| News | |||

|

|

|||

SERVICES SECTOR CONTINUES TO CONTRIBUTE SIGNIFICANTLY TO INDIA'S GROWTH, ACCOUNTS FOR ABOUT 55 PER CENT OF TOTAL SIZE OF THE ECONOMY IN FY24 |

|||

| 22-7-2024 | |||

AS PER PROVISIONAL ESTIMATES, THE SERVICES SECTOR IS ESTIMATED TO HAVE GROWN BY 7.6 PER CENT IN FY24: ECONOMIC SURVEY 2024 “Through the vicissitudes of the last three decades, the services sector stood as the bulwark of India's economic growth. Aided by the focus on policy and procedural reforms, physical infrastructure and logistics, all significant business, personal, financial and infrastructure-based services have emerged strongly from the pandemic… However, the transformation lies in the fast-paced shift towards digital services like online payments, e-commerce, and entertainment platforms, as well as the increase in the demand for high-tech services as inputs in other productive activities.” This was highlighted in Economic Survey 2023-2024 tabled in Parliament by Union Minister for Finance and Corporate Affairs, Smt. Nirmala Sitharaman today.

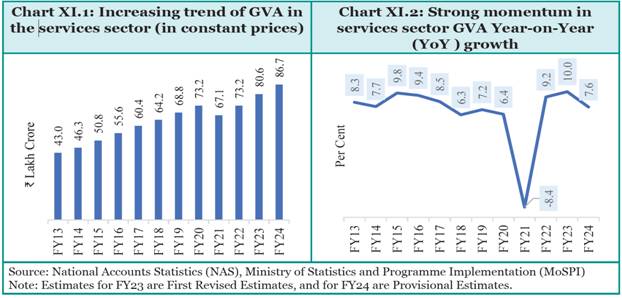

The services sector continues to be a significant contributor to India’s growth, accounting for about 55 per cent of the total size of the economy in FY24, states Economic Survey. The significant domestic demand, rapid urbanization, expansion of e-commerce platforms generated heightened requirements for logistics, digital related services are important factors which have determined the domestic demand of services. The Economic Survey further states that the Government has played a crucial role in fostering the growth and competitiveness of India’s services by creating an enabling environment, promoting investment, enhancing skills and facilitating market access. Gross Value Added (GVA) in the services sector The contribution of the services sector to the overall GVA has increased significantly in the last decade. Globally, India’s services sector witnessed a real growth of more than 6 percent and the services exports constituted 4.4 per cent of the world's commercial services exports in 2022.

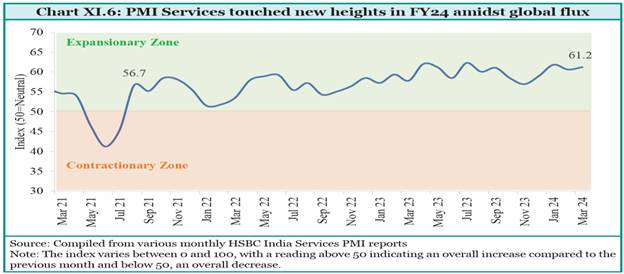

For a decade before COVID, the services sector's real growth rate consistently exceeded the overall economic growth. Post-COVID, the services sector's growth, spurred by non-contact intensive services, primarily financial, information technology and professional services, outpaced overall GVA growth in FY23 and FY24, reclaiming its role in driving the economy's upward trajectory. The Survey further states that as per the Provisional Estimates, the services sector is estimated to have grown 7.6 percent in FY24. The gross GST collection reached ₹20.18 lakh crores in FY24, marking 11.7 per cent increase from the previous year, underscoring robust domestic trading activity. Purchasing Managers’ Index (PMI)- Services Business activity in the services sector in the country transcended the obstacles of the pandemic and other disruptions worldwide. In March 2024, services PMI soared to 61.2, marking one of the sector's most significant sales and business activity expansions in nearly 14 years. As can be seen from Chart XI.6 (below), the services PMI has remained above 50 since August 2021, implying continuous expansion for the last 35 months.

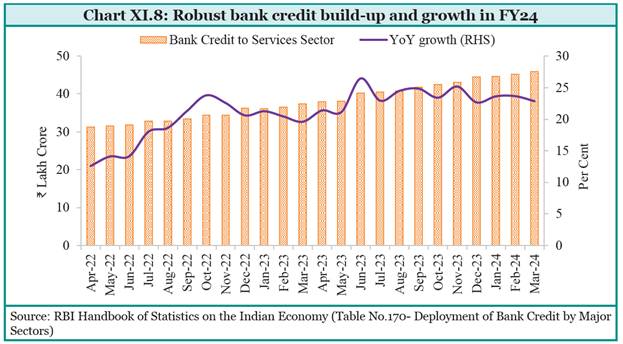

Trade in the services sector Post-pandemic, services exports have maintained a steady momentum and accounted for 44 per cent of India’s total exports in FY24 the survey notes. India ranked fifth in services exports, with other countries being the European Union (excluding intra-EU trade), the United States, the United Kingdom, and China. India’s growing reputation as the preferred destination for Global Capability Centres (GCCs) by multinational corporations has significantly boosted software and business services exports. India's share in digitally delivered services exports globally increased to 6.0 per cent in 2023 from 4.4 per cent in 2019. This rise in services exports, coupled with a fall in imports, led to an increase in net services receipts on a YoY basis during FY24, which helped cushion India’s current account deficit. Financing Sources for Services Sector Activity The services sector fulfils its financing needs domestically through

|

|||

9911796707

9911796707