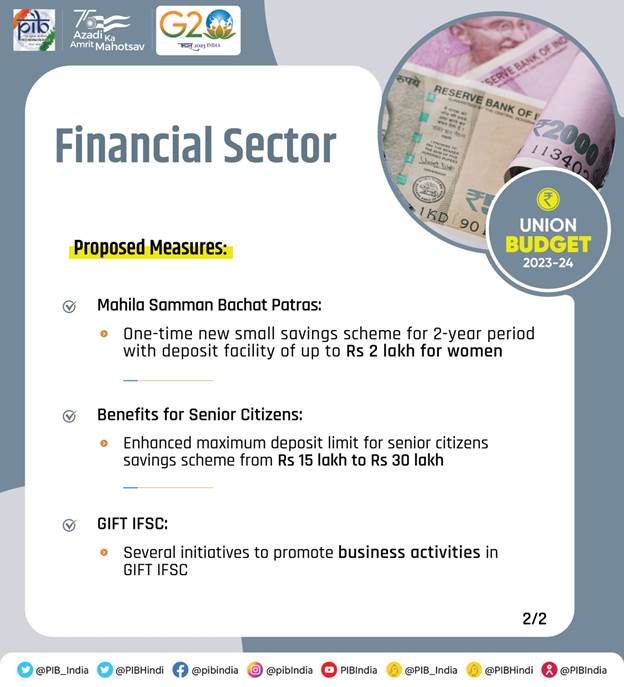

NATIONAL FINANCIAL INFORMATION REGISTRY The Finance Minister also announced setting up of a National Financial Information Registry to serve as the central repository of financial and ancillary information. “This will facilitate efficient flow of credit, promote financial inclusion, and foster financial stability,” she said. Smt. Sitharaman added that a new legislative framework will govern this credit public infrastructure, and it will be designed in consultation with the RBI. GIFT IFSC To enhance business activities in GIFT IFSC, Budget 2023-24 proposes a slew of initiatives viz. delegating powers under SEZ Act to IFSCA to avoid dual regulation, single window IT system for registration and regulatory approval, permitting acquisition financing by IFSC banking units of foreign banks, establishing subsidiary of EXIM Bank for trade re-financing, recognizing offshore derivative instruments as valid contracts.

FINANCIAL SECTOR REGULATIONS In order to meet the needs of Amrit Kaal and to facilitate optimum regulation in the financial sector, the Finance Minister proposed to incorporate public consultation, as necessary and feasible, to the process of regulation-making and issuing subsidiary directions. Smt. Sitharaman added that financial sector regulators will be requested to comprehensively review existing regulations to simplify, ease and reduce cost of compliance. “For this, they will consider suggestions from public and regulated entities. Time limits to decide the applications under various regulations will also be laid down,” she said. ****** |

|||

9911796707

9911796707