| News | |||||||||||||||

|

|

|||||||||||||||

Minutes of the Monetary Policy Committee Meeting, February 6-8, 2023 [Under Section 45ZL of the Reserve Bank of India Act, 1934] |

|||||||||||||||

| 23-2-2023 | |||||||||||||||

The forty first meeting of the Monetary Policy Committee (MPC), constituted under section 45ZB of the Reserve Bank of India Act, 1934, was held during February 6-8, 2023. 2. The meeting was attended by all the members – Dr. Shashanka Bhide, Honorary Senior Advisor, National Council of Applied Economic Research, Delhi; Dr. Ashima Goyal, Emeritus Professor, Indira Gandhi Institute of Development Research, Mumbai; Prof. Jayanth R. Varma, Professor, Indian Institute of Management, Ahmedabad; Dr. Rajiv Ranjan, Executive Director (the officer of the Reserve Bank nominated by the Central Board under Section 45ZB(2)(c) of the Reserve Bank of India Act, 1934); Dr. Michael Debabrata Patra, Deputy Governor in charge of monetary policy – and was chaired by Shri Shaktikanta Das, Governor. 3. According to Section 45ZL of the Reserve Bank of India Act, 1934, the Reserve Bank shall publish, on the fourteenth day after every meeting of the Monetary Policy Committee, the minutes of the proceedings of the meeting which shall include the following, namely:

4. The MPC reviewed the surveys conducted by the Reserve Bank to gauge consumer confidence, households’ inflation expectations, corporate sector performance, credit conditions, the outlook for the industrial, services and infrastructure sectors, and the projections of professional forecasters. The MPC also reviewed in detail the staff’s macroeconomic projections, and alternative scenarios around various risks to the outlook. Drawing on the above and after extensive discussions on the stance of monetary policy, the MPC adopted the resolution that is set out below. Resolution 5. On the basis of an assessment of the current and evolving macroeconomic situation, the Monetary Policy Committee (MPC) at its meeting today (February 8, 2023) decided to:

Consequently, the standing deposit facility (SDF) rate stands adjusted to 6.25 per cent and the marginal standing facility (MSF) rate and the Bank Rate to 6.75 per cent.

These decisions are in consonance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4 per cent within a band of +/- 2 per cent, while supporting growth. The main considerations underlying the decision are set out in the statement below. Assessment Global Economy 6. The outlook on global growth has improved in recent months, despite the persistence of geopolitical hostilities and the impact of monetary policy tightening by central banks across the world. Nonetheless, global growth is expected to decelerate during 2023. Inflation is exhibiting some softening from elevated levels, prompting central banks to moderate the size and pace of rate actions. However, central banks are reiterating their commitment to bring down inflation close to their targets. Bond yields remain volatile. The US dollar has come off its recent peak, and equity markets have moved higher since the last MPC meeting. Weak external demand in major advanced economies (AEs), the rising incidence of protectionist policies, volatile capital flows and debt distress could, however, weigh adversely on prospects for emerging market economies (EMEs). Domestic Economy 7. The first advance estimates (FAE) released by the National Statistical Office (NSO) on January 6, 2023, placed India’s real gross domestic product (GDP) growth at 7.0 per cent year-on-year (y-o-y) for 2022-23, driven by private consumption and investment. On the supply side, gross value added (GVA) was estimated at 6.7 per cent. 8. High frequency indicators suggest that economic activity has remained strong in Q3 and Q4:2022-23. Rabi acreage exceeded last year’s area by 3.3 per cent as on February 3, 2023. Industrial production expanded by 7.1 per cent in November, after contracting by 4.2 per cent in October. Capacity utilisation in manufacturing is now above its long period average. Port freight traffic, e-way bills and toll collections were buoyant in December. Purchasing managers’ indices (PMIs) for manufacturing as well as services remained in expansion in January, despite some moderation compared to the previous month. 9. Domestic demand has been sustained by strong discretionary spending. Urban demand exhibited resilience as reflected in healthy passenger vehicle sales and domestic air passenger traffic. Rural demand is improving. Investment activity is gradually gaining ground. Non-oil non-gold imports expanded in December. Merchandise exports, on the other hand, contracted in December on weak global demand. 10. CPI headline inflation moderated to 5.7 per cent (y-o-y) in December 2022 – after easing to 5.9 per cent in November – on the back of double digit deflation in vegetable prices. On the other hand, inflationary pressures accentuated across cereals, protein-based food items and spices. Fuel inflation edged up primarily from an uptick in kerosene prices. Core CPI (i.e., CPI excluding food and fuel) inflation rose to 6.1 per cent in December due to sustained price pressures in health, education and personal care and effects. 11. The overall liquidity remains in surplus, with average daily absorption under the LAF increasing to ₹1.6 lakh crore during December-January from an average of ₹1.4 lakh crore in October-November. On a y-o-y basis, money supply (M3) expanded by 9.8 per cent as on January 27, 2023, while non-food bank credit rose by 16.7 per cent. India’s foreign exchange reserves were placed at US$ 576.8 billion as on January 27, 2023. Outlook 12. The outlook for inflation is mixed. While prospects for the rabi crop have improved, especially for wheat and oilseeds, risks from adverse weather events remain. The global commodity price outlook, including crude oil, is subject to uncertainties on demand prospects as well as from risks of supply disruptions due to geopolitical tensions. Commodity prices are expected to face upward pressures with the easing of COVID-related mobility restrictions in some parts of the world. The ongoing pass-through of input costs to output prices, especially in services, could continue to exert pressures on core inflation. The Reserve Bank’s enterprise surveys point to some softening of input cost and output price pressures in manufacturing. Taking into account these factors and assuming an average crude oil price (Indian basket) of US$ 95 per barrel, inflation is projected at 6.5 per cent in 2022-23, with Q4 at 5.7 per cent. On the assumption of a normal monsoon, CPI inflation is projected at 5.3 per cent for 2023-24, with Q1 at 5.0 per cent, Q2 at 5.4 per cent, Q3 at 5.4 per cent and Q4 at 5.6 per cent, and risks evenly balanced (Chart 1). 13. The stronger prospects for agricultural and allied activities are likely to boost rural demand. The rebound in contact-intensive sectors and discretionary spending is expected to support urban consumption. Businesses and consumers surveyed by the Reserve Bank are optimistic about the outlook. Strong credit growth, resilient financial markets, and the government’s continued thrust on capital spending and infrastructure create a congenial environment for investment. On the other hand, external demand is likely to be dented by a slowdown in global activity, with adverse implications for exports. Taking all these factors into consideration, real GDP growth for 2023-24 is projected at 6.4 per cent with Q1 at 7.8 per cent, Q2 at 6.2 per cent, Q3 at 6.0 per cent and Q4 at 5.8 per cent, and risks broadly balanced (Chart 2).

14. The easing of inflation in the last two months was driven by strong deflation in vegetables, which may dissipate with the summer season uptick. Headline inflation excluding vegetables has been rising well above the upper tolerance band and may remain elevated, especially with high core inflation pressures. Inflation, therefore, remains a major risk to the outlook. Domestic economic activity is expected to remain resilient aided by the sustained focus on capital and infrastructure spending in the Union Budget 2023-24, even as continuing fiscal consolidation creates space for private investment. While the policy repo rate increases undertaken since May 2022 are working their way through the system, it is imperative to remain alert on inflation so as to ensure that it remains within the tolerance band and progressively aligns with the target. On balance, the MPC is of the view that further calibrated monetary policy action is warranted to keep inflation expectations anchored, break core inflation persistence and thereby strengthen medium-term growth prospects. Accordingly, the MPC decided to increase the policy repo rate by 25 basis points to 6.50 per cent. The MPC also decided to remain focused on withdrawal of accommodation to ensure that inflation remains within the target going forward, while supporting growth. 15. Dr. Shashanka Bhide, Dr. Rajiv Ranjan, Dr. Michael Debabrata Patra and Shri Shaktikanta Das voted to increase the policy repo rate by 25 basis points. Dr. Ashima Goyal and Prof. Jayanth R. Varma voted against the repo rate hike. 16. Dr. Shashanka Bhide, Dr. Rajiv Ranjan, Dr. Michael Debabrata Patra and Shri Shaktikanta Das voted to remain focused on withdrawal of accommodation to ensure that inflation remains within the target going forward, while supporting growth. Dr. Ashima Goyal and Prof. Jayanth R. Varma voted against this part of the resolution. 17. The minutes of the MPC’s meeting will be published on February 22, 2023. 18. The next meeting of the MPC is scheduled during April 3, 5 and 6, 2023. Voting on the Resolution to increase the policy repo rate to 6.50 per cent

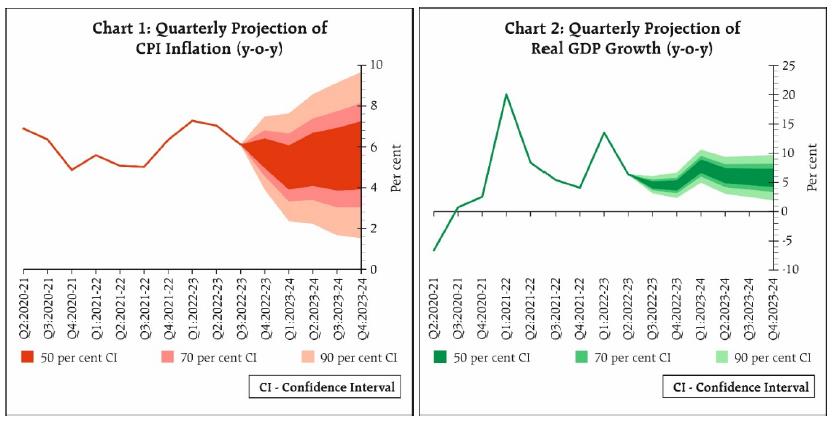

Statement by Dr. Shashanka Bhide 19. The present trajectories of inflation and growth, relative to the situation that prevailed in the December 2022 MPC meeting reflect continued moderation in the pace of CPI inflation seen in November into December and also holding on to the growth momentum projected for FY 2022-23. However, the moderation seen in inflation is mainly driven by a few food commodities and the CPI excluding food and fuel, remained at or above 6 per cent, year on year basis, during November-December 2022. On the growth front, the slowdown in the pace of global output growth has begun to impact external demand conditions. While the indicators such as non-food bank credit, GST collections and PMI for both manufacturing and services point to the continued momentum of domestic demand, the overall YOY growth in H2 of 2022-23 is expected to be lower compared to H1. The evolving trajectories of growth and inflation in the short term are, therefore, subject to significant uncertainty. 20. The First Advance Estimates of national income by the NSO for FY 2022-23 place the real GDP growth at 7 per cent over the previous year, slightly above the assessment provided during the December 2022 meeting of the MPC. The first official estimates of the economic activity by the NSO for the year 2022-23 as a whole point to the continued modest growth momentum over the pre-pandemic year, in the face of multiple challenges that emerged through the year. Private Consumption Expenditure, Gross Fixed Capital Formation and Exports of Goods and Services rose YOY basis, but at slower pace than in 2021-22. The growth performance in FY 2022-23 was contributed mainly by the sharp rise of 13.5 per cent in Q1 followed by an expected average of 5.1 per cent in the subsequent three quarters. Nevertheless, the year has seen steady quarter-on quarter growth momentum. 21. The IMF projections of World Output growth for 2022 and 2023 have been revised upward in the January 2023 World Economic Outlook Update compared to the assessment in October 2022. However, the output growth rate in 2023 is projected to decline to 2.9 per cent from 3.4 percent in 2022 and then rise to 3.1 per cent in 2024. Growth in the World trade volume is projected to decline sharply in 2023 with a pickup in the momentum in 2024. Commodity prices - both fuel and non-fuel - are projected to decline by the IMF in 2023 and 2024. The IMF update also notes that the risks to the projections are on the downside, with lower growth and higher inflation, but more moderate than its October 2022 assessment. 22. The impact of slowdown of growth globally on India’s external sector was evident in the slower pace of growth of exports and imports of goods and services in terms of constant rupee value. In terms of US dollar value, merchandise exports growth was negative in Q3: 2022-23. Merchandise imports growth, YOY basis, declined sharply in Q3 turning negative in December. 23. As the external demand conditions remain weak, domestic growth impulses are necessary for sustaining aggregate demand. The FAE point to GVA growth of 13.7 per cent YOY basis in 2022-23 in trade, transport, communication and broadcasting services driving growth in the services sector as a whole at 9.1 per cent. Industry, in contrast, is projected to grow by less than 3 per cent and manufacturing by less than 2 per cent in terms of GVA. For industry, even in terms of IIP, the growth performance in 2022-23 has been fluctuating. IIP for capital goods and infrastructure/ construction goods rose sharply in November 2022, on YOY basis, after a weak growth in October. Similar pattern was seen during August and September 2022. IIP Consumer durables and non-durables registered negative YOY growth rates during August 2022 to October 2022, to rise in November 2022. In this sense, a balanced growth performance will require significant acceleration in the manufacturing growth that will also require rising demand for manufactured goods. The Union Budget for 2023-24 with its stepped up capital expenditure will support capital formation in the key areas of infrastructure. 24. In terms of forward-looking data, the RBI survey of consumer confidence conducted in January 2023, reflects improvement in one-year ahead expectations buoyed by expectations of higher spending, improved general economic conditions, employment and income. However, the spending sentiments appear cautious, especially the ‘non-essential expenditure’. While there is an increase in the proportion of sample households who expect to spend more on ‘essential items’ over the previous round of the survey, the sample households are evenly divided on the expectations to increase or not increase the ‘non-essential spending’ one year ahead from now. The caution appears to be related to the expectation of higher inflation rate. The one-year ahead consumer expectations point to a higher inflation rate compared to the prevailing conditions. 25. The enterprise surveys on outlook conducted by RBI during mid-October to mid-December 2022 reflect improved overall business situation in the immediate term of Q4:2022-23 for manufacturing and infrastructure but stable for services after an overall significant improvement in Q3 for all three segments. The expectations for the first two quarters of 2023-24 are mixed, with the manufacturing sector enterprises showing diminished expectations, while expectations of services and infrastructure enterprises remain unchanged from Q4: 2022-23. The NCAER-NSE Business Confidence Index1 based on the quarterly survey of enterprises conducted in December 2022 was higher YOY basis but fell sequentially as compared to Q1 and Q2: 2022-23. 26. The inflation pattern in November and December 2022 shows moderation in price pressures at the aggregate level but the moderation is resulting mainly from a sharp decline in prices of vegetables. The headline CPI inflation came below 6 per cent mark in November and December. The ‘Food and Beverages’ component of CPI registered YOY increase of under 6 per cent in these two months, with CPI for Fuel and Light increasing at double digit rate and CPI excluding food and fuel at or above 6 per cent. The current momentum of the decline in inflation rate remains vulnerable to price changes in one or two commodity groups. Across the main commodity groups within the food sector, a number of them show YOY inflation rate of above 6 per cent. Cereals & products, eggs, milk and products, spices and prepared meals & snacks, accounting for more than half the weight of the Food & Beverages group in the CPI, rose at rates above 6 per cent in December 2022. Cereals and products rose at double digit YOY rates during September-December 2022. The Business Inflation Expectations Survey (BIES) conducted by IIM Ahmedabad covering mainly manufacturing firms has reported a decline in the one-year ahead expectation of YOY consumer inflation to 4.91 per cent in December 2022 compared to 5.32 per cent in October 2022. The survey also reports an assessment of the one-year ahead ‘business inflation’ based on the unit cost, at 4.19 per cent in December 2022 down from 4.70 per cent in October 2022. In both the cases, the expected inflation rates have generally declined in the period June 2022 onwards. 27. The trends in various indicators of level of economic activity point to achieving the FAE of GDP growth of 7 per cent in 2022-23. The weakened global growth conditions on account of tight monetary policy conditions and the continuing Russia-Ukraine war would mean a lower growth of about 6.4 per cent in 2023-24, with a quarterly break up provided in the MPC Resolution. The Survey of Professional Forecasters conducted by the RBI in January 2023 projects, YOY basis, GDP growth rate of 6.9 per cent for FY 2022-23 and 6.0 per cent for FY 2023-24. 28. The inflation pressures have persisted even with the decline in the headline inflation rate below 6 per cent in November and December 2022. The decline in vegetable prices, main contributor to the moderation in Headline inflation rate, is a seasonal feature, although the correction this time has taken place earlier and is more than the usual fall. The pattern in the several other commodity prices, where the price rise has been sharp, is of concern from a price stability perspective. Moderation in the headline inflation can be expected on a sustained basis only when most of the major components of the index come within the 6 per cent mark. External factors such as international commodity prices are expected to provide relief on the price front; but the pass through of this benefit to the consumer basket will be affected by the exchange rate variations and domestic price setting of petroleum fuels. The headline inflation rate for FY 2022-23 and FY 2023-24 is now projected at 6.5 per cent and 5.3 per cent, respectively, with the quarterly break up provided in the MPC Resolution. In comparison, the Survey of Professional Forecasters conducted by the RBI in January 2023 projects a headline inflation rate of 6.5 per cent for FY 2022-23 and 5.1 per cent for FY 2023-24. 29. Persistence of core inflation at a high level is a crucial concern at this stage. It is important to reduce the demand side pressures on inflation and bring the inflation expectations of the various stake holders closer to the policy target to sustain the growth momentum. 30. In view of the above, I vote (1) to increase the policy repo rate by 25 basis points and also (2) to remain focused on withdrawal of accommodation to ensure that inflation remains within the target going forward, while supporting growth. Statement by Dr. Ashima Goyal 31. Central Banks around the world had to raise rates fast to reverse large pandemic time cuts once inflation rose. But high inflation has not persisted as long as in the seventies so long-run inflation expectations largely remain anchored. Normalization of supply chains, softening commodity prices and falling global demand are bringing inflation down in most countries. US Fed communication on ‘higher for longer’ independent of data may not be appropriate and has mellowed somewhat. The economy seems to have survived sharp tightening well, as better growth compensated for higher rates. Crashing markets would be a very costly way to get policy transmission. Pressure on emerging market (EM) currencies and inflation from dollar appreciation has reduced. 32. Although global growth prospects have improved, a slowdown continues in advanced economies. Indian exports are showing signs of strain. The Indian PMI new export orders index fell to 51.2 in January from 53.4 in December. PMI has also softened for both manufacturing and services although it remains well above 50. There are still only early signs of a revival in private investment, which has yet to come out of a decade long slowdown. The RBI consumer confidence survey shows while consumer confidence is recovering it is still below 2019 levels. The current account deficit is also decreasing towards sustainable levels. 33. Headline inflation came in below forecasts, although largely driven by a sharp transient fall in vegetable prices. But agriculture seems to have been resilient to prolonged rains, pointing to productivity improvements that augur well for the future also. Diversification away from cereals has made output less volatile. The cereal price shock after the Ukraine war, however, has been a major factor raising Indian inflation. Higher fodder prices are raising milk prices. But wheat prices may also soften with sales from government stocks and expectations of a good harvest. 34. The government has stayed on its announced fiscal consolidation path reducing the government contribution to demand, while expanding supply with its sustained push on infrastructure. It also continues with other supply-side measures to reduce inflation. These enable the excellent monetary-fiscal coordination that has contributed to India’s relative outperformance in a difficult period. 35. It may be time, however, for some more excise tax cuts as multiple supply shocks have imparted persistence to inflation. The large commodity component in India’s consumer price basket, and pockets of supply constraints, respond better to fiscal action. Our government has used such action very effectively in the pandemic period. Inflation still has many administered price components and all regulators need to internalize the inflation target in order for it to be achieved. If inflation remains within its tolerance band the MPC can keep real interest rates low so that growth remains high and contributes to reducing the government debt/GDP ratio. 36. The RBI inflation expectation survey shows household expectation to be highly influenced by events. A pass through of the persistent softening in international oil prices could help to counter adverse effects of global uncertainty and reduce inflation expectations. Oil marketing companies have had ample time to complete cost recovery. 37. Since there are still little signs of wage or demand led second round effects on inflation, however, core may soften over the year. There are signs of the latter in some core components (transport, textiles, and recreation and amusement services). Since firms have benefitted from reduction in international input costs and demand is also slackening they may hesitate to raise prices. The WPI includes firm level prices and WPI inflation has fallen steeply. As the aggressive MPC tightening is more fully passed through it will further reduce demand. The interest elasticity of output is high in India because of a large young population buying flats and equipping them on credit. 38. The real rate is already positive and is likely to become more so, if inflation falls. The RBI’s average inflation forecast for FY 24 of 5.3 per cent gives a real interest rate of almost unity with a repo rate of 6.25 per cent. It can rise above this if inflation comes in below expectations that are based on an oil price of $95, risking a procyclical stance as policy tightens despite pressures on growth. Policy would then have moved away from the nuanced countercyclical stance that has been very effective in smoothing recent external pluri-shocks. Market inflation expectations are below those of the RBI. The Bloomberg consensus forecast is 5 per cent. 39. A real repo rate of around unity suits the current stage of the cycle. It also balances the conflicting requirements of inflation and growth, savers and borrowers well. It ensures nominal rates rise with expected inflation as is required in inflation targeting but prevents large nominal volatility. Research shows it is better to limit volatility so that real interest and exchange rates, that impact the real sector, do not deviate much from their equilibrium values2. Some volatility of nominal rates is good for financial stability, as long as volatility is limited. 40. The US Fed is expected to over-correct and cut after. But it is only short-term market players who benefit from excess volatility and overshooting of exchange and interest rates, which hurt the real sector as well as those who take market positions based on fundamentals. 41. When the Fed is tightening, interest rates tend to rise more for EMs that have sharp currency depreciation. Intervention in FX markets has lowered rupee volatility and helped maintain independence from the Fed stance. Reserves have also recovered. Fed action is due to large excess demand, tight labour markets and an unprecedented deviation from the inflation target. India does not have these conditions and has the space not to follow the Fed. It also started from higher nominal policy rates. 42. If a sharp rise in the real policy rate, substantially above unity, triggers a shift to a lower trend of private investment and growth, then the sacrifice ratio of disinflation can be very high, as it was in the 2010s3. When such multiple paths exist, over-tightening today does not necessarily improve the future. Inflation can rise over time because supply bottlenecks worsen. 43. Excessive front-loading of rate hikes carries the risk of over-shooting that is best avoided for compelling reasons in the Indian context: First, raising real policy rates to reduce demand has a stronger effect on growth than it does on inflation4. Second, since there are more lags in monetary transmission in India, over-shooting can have persistent deleterious effects here, including instability. Third, macroeconomic stability improves most rapidly if real interest rates are kept smoothly below growth rates and counter external shocks. The Indian economy is well-poised to achieve this combination and to reduce its chronic underemployment. 44. In view of these arguments, I vote for a pause. It is better to give time for possible softening of both inflation and growth and effects of past monetary tightening to play out. I am also in favour of a shift to a neutral stance which is consistent with response in any direction as required depending on the impact of global and domestic factors on expected inflation. Policy, and market adjustments, would be based on incoming data and its effect on the future outlook. Statement by Prof. Jayanth R. Varma 45. Much of what I wrote in my December statement remains valid now as well. Rather than repeat those arguments all over again, I will be very brief. In the second half of 2021-22, monetary policy was complacent about inflation, and we are paying the price for that in terms of unacceptably high inflation in 2022-23. In the second half of 2022-23, monetary policy has, in my view, become complacent about growth, and I fervently hope that we do not pay the price for this in terms of unacceptably low growth in 2023-24. 46. I believe that the 25 basis point rate hike approved by the majority of the MPC is not warranted in the current context of diminished inflationary expectations and heightened growth concerns. I therefore vote against this resolution. 47. Turning to the stance, I believe that a repo rate of 6.50% very likely overshoots the policy rate needed to achieve price stability, and further tightening is not desirable. I therefore vote against this resolution also. Statement by Dr. Rajiv Ranjan 48. Besides growing divergence in the pace of policy normalisation across the world, recent monetary policy actions by systemic central banks suggest a dichotomy between the policy actions and the stance. Moreover, while nearly all have hiked rates with a pivot towards smaller quantum of rate hikes, clear forward guidance is missing given the difficulty in forecasting inflation presciently in the backdrop of prevailing uncertainties. Taking cues from tapered rate hikes and dovish tones in the stance, global financial markets have priced in a pause and subsequent rate cuts by major advanced economies in the later part of the year. The persistence of inflation, however, can lead to large repricing of risk with consequent market turmoil. Moreover, financial conditions have eased around much of the globe despite sharp monetary policy tightening, which poses a challenge for central banks.5 Therefore, it will be premature to lower the guard on inflation as the credibility of central banks in fighting inflation has large ramifications for stabilisation of inflation and firm anchoring of inflation expectations. 49. In the Indian context, even though inflation remained below the upper tolerance threshold of 6 per cent for two consecutive months in November-December 2022, a deep dive into CPI inflation indicates little evidence of a decisive and durable disinflation process. The softening of headline inflation can largely be attributed to the sharp and early seasonal correction in prices of vegetables. Excluding vegetables, both food and headline inflation edged up during November-December 2022. Eight out of 12 food sub-groups, comprising 66 per cent of CPI food basket, registered an increase in inflation in December.6 Core (CPI excluding food and fuel) inflation edged up above 6.0 per cent while other exclusion-based core inflation measures were in the range of 6.0-6.8 per cent. Trimmed mean measures of inflation and diffusion indices for CPI suggest heightened underlying and generalised inflation pressures across the CPI basket. 50. Our inflation projection is premised on crude prices at US$ 95 per barrel. I believe it is necessary to remain conservative on crude prices and avoid best-case scenarios given the volatile nature of crude prices, progressive opening up of China and continuing war in Europe. Moreover, with retail petrol and diesel prices unchanged, the sensitivity of inflation to crude oil price movements is low in the short term but remain relevant for the external sector. 51. Going forward, inflation is projected to moderate to 5.3 per cent in 2023-24. However, its quarterly path indicates considerable variation due to the large influence of base effects – especially in Q1:2023-24. There does exist considerable uncertainty to this baseline trajectory. A likely bumper rabi harvest could bring about a softening of food inflation; however, there could be risks emanating from adverse weather events. The trajectory of global commodity prices remains uncertain, even as output price pass-through of pending cost pressures continues, especially in services. This, along with housing component in CPI, needs to be monitored closely, given the stickiness of core inflation at around 6 per cent. 52. On the other hand, I am reasonably convinced about the inherent strength of the Indian economy as reflected in (i) high frequency indicators; (ii) resilient domestic demand; (iii) budgetary focus on capital expenditure; (iv) sound health of corporates and banking sector; (v) improving external sector indicators; and (vi) depth of the financial markets. Moreover, February 2023 has been a defining moment for fiscal monetary coordination, which has been the hallmark during the pandemic. Fiscal expansion through higher expenditures can stimulate or retard growth depending upon the phase of the business cycle and the quality of expenditure.7 The government has continued on the path of fiscal consolidation in the Union Budget 2023-24 by reprioritising expenditure from revenue to capital, which will be growth augmenting through higher multiplier effect of investment over the medium term. Thus, the Union Budget served the macroeconomic objective as well as the inflation targeting mandate of the Reserve Bank. Prudent fiscal and monetary policies at this juncture are likely to give us the optimal macro-economic outlook – a soft landing for the economy through gradual disinflation amidst resilient growth outcomes. The growth projection of 6.4 per cent for 2023-24 reflects these underlying strengths. The quarterly momentum in the projection of real GDP is now close to that of the pre-COVID decade. 53. In the above context, it will be hasty to ease the vigil against inflation. As noted by Milton Friedman, there is a distinction: “...between a steady inflation, one that proceeds at a more or less constant rate, and an intermittent inflation, one that proceeds by fits and starts...”.8 This crucial difference between “steady inflation” and “intermittent inflation” is paramount while formulating the policy choice. The overly large focus on the recent fall in inflation led by “intermittent inflation” may tempt for an untimely pause in monetary policy action, a costly policy error. The continuously high core inflation points to the persistence in “steady inflation”, which warrants caution. Thus, it will be premature to pause when there are no definitive signs of slowdown in inflation, particularly core inflation. Nevertheless, as the policy rate adjusted for inflation has now turned positive, albeit barely so, there is a case for paring down the pace of rate hike to the usual 25 bps. 54. These factors call for continuity in policy stance and response, to ensure a decisive and durable moderation in inflation towards the target, while keeping in mind the objective of growth. In view of the above, I vote for a lower rate hike of 25 bps without changing the stance. Going ahead, assessment of the impact of the cumulative rate hikes will become important especially in view of higher policy transmission in a primarily bank-based economy. Statement by Dr. Michael Debabrata Patra 55. Over the year gone by, monetary policy actions have been undertaken and accommodation has been withdrawn to restore price stability. The impact of these actions is beginning to be reflected in the channels of transmission. This provides little comfort though, as barring the pronounced winter easing of vegetables prices, almost every other component of the consumer price index is showing a hardening of price pressures. Statistical and exclusion-based measures of underlying inflation are actually showing an uptick. It is eminently likely that as the cooler weather gives way to summer, vegetable prices will turn up again as they usually do. Households sense this, as revealed in largely unchanged inflation expectations and muted discretionary spends, especially in rural areas. Businesses are accordingly encountering a moderation in sales and revenues. With input cost pressures still being passed through into expenditures, capital spending remains restrained. 56. Hence, the stance of monetary policy will need to remain disinflationary till inflation is returned to target. The Indian economy has demonstrated strength in the face of formidable global adversities and there is positive momentum underlying the steady emergence from the drag of the pandemic and the war. While the full effects of monetary policy actions on economic activity are yet to be seen, increasingly it is becoming evident that inflation is weakening domestic consumption and investment as well as confidence. Combined with the drag on exports due to the retarding effects of slowing global activity, and the expected consolidation of fiscal spending, the prospects for growth in 2023-24 hinge around price stability, anchored inflation expectations and improving supply responses across agriculture, industry and services. 57. Although it seems to have peaked, inflation remains high and, in my view, it is the biggest threat to the macroeconomic outlook. Restoration of price stability – as statutorily mandated – will provide a solid foundation for a growth trajectory that actualises India’s potential. Taking into account the height of inflation, current and projected, monetary and financial conditions still reflect some slack, although they are moving into tighter territory with the follow through of recent monetary policy actions. The issue is one of timing. 58. The fight against inflation is complicated by the global outlook. There is some consensus growing around a milder slowdown than earlier feared, although geographical disparities complicate the prognosis. Be that as it may, the outlook for global inflation is turning more uncertain than before. While central banks expect only a stubborn easing, financial markets are betting on a more dramatic downturn as commodity price pressures ease and supply chains improve. Nonetheless, future shocks associated with the war and the pandemic are possible. 59. Turning to the implications for policy, the MPC has to remain committed to its primary mandate. The recent experience has amply demonstrated that low and stable inflation is the credible nominal anchor for a reinvigoration of growth. Moving the policy rate into restrictive territory at a resolute pace has provided the headroom to continue to moderate the order of rate increases. This enables us to assess the impact of our actions carefully while taking into account the risks around the outlook. It also demonstrates the credibility of our actions through carefully calibrated rate changes without any backtracks. In the final analysis, the size and timing of rate changes is the best embodiment of the stance. While keeping in mind the objective of growth, the foot must remain on the brake as we chart our future trajectory. On a pragmatic basis, it is important to at least contain inflation within the tolerance band in 2023-24 as the first milestone to be passed in aligning inflation with the target. Accordingly, I vote for increasing the policy rate by 25 basis points while continuing to withdraw accommodation. Statement by Shri Shaktikanta Das 60. The global economic outlook has improved since the December (2022) meeting of the MPC. Inflation in major countries has eased in recent prints but remains significantly above their respective targets. Monetary policy is thus expected to remain in a tightening mode, but there is uncertainty about its trajectory. This is leading to bouts of volatility in global financial markets whose spillovers are posing challenges to emerging market economies. 61. In a world of extreme uncertainty, India is witnessing a conducive environment of macroeconomic stability: the economy remains resilient; inflation has moderated in the past two months to below 6 per cent; fiscal consolidation is gaining traction; current account deficit is showing signs of moderation; forex reserves have improved; and the banking sector remains healthy. 62. The sustained buoyancy in domestic demand, especially private consumption and investment, is driving growth. While weak external demand is a drag on our merchandise exports, growth of remittances and exports of services is robust. Going ahead, the persisting recovery in contact-intensive services and good prospects of rabi production are likely to support urban and rural consumption. The enhanced thrust on capital spending and infrastructure in the Union Budget 2023-24 should bolster manufacturing and investment activity. 63. CPI inflation has moderated primarily due to lower vegetable prices. Core inflation (i.e., CPI excluding food and fuel), however, is elevated and sticky at around 6 per cent. CPI inflation excluding vegetables has moved higher. Going forward, the baseline projections indicate that headline inflation is likely to moderate to 5.3 per cent in 2023-24. These projections also indicate that the disinflation towards the target rate is likely to be protracted given the stickiness of core inflation at elevated levels. Durability of a disinflation process cannot solely rely on food inflation, given its uncertainty and susceptibility to weather events. Overall, there is considerable uncertainty at this stage on the evolving inflation trajectory due to ongoing geopolitical tensions, global financial market volatility, rising non-oil commodity prices, volatile crude oil prices and also weather-related events. 64. We must, therefore, remain unwavering in our commitment to bring down inflation to ensure a decisive and durable moderation in inflation towards the target of 4 per cent over the medium term, while being mindful of growth. Hence, further calibrated monetary policy action is necessary in the current MPC meeting to keep inflation expectations anchored and break the persistence of core inflation while containing second round effects. I also believe that we should taper the pace of rate hike in view of two considerations: (i) we need to give time for our past policy actions to work through the system; and (ii) it would be premature to pause, lest we are caught off-guard and need to do a catching up later. I, therefore, vote for an increase of 25 basis points in the policy repo rate to 6.50 per cent. This order of rate increase provides space to calibrate future monetary policy actions and stance based on evolving macroeconomic conditions. 65. Our actions have nudged the policy rate adjusted for inflation to positive territory after a while. Liquidity remains in surplus mode, even as the surplus is moderating. The overall monetary and liquidity conditions, therefore, remain accommodative. In such a scenario, it is necessary to persevere with the stance of withdrawal of accommodation to ensure a decisive process of disinflation. Accordingly, I vote for continuing with the stance of withdrawal of accommodation. 66. There has been some discussion in the public space about the need to give forward guidance on monetary policy actions. As I have stated on several occasions, it would be inadvisable to provide specific guidance when we are in a tightening cycle and when we are experiencing such extreme uncertainty. The only forward guidance that we can provide is that we will remain vigilant, monitor every incoming information and data, and shall act appropriately to maintain price stability in the interest of strengthening medium-term growth. (Yogesh Dayal) -------- 1 https://www.ncaer.org/BES/NCAER_NSE_BES_Report_January_2023.pdf. 2 Goyal, A. and A. Kumar, 2021. ‘Asymmetry, Terms of Trade and the Aggregate Supply Curve in an Open Economy Model’, The Journal of Economic Asymmetries, Volume 24, November, e00206. https://doi.org/10.1016/j.jeca.2021.e00206. 3 Goyal, A. and G. Goel, 2019. ‘Correlated Shocks, Hysteresis, and the Sacrifice Ratio: Evidence from India’, Emerging Markets Finance and Trade. Vol. 57, Issue 10. Pgs. 2929-2945. Published online: 11 Oct. https://www.tandfonline.com/doi/full/10.1080/1540496X.2019.1668770. 4 Goyal, A. and S. Tripathi, 2015. ‘Separating Shocks from Cyclicality in Indian Aggregate Supply’, Journal of Asian Economics, 38: 93-103. 2015. https://www.sciencedirect.com/science/article/abs/pii/S1049007815000329. 5 https://www.imf.org/en/Blogs/Articles/2023/02/02/looser-financial-conditions-pose-conundrum-for-central-banks. 6 Moreover, five food sub-groups comprising 54 per cent of CPI food basket registered an inflation rate of more than 6 per cent. 7 Report on Currency and Finance, RBI 2021-22. Revenue expenditures have negative multiplier during upturns. 8 Friedman, Milton (1963), Inflation: Causes and Consequences, Bombay: Asia Publishing House, reprinted in, Dollars and Deficits, Englewood Cliffs, N.J.: Prentice-Hall, 1968. |

|||||||||||||||

9911796707

9911796707