In 2024, the Department of Economic Affairs (DEA), Ministry of Finance, spearheaded transformative initiatives to enhance India’s economic resilience and global integration. Notably, the Union Cabinet approved the new Framework on Currency Swap Arrangement for SAARC Countries (2024-27), fostering financial cooperation and regional integration. This framework introduced an INR Swap Window worth ₹25,000 crore, supplementing the USD/Euro Swap Window, and aimed to promote the internationalization of the Indian Rupee. These measures underscore India’s commitment to strengthening ties with SAARC nations and providing financial stability in the region.

Further solidifying India’s international partnerships, the signing and enforcement of the India-UAE Bilateral Investment Treaty (BIT) marked a new chapter in fostering investor confidence and economic collaboration, while the India-Uzbekistan BIT emphasised investor protection and dispute resolution mechanisms. Additionally, the constitution of the Joint Task Force on Investment between India and Qatar facilitated deeper cooperation, and India’s proactive role in Sri Lanka’s economic stabilisation highlighted its leadership in addressing regional financial challenges. These initiatives reflect India’s dedication to fostering global economic partnerships and supporting sustainable development.

Domestically, the DEA introduced many Ease of Doing Business (EoDB) reforms to enhance infrastructure and simplify investment regulations. The launch of the National Infrastructure Readiness Index (NIRI) promoted cooperative and competitive federalism by evaluating and encouraging infrastructure development across states and central ministries. Simultaneously, amendments to foreign investment rules, including the Overseas Direct Investment Regulation and the Foreign Exchange Management Rules, streamlined processes and facilitated cross-border investments. These initiatives collectively enhanced India’s investment climate, enabling global expansion for Indian companies and boosting financial inclusion nationwide.

Following are some of the major achievements of the Department of Economic Affairs, Ministry of Finance, in 2024:

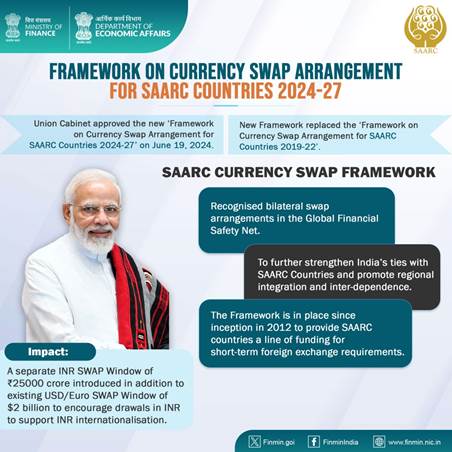

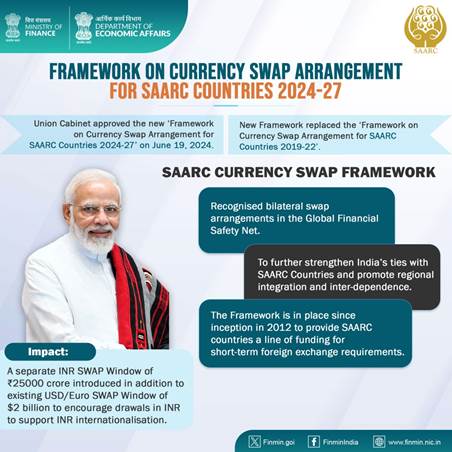

FRAMEWORK ON CURRENCY SWAP ARRANGEMENT FOR SAARC COUNTRIES 2024-27

The Union Cabinet approved the new ‘Framework on Currency Swap Arrangement for SAARC Countries 2024-27’ on June 19, 2024. New Framework replaced the ‘Framework on Currency Swap Arrangement for SAARC Countries 2019-22’.

SAARC Currency Swap Framework

- Recognised bilateral swap arrangements in the Global Financial Safety Net.

- To further strengthen India’s ties with SAARC Countries and promote regional integration and inter-dependence.

- The Framework is in place since inception in 2012 to provide SAARC countries a line of funding for short-term foreign exchange requirements.

Impact:

- A separate INR SWAP Window of ₹25000 crore introduced in addition to existing USD/Euro SWAP Window of $2 billion to encourage drawals in INR to support INR internationalisation.

INDIA-UAE BILATERAL INVESTMENT TREATY (BIT)

- India-UAE Bilateral Investment Treaty (BIT) was signed on 13th February 2024 in the presence of Prime Minister of India and HH Sheikh Mohamed bin Zayed AI Nahyan, President of the UAE.

- India-UAE BIT came into effect on August 31,2024.

- The BIT will increase the comfort level and boost the confidence of investors by assuring minimum standard of treatment and national treatment for investments post establishment.

- It will mutually benefit both nations by reinforcing the economic partnership and promoting investment between India and the UAE.

- BIT underscores the significance of the economic relationship and the commitment to fostering a favorable investment environment.

Some of the key features of the India-UAE BIT 2024 are: -

- Closed asset-based definition of Investment with coverage of Portfolio Investment

- Treatment of Investment with obligation for no denial of justice, no fundamental breach of due process, no targeted discrimination and no manifestly abusive or arbitrary treatment

- Scope carve out for measures such as those related to taxation, local government, government procurement, subsidies or grants and Compulsory license.

- Investor-State Dispute Settlement (ISDS) through arbitration with mandatory exhaustion of Local remedies for 3 years

- General and Security Exceptions

- Right to Regulate for State

- No investor claim in case investments is involved with corruption, fraud, round tripping etc.

- Provision on National Treatment.

- Treaty provides for protection to investments from Expropriation, provides for Transparency, Transfers and Compensation for losses.

INDIA-UZBEKISTAN BILATERAL INVESTMENT TREATY (BIT)

India and Republic of Uzbekistan signed Bilateral Investment Treaty on 27th September 2024 in Tashkent. BIT assures appropriate protection to Uzbekistan investors in India and Indian investors in the Republic of Uzbekistan, in light of relevant international precedents and practice.

Salient features of India-Uzbekistan BIT

- Mutual appropriate protection to investors in both nations in light of relevant international precedents and practices.

- Minimum standard of treatment and non-discrimination while providing for an independent forum for dispute settlement through arbitration

- Protection to investments from expropriation, provides for transparency, transfers and compensation for losses

JOINT TASK FORCE ON INVESTMENT BETWEEN INDIA AND QATAR

Joint Task Force (JTF) on Investment between India and Qatar was constituted with Secretary, Economic Affairs and Under Secretary of Ministry of Commerce and Industry of the State of Qatar as co-chair.

In its first meeting on 6th June 2024 in New Delhi, the JTF explored:

- Strengthening investment cooperation through an institutional arrangement

- Ways to increase investments and deliberate on opportunities for cooperation and investment in both the countries.

- MoU between Sri Lanka and Exim Bank of India

MOU BETWEEN SRI LANKA AND EXIM BANK OF INDIA

- India extended seven (7) GOILOCs with aggregate outstanding of $718.12 million and Buyer's Credit programme under the National Export Insurance Account (BC-NEIA) facility extended by India Exim Bank Restructuring

- IMF had approved the Extended Fund Facility (EEF programme) for Sri Lanka on 20th March, 2023

- Debt restructuring for Sri Lanka was undertaken through the Common Forum co-chaired by India, Japan & France (Chair of Paris Club)

- India’s extensive work as co-chair paved the way for approval of third disbursement from IMF, ensuring Sri Lanka’s return to a sustainable economic recovery.

- India has retained their commitment to the stabilization, recovery and growth of the Sri Lankan economy by adopting a proactive approach towards facilitating the debt resolution.

Development of the National Infra Readiness Index (NIRI)

Launched in September 2024, National Infrastructure Readiness Index (NIRI) is developed to further the ideas of cooperative and competitive federalism to:

- Encourage competition among states/UTs and identified central infrastructure Ministries /Departments to improve their respective performance and further enhance the infra-development climate.

- Pave way for infrastructure development and its enabling environment.

- Be a comprehensive evaluation tool used to assess the preparedness and capacity of a State/UT or an infrastructure ministry/dept. for infrastructure development.

- Assess and categorise the performance of States/UTs and infra-focused Ministries/Dept.

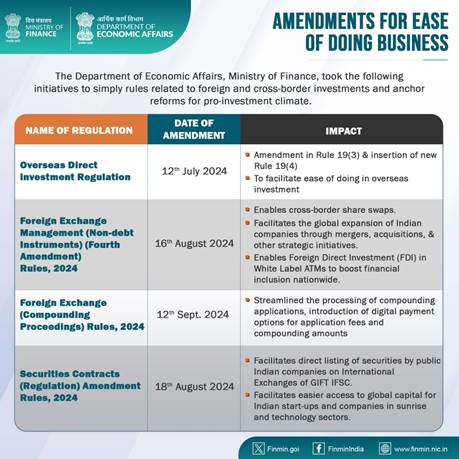

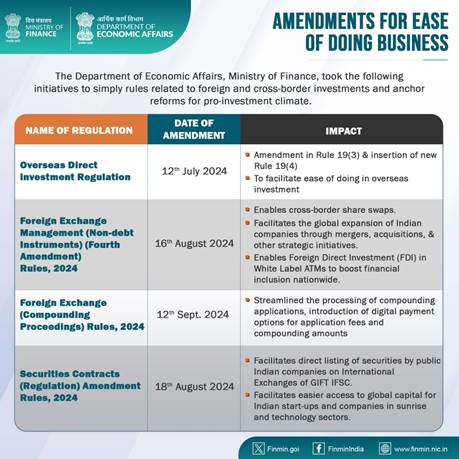

AMENDMENTS FOR EASE OF DOING BUSINESS

The Department of Economic Affairs, Ministry of Finance, took the following initiatives to simply rules related to foreign and cross-border investments and anchor reforms for pro-investment climate.

|

NAME OF REGULATION

|

DATE OF AMENDMENT

|

IMPACT

|

|

Overseas Direct investment Regulation

|

12th July 2024

|

- Amendment in Rule 19(3) and insertion of new Rule 19(4)

- To facilitate ease of doing in overseas investment

|

|

Foreign Exchange Management (Non-debt Instruments) (Fourth Amendment) Rules, 2024

|

16th August 2024

|

- Enables cross-border share swaps.

- Facilitates the global expansion of Indian companies through mergers, acquisitions, and other strategic initiatives.

- Enables Foreign Direct Investment (FDI) in White Label ATMs to boost financial inclusion nationwide.

|

|

Foreign Exchange (Compounding Proceedings) Rules, 2024

|

12th Sept. 2024

|

- Streamlined the processing of compounding applications, introduction of digital payment options for application fees and compounding amounts

|

|

Securities Contracts (Regulation) Amendment Rules, 2024

|

18th August 2024

|

- Facilitates direct listing of securities by public Indian companies on International Exchanges of GIFT IFSC.

- Facilitates easier access to global capital for Indian start-ups and companies in sunrise and technology sectors.

|

9911796707

9911796707