GST collections breach landmark milestone of ₹2 lakh crore

Gross Revenue Records 12.4% y-o-y growth

Net Revenue (after refunds) stood at ₹1.92 lakh crore; 17.1% y-o-y growth

The Gross Goods and Services Tax (GST) collections hit a record high in April 2024 at ₹2.10 lakh crore. This represents a significant 12.4% year-on-year growth, driven by a strong increase in domestic transactions (up 13.4%) and imports (up 8.3%). After accounting for refunds, the net GST revenue for April 2024 stands at ₹1.92 lakh crore, reflecting an impressive 17.1% growth compared to the same period last year.

Positive Performance Across Components:

Breakdown of April 2024 Collections:

- Central Goods and Services Tax (CGST): ₹43,846 crore;

- State Goods and Services Tax (SGST): ₹53,538 crore;

- Integrated Goods and Services Tax (IGST): ₹99,623 crore, including ₹37,826 crore collected on imported goods;

- Cess: ₹13,260 crore, including ₹1,008 crore collected on imported goods.

Inter-Governmental Settlement: In the month of April, 2024, the central government settled ₹50,307 crore to CGST and ₹41,600 crore to SGST from the IGST collected. This translates to a total revenue of ₹94,153 crore for CGST and ₹95,138 crore for SGST for April, 2024 after regular settlement.

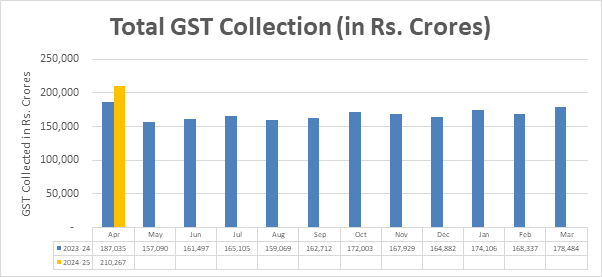

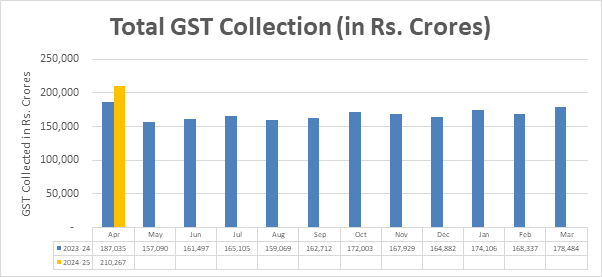

The chart below shows trends in monthly gross GST revenues during the current year. Table-1 shows the state-wise figures of GST collected in each State during the month of April, 2024 as compared to April, 2023. Table-2 shows the state-wise figures of post settlement GST revenue of each State for the month of April, 2024.

Chart: Trends in GST Collection

Table 1: State-wise growth of GST Revenues during April, 2024[1]

|

State/UT

|

Apr-23

|

Apr-24

|

Growth (%)

|

|

Jammu and Kashmir

|

803

|

789

|

-2%

|

|

Himachal Pradesh

|

957

|

1,015

|

6%

|

|

Punjab

|

2,316

|

2,796

|

21%

|

|

Chandigarh

|

255

|

313

|

23%

|

|

Uttarakhand

|

2,148

|

2,239

|

4%

|

|

Haryana

|

10,035

|

12,168

|

21%

|

|

Delhi

|

6,320

|

7,772

|

23%

|

|

Rajasthan

|

4,785

|

5,558

|

16%

|

|

Uttar Pradesh

|

10,320

|

12,290

|

19%

|

|

Bihar

|

1,625

|

1,992

|

23%

|

|

Sikkim

|

426

|

403

|

-5%

|

|

Arunachal Pradesh

|

238

|

200

|

-16%

|

|

Nagaland

|

88

|

86

|

-3%

|

|

Manipur

|

91

|

104

|

15%

|

|

Mizoram

|

71

|

108

|

52%

|

|

Tripura

|

133

|

161

|

20%

|

|

Meghalaya

|

239

|

234

|

-2%

|

|

Assam

|

1,513

|

1,895

|

25%

|

|

West Bengal

|

6,447

|

7,293

|

13%

|

|

Jharkhand

|

3,701

|

3,829

|

3%

|

|

Odisha

|

5,036

|

5,902

|

17%

|

|

Chhattisgarh

|

3,508

|

4,001

|

14%

|

|

Madhya Pradesh

|

4,267

|

4,728

|

11%

|

|

Gujarat

|

11,721

|

13,301

|

13%

|

|

Dadra and Nagar Haveli and

Daman & Diu

|

399

|

447

|

12%

|

|

Maharashtra

|

33,196

|

37,671

|

13%

|

|

Karnataka

|

14,593

|

15,978

|

9%

|

|

Goa

|

620

|

765

|

23%

|

|

Lakshadweep

|

3

|

1

|

-57%

|

|

Kerala

|

3,010

|

3,272

|

9%

|

|

Tamil Nadu

|

11,559

|

12,210

|

6%

|

|

Puducherry

|

218

|

247

|

13%

|

|

Andaman and Nicobar

Islands

|

92

|

65

|

-30%

|

|

Telangana

|

5,622

|

6,236

|

11%

|

|

Andhra Pradesh

|

4,329

|

4,850

|

12%

|

|

Ladakh

|

68

|

70

|

3%

|

|

Other Territory

|

220

|

225

|

2%

|

|

Center Jurisdiction

|

187

|

221

|

18%

|

|

Grand Total

|

1,51,162

|

1,71,433

|

13%

|

Table-2: SGST & SGST portion of IGST settled to States/UTs

April (Rs. in crore)

|

|

Pre-Settlement SGST

|

Post-Settlement SGST[2]

|

|

State/UT

|

Apr-23

|

Apr-24

|

Growth

|

Apr-23

|

Apr-24

|

Growth

|

|

Jammu and Kashmir

|

394

|

362

|

-8%

|

918

|

953

|

4%

|

|

Himachal Pradesh

|

301

|

303

|

1%

|

622

|

666

|

7%

|

|

Punjab

|

860

|

999

|

16%

|

2,090

|

2,216

|

6%

|

|

Chandigarh

|

63

|

75

|

20%

|

214

|

227

|

6%

|

|

Uttarakhand

|

554

|

636

|

15%

|

856

|

917

|

7%

|

|

Haryana

|

1,871

|

2,172

|

16%

|

3,442

|

3,865

|

12%

|

|

Delhi

|

1,638

|

2,027

|

24%

|

3,313

|

4,093

|

24%

|

|

Rajasthan

|

1,741

|

1,889

|

9%

|

3,896

|

3,967

|

2%

|

|

Uttar Pradesh

|

3,476

|

4,121

|

19%

|

7,616

|

8,494

|

12%

|

|

Bihar

|

796

|

951

|

19%

|

2,345

|

2,688

|

15%

|

|

Sikkim

|

110

|

69

|

-37%

|

170

|

149

|

-12%

|

|

Arunachal Pradesh

|

122

|

101

|

-17%

|

252

|

234

|

-7%

|

|

Nagaland

|

36

|

41

|

14%

|

107

|

111

|

4%

|

|

Manipur

|

50

|

53

|

6%

|

164

|

133

|

-19%

|

|

Mizoram

|

41

|

59

|

46%

|

108

|

132

|

22%

|

|

Tripura

|

70

|

80

|

14%

|

164

|

198

|

21%

|

|

Meghalaya

|

69

|

76

|

9%

|

162

|

190

|

17%

|

|

Assam

|

608

|

735

|

21%

|

1,421

|

1,570

|

10%

|

|

West Bengal

|

2,416

|

2,640

|

9%

|

3,987

|

4,434

|

11%

|

|

Jharkhand

|

952

|

934

|

-2%

|

1,202

|

1,386

|

15%

|

|

Odisha

|

1,660

|

2,082

|

25%

|

2,359

|

2,996

|

27%

|

|

Chhattisgarh

|

880

|

929

|

6%

|

1,372

|

1,491

|

9%

|

|

Madhya Pradesh

|

1,287

|

1,520

|

18%

|

2,865

|

3,713

|

30%

|

|

Gujarat

|

4,065

|

4,538

|

12%

|

6,499

|

7,077

|

9%

|

|

Dadra and Nagar

Haveli and Daman

and Diu

|

62

|

75

|

22%

|

122

|

102

|

-16%

|

|

Maharashtra

|

10,392

|

11,729

|

13%

|

15,298

|

16,959

|

11%

|

|

Karnataka

|

4,298

|

4,715

|

10%

|

7,391

|

8,077

|

9%

|

|

Goa

|

237

|

283

|

19%

|

401

|

445

|

11%

|

|

Lakshadweep

|

1

|

0

|

-79%

|

18

|

5

|

-73%

|

|

Kerala

|

1,366

|

1,456

|

7%

|

2,986

|

3,050

|

2%

|

|

Tamil Nadu

|

3,682

|

4,066

|

10%

|

5,878

|

6,660

|

13%

|

|

Puducherry

|

42

|

54

|

28%

|

108

|

129

|

19%

|

|

Andaman and

Nicobar

Islands

|

46

|

32

|

-32%

|

78

|

88

|

13%

|

|

Telangana

|

1,823

|

2,063

|

13%

|

3,714

|

4,036

|

9%

|

|

Andhra Pradesh

|

1,348

|

1,621

|

20%

|

3,093

|

3,552

|

15%

|

|

Ladakh

|

34

|

36

|

7%

|

55

|

61

|

12%

|

|

Other Territory

|

22

|

16

|

-26%

|

86

|

77

|

-10%

|

|

Grand Total

|

47,412

|

53,538

|

13%

|

85,371

|

95,138

|

11%

|

[1] Does not include GST on import of goods

[2] Post-Settlement GST is cumulative of the GST revenues of the States/UTs and the SGST portion of the IGST settled to the States/UTs

|

9911796707

9911796707