| News | |||

|

|

|||

Monetary Policy Statement, 2022-23 Resolution of the Monetary Policy Committee (MPC) February 6-8, 2023 |

|||

| 8-2-2023 | |||

On the basis of an assessment of the current and evolving macroeconomic situation, the Monetary Policy Committee (MPC) at its meeting today (February 8, 2023) decided to:

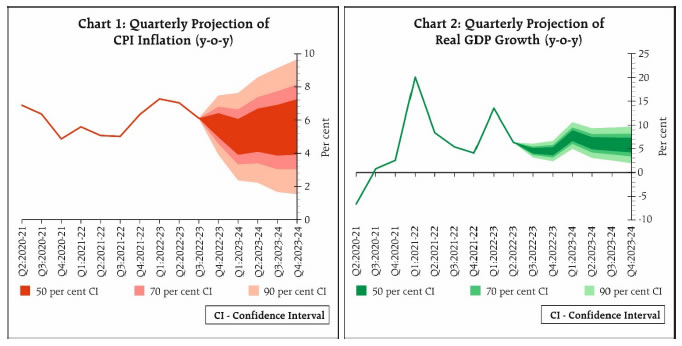

Consequently, the standing deposit facility (SDF) rate stands adjusted to 6.25 per cent and the marginal standing facility (MSF) rate and the Bank Rate to 6.75 per cent.

These decisions are in consonance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4 per cent within a band of +/- 2 per cent, while supporting growth. The main considerations underlying the decision are set out in the statement below. Assessment Global Economy 2. The outlook on global growth has improved in recent months, despite the persistence of geopolitical hostilities and the impact of monetary policy tightening by central banks across the world. Nonetheless, global growth is expected to decelerate during 2023. Inflation is exhibiting some softening from elevated levels, prompting central banks to moderate the size and pace of rate actions. However, central banks are reiterating their commitment to bring down inflation close to their targets. Bond yields remain volatile. The US dollar has come off its recent peak, and equity markets have moved higher since the last MPC meeting. Weak external demand in major advanced economies (AEs), the rising incidence of protectionist policies, volatile capital flows and debt distress could, however, weigh adversely on prospects for emerging market economies (EMEs). Domestic Economy 3. The first advance estimates (FAE) released by the National Statistical Office (NSO) on January 6, 2023, placed India’s real gross domestic product (GDP) growth at 7.0 per cent year-on-year (y-o-y) for 2022-23, driven by private consumption and investment. On the supply side, gross value added (GVA) was estimated at 6.7 per cent. 4. High frequency indicators suggest that economic activity has remained strong in Q3 and Q4:2022-23. Rabi acreage exceeded last year’s area by 3.3 per cent as on February 3, 2023. Industrial production expanded by 7.1 per cent in November, after contracting by 4.2 per cent in October. Capacity utilisation in manufacturing is now above its long period average. Port freight traffic, e-way bills and toll collections were buoyant in December. Purchasing managers’ indices (PMIs) for manufacturing as well as services remained in expansion in January, despite some moderation compared to the previous month. 5. Domestic demand has been sustained by strong discretionary spending. Urban demand exhibited resilience as reflected in healthy passenger vehicle sales and domestic air passenger traffic. Rural demand is improving. Investment activity is gradually gaining ground. Non-oil non-gold imports expanded in December. Merchandise exports, on the other hand, contracted in December on weak global demand. 6. CPI headline inflation moderated to 5.7 per cent (y-o-y) in December 2022 – after easing to 5.9 per cent in November – on the back of double digit deflation in vegetable prices. On the other hand, inflationary pressures accentuated across cereals, protein-based food items and spices. Fuel inflation edged up primarily from an uptick in kerosene prices. Core CPI (i.e., CPI excluding food and fuel) inflation rose to 6.1 per cent in December due to sustained price pressures in health, education and personal care and effects. 7. The overall liquidity remains in surplus, with average daily absorption under the LAF increasing to ₹1.6 lakh crore during December-January from an average of ₹1.4 lakh crore in October-November. On a y-o-y basis, money supply (M3) expanded by 9.8 per cent as on January 27, 2023, while non-food bank credit rose by 16.7 per cent. India’s foreign exchange reserves were placed at US$ 576.8 billion as on January 27, 2023. Outlook 8. The outlook for inflation is mixed. While prospects for the rabi crop have improved, especially for wheat and oilseeds, risks from adverse weather events remain. The global commodity price outlook, including crude oil, is subject to uncertainties on demand prospects as well as from risks of supply disruptions due to geopolitical tensions. Commodity prices are expected to face upward pressures with the easing of COVID-related mobility restrictions in some parts of the world. The ongoing pass-through of input costs to output prices, especially in services, could continue to exert pressures on core inflation. The Reserve Bank’s enterprise surveys point to some softening of input cost and output price pressures in manufacturing. Taking into account these factors and assuming an average crude oil price (Indian basket) of US$ 95 per barrel, inflation is projected at 6.5 per cent in 2022-23, with Q4 at 5.7 per cent. On the assumption of a normal monsoon, CPI inflation is projected at 5.3 per cent for 2023-24, with Q1 at 5.0 per cent, Q2 at 5.4 per cent, Q3 at 5.4 per cent and Q4 at 5.6 per cent, and risks evenly balanced (Chart 1). 9. The stronger prospects for agricultural and allied activities are likely to boost rural demand. The rebound in contact-intensive sectors and discretionary spending is expected to support urban consumption. Businesses and consumers surveyed by the Reserve Bank are optimistic about the outlook. Strong credit growth, resilient financial markets, and the government’s continued thrust on capital spending and infrastructure create a congenial environment for investment. On the other hand, external demand is likely to be dented by a slowdown in global activity, with adverse implications for exports. Taking all these factors into consideration, real GDP growth for 2023-24 is projected at 6.4 per cent with Q1 at 7.8 per cent, Q2 at 6.2 per cent, Q3 at 6.0 per cent and Q4 at 5.8 per cent, and risks broadly balanced (Chart 2).

10. The easing of inflation in the last two months was driven by strong deflation in vegetables, which may dissipate with the summer season uptick. Headline inflation excluding vegetables has been rising well above the upper tolerance band and may remain elevated, especially with high core inflation pressures. Inflation, therefore, remains a major risk to the outlook. Domestic economic activity is expected to remain resilient aided by the sustained focus on capital and infrastructure spending in the Union Budget 2023-24, even as continuing fiscal consolidation creates space for private investment. While the policy repo rate increases undertaken since May 2022 are working their way through the system, it is imperative to remain alert on inflation so as to ensure that it remains within the tolerance band and progressively aligns with the target. On balance, the MPC is of the view that further calibrated monetary policy action is warranted to keep inflation expectations anchored, break core inflation persistence and thereby strengthen medium-term growth prospects. Accordingly, the MPC decided to increase the policy repo rate by 25 basis points to 6.50 per cent. The MPC also decided to remain focused on withdrawal of accommodation to ensure that inflation remains within the target going forward, while supporting growth. 11. Dr. Shashanka Bhide, Dr. Rajiv Ranjan, Dr. Michael Debabrata Patra and Shri Shaktikanta Das voted to increase the policy repo rate by 25 basis points. Dr. Ashima Goyal and Prof. Jayanth R. Varma voted against the repo rate hike. 12. Dr. Shashanka Bhide, Dr. Rajiv Ranjan, Dr. Michael Debabrata Patra and Shri Shaktikanta Das voted to remain focused on withdrawal of accommodation to ensure that inflation remains within the target going forward, while supporting growth. Dr. Ashima Goyal and Prof. Jayanth R. Varma voted against this part of the resolution. 13. The minutes of the MPC’s meeting will be published on February 22, 2023. 14. The next meeting of the MPC is scheduled during April 3, 5 and 6, 2023. (Yogesh Dayal) |

|||

9911796707

9911796707